General Motors Incentives Skyrocket In November; GM Inventory Still Ballooning

General Motors moved to increase the average incentive spend per Buick, Cadillac, Chevrolet, and GMC vehicle by 36 percent in November in order to clear out an inventory glut that seemingly refuses to be cleared out.

According to Autodata, General Motors now has more than 873,000 vehicles in stock, nearly three months of supply. That’s 26 percent more inventory than at this stage of 2015, when industry-wide volume was pacing at roughly the same level as today, albeit with significantly less incentivization.

J.D. Power PIN data shows that General Motors spent $4,912 per vehicle sale in November 2016, a $1,302 increase compared with November 2015. According to TrueCar, industry-wide incentive spending rose 13 percent, year-over-year, a figure skewed by the dramatic increase at America’s biggest holder of market share.

Besides the striking incentive increase, GM once again resorted to fleet volume in order to generate overall sales momentum. After decreasing fleet emphasis throughout the year, GM’s fleet sales jumped 19 percent in November 2016, an 8,880-unit increase compared with November 2015 that drew fleet sales up to 22 percent of GM’s overall mix. (Year-to-date, 19 percent of U.S. GM sales are fleet-derived.)

Prior to November, GM had not reported a year-over-year fleet sales increase since last year.

Nowhere was GM’s push to produce greater volume more evident than with the company’s full-size pickup trucks. The Chevrolet Silverado and GMC Sierra generate more than one-quarter of GM’s U.S. volume. In order to keep pace with a full-size pickup truck market that grew 9 percent in November, GM spent an average of $5,753 to move each Silverado and Sierra, a 46-percent increase compared with the same period one year ago.

Ram spent $6,062 per truck sale, a 19-percent increase. Ford’s F-Series was incentivized to the tune of $4,467.

Ford reported 72,089 total F-Series sales in November 2016, a 10-percent uptick. Combined, the Silverado and Sierra trailed the F-Series by nearly 8,000 sales. 2015 was the first year since 2009 in which the GM twins combined to outsell the F-Series. But even with audacious discounts, the GM twins by 14,293 sales heading into December. (GM also sold 132,695 midsize pickups in the first 11 months of 2016.)

With a market that’s essentially flat and the demand that does exist fueled in no small part by hefty price reductions, GM has nevertheless forged on building vehicles like the market has plenty of room to grow. Fiat Chrysler Automobiles’ inventory is 9 percent lower today than it was a year ago; the Ford Motor Company’s inventory is nearly 2 percent lower.

General Motors outsold the next-best-selling manufacturer, Toyota, by 55,000 units in November. Buick, Cadillac, and GMC all posted double-digit percentage gains. Chevrolet sales grew 8 percent.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Flashindapan I always thought these look nice. I was working at a Land Rover dealership at the time the LR3 came out and we were all impressed how much better it was then the Discovery in just about every measurable way.

- Bd2 If I were going to spend $ on a ticking time bomb, it wouldn't be for an LR4 (the least interesting of Land Rovers).

- Spectator Wild to me the US sent like $100B overseas for other peoples wars while we clammer over .1% of that money being used to promote EVs in our country.

- Spectator got a pic of that 27 inch screen? That sounds massive!

- MaintenanceCosts "And with ANY car, always budget for maintenance."The question is whether you have to budget a thousand bucks (or euro) a year, or a quarter of your income.

Comments

Join the conversation

@Whiskeyriver... I don't think you understand how desperate things were at the time of the GM bailout. Banks were near collapse. McDonalds and many of their franchisees nearly didn't have access to cash to make payroll. This wasn't 1%'ers getting bailed out, this was the whole financial system getting a bailout. If GM failed today the assets would get picked up and the world would carry on. Cash is available. In 2009 that wasn't the case. Credit markets were frozen. Banks were near collapse (and Lehman did collapse). The auto industry bail out cost $10 billion. Chump change compared to the trillion dollar cost and years of lost productivity caused by a GM failure. That was one of the best expenditures ever made by the US government. Also, before the bankruptcy GM had a lot of inventory, very little cash in the bank, lots of debt payments coming due, factories operating at 50% capacity, and a poor product line up. The case couldn't be more different today. And if gas goes to $4 a gallon, GM has a lot of very desirable cars in the line up that don't sell well in today's CUV/truck crazed market. I think you need to pay more attention to critical analysis backed up by data and less to emotional rants.

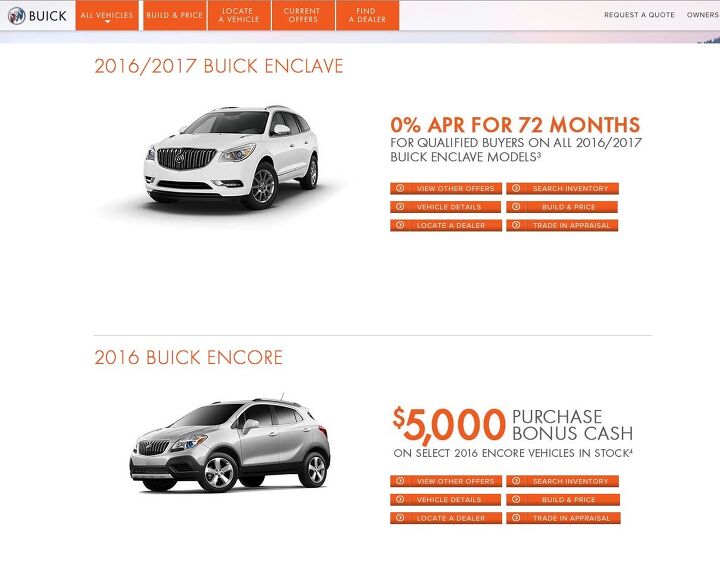

The title of this article got me excited. I'm in the market for a Suburban, maybe there's a deal to be had. Nope. Checked Chevrolet's site for current incentives and I found: 2017 Suburban: $500 cash back 2016 Suburban: $1500 cash back Or if I decided to get a new truck instead: 2017 Silverado CC: $1000 cash back 2016 Silverado CC: $3000 cash back These aren't any special deals and $500 cash back on a $55k vehicle is a joke. Looking at the deals advertised in the article, $5000 cash back on an Encore is a good deal. The $8688 off a Sierra is disingenuous and I despise advertising like that. The real incentive is $4000 cash back which is good, not fantastic. The option package "discount" isn't. You're just paying what GM charges for that option package; that's what an option package is. Pretending is some kind of discount and adding it to the price off the truck is misleading. Also noted that money off MSRP is included here as if that wasn't something you get any time you buy any new vehicle. I've never paid MSRP for a vehicle; hell I've never paid invoice. This is money you always get and has to do with how well you negotiate with the dealer; it has no place in an advertisement. Advertise $4k cash back and that's it.