U.S. Midsize Pickup Truck Market Share Going Nowhere Fast

As global markets greet new players such as the Mercedes-Benz X-Class and as the North American market prepares to welcome back (later rather than sooner) the Ford Ranger, midsize pickup trucks are no longer making any headway in the United States of America.

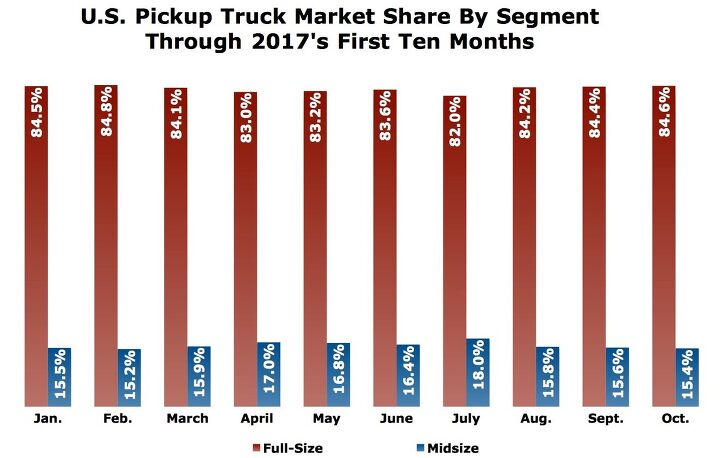

In fact, October 2017 sales of five midsize pickup trucks (Tacoma, Colorado, Frontier, Ridgeline, Canyon) declined 4 percent. Given the rapid growth rate of full-size pickup trucks — six nameplates jumped 10 percent in October, year-over-year — it’s not surprising to see midsize truck market share fall. Through the first ten months of 2017, midsize trucks own 16 percent of America’s pickup truck market, down from 17 percent in 2016.

And in October, the midsize category’s share of America’s truck market slid to 15 percent. Is this what Ranger, Raider, Equator, Dakota, and B-Series dreams are made of?

Each of the midsize pickups that slowed in October did so for different reasons. Toyota continues to wish for more Tacoma supply, and the company has acted and is continuing to act to source that supply in Texas and Tijuana. Tacoma sales slid only marginally, just 4 percent, in October. Sales of its big brother, the Tundra, rose 5 percent, on the other hand.

General Motors reported a 4-percent drop in sales of its midsize twins, the Chevrolet Colorado and GMC Canyon. Yet after a slow start to the year for the midsize twins’ big brothers, sales of the Chevrolet Silverado and GMC Sierra are now rising, and quickly. Total Silverado/Sierra volume was up was up 11 percent last month, as the full-size trucks’ affordability and capability surely hamper midsize demand. Silverado/Sierra outsold Colorado/Canyon by nearly six-to-one in October.

The Nissan Frontier’s downturn continued in October with a 2-percent drop to 6,219 units. Though still a substantially more popular truck than its Nissan Titan sibling, the Frontier is undeniably losing out as the Titan makes headway. A year ago, the Frontier was the readily available Nissan truck. Now the Titan is the major player, and Frontier volume has decreased in nine of the last ten months.

Throw in the Honda Ridgeline’s 20-percent loss, its fourth consecutive monthly decline, and midsize pickup trucks lost 1,400 sales, year-over-year, while full-size trucks gained nearly 20,000 in October. Gone is the momentum enjoyed by the Colorado/Canyon relaunch, the revamped Tacoma’s quick build-up, the Frontier’s exceptional Titanless performance, and the Ridgeline’s unique rebirth.

TruckOct. 2017Oct. 2016% Change2017 YTD2016 YTD% ChangeFord F-Series75,97465,54215.9%734,610661,19811.1%Chevrolet Silverado53,15749,7686.8%471,747475,324-0.8%Ram P/U44,20143,8910.7%419,102404,9773.5%GMC Sierra18,89515,05025.5%173,371179,490-3.4%Toyota Tacoma15,80415,875-0.4%163,224158,5862.9%Toyota Tundra10,0229,5335.1%95,69994,3551.4%Chevrolet Colorado9,99010,578-5.6%93,02490,6252.6%Nissan Frontier6,2196,364-2.3%61,42775,752-18.9%Nissan Titan4,1143,18129.3%39,66314,155180%Honda Ridgeline2,7093,371-19.6%29,28516,11881.7%GMC Canyon2,8602,7852.7%26,12929,991-12.9%Midsize Trucks37,58238,973-3.5%373,089371,0720.5%Full-Size Trucks206,363186,96510.4%1,934,1921,829,4995.7%TOTAL243,945225,9388.0%2,307,2812,200,5714.8%These are hardly the results of a blossoming category; hardly the kind of figures that could even dream of replicating pre-recession results. In 2007, small/midsize pickups accounted for 19 percent of all truck sales.

Of course, the midsize truck quintet is nowhere near as deserving of blame as the full-size truck category is deserving of the credit. America’s best-selling line of vehicles, the Ford F-Series, began to capitalize on the launch of refreshed 2018 models with a 16-percent year-over-year improvement. That’s 10,432 extra F-Series sales, or twice many extra F-Series sales as the Ridgeline and Canyon totalled together.

Sales of the Silverado, Ram, Sierra, Tundra, and Titan, meanwhile, combined to grow by nearly 9,000 units. The three top truck lines — F-Series, Silverado, Ram — each easily outsold the entire midsize category. The F-Series outsold the five midsize trucks by a two-to-one margin.

New contenders surely won’t hurt. In fact, when the midsize segment last welcome new contenders, the Colorado and Canyon, sales of existing midsize trucks increased. But is it reasonable to expect similar circumstances when the 2019 Ford Ranger finally reaches Blue Oval showrooms? Rising Tacoma, Colorado, Frontier, Canyon, and Ridgeline sales all due to the presence of another midsize truck?

Or are midsize pickups destined to pick up full-size pickup scraps?

[Image: Toyota]

Timothy Cain is a contributing analyst at The Truth About Cars and Autofocus.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- THX1136 I would agree with Kwik & Ollicat with this caveat, none should be mandated unless it is proven 1000% bulletproof reliable with a failure rate of less than 1 in 1million vehicles. Have no issue with making the tech available to those who chose to purchase it.

- Jpolicke Did they ever clear out the arena parking lot with all the buy-back VW diesels?

- Bd2 Tech that prevents non Tesla owners from using electric charging stations and also prevents racist behaviors.

- AZFelix e:Ny1grotto?

- Kwik_Shift_Pro4X The more taxpayer dollars wasted, the closer it will be to having all your assets taken from you.

Comments

Join the conversation

"Try me and find out" what does that mean?

Mini trucks had a boom for several reasons in the 80's and 90's. for one you could get a brand new one for 7 grand give or take. S-10's and Rangers sold by the hundreds of thousands. eventually sales tapered off and the Ranger really fell off, it was the last one on the market. That's why they don't make them, this isn't complicated. I just turned 450,000 on my S-10. sure glad I don't waste money on vehicles.