Chart Of The Day: Many Parts Of FCA's Lineup Are Growing Faster Than The FCA Lineup

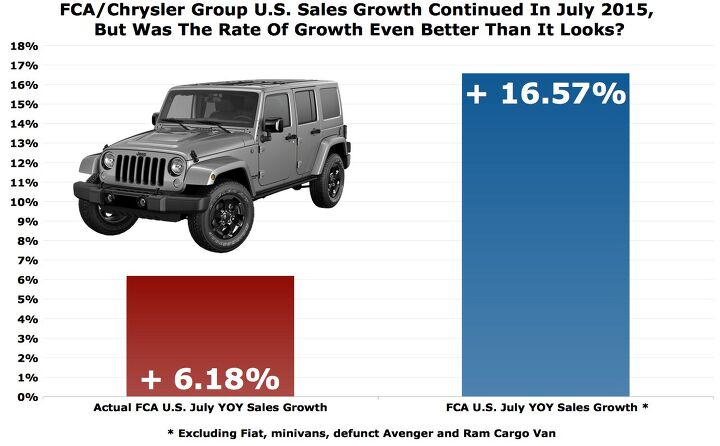

Each and every month, a great deal of attention is paid to the length of Fiat Chrysler Automobiles’ U.S. growth streak. July 2015, for example, was the 64th consecutive month in which FCA, formerly known as the Chrysler Group, reported a year-over-year sales gain.

Yet so much of FCA’s rate of expansion in the U.S. market is muddied by dreadful results in a few small corners of their lineup.

The Fiat brand suffered a 15-percent decline in July sales compared with the same period one year earlier. As the 500X finally began generating proper volume — 962 copies were sold last month — the 500L posted a 78-percent drop. The 500’s 17-percent year-over-year slide was its ninth consecutive decrease.

Discontinued models help to clarify the year-over-year picture, but they don’t help us forecast that which is ahead. The Dodge Avenger has been winding down for more than a year. July Avenger volume plunged 98 percent, a loss of 4,240 units, to just 78 sales. Similarly, the Ram Cargo Van has no future. Sales of the Grand Caravan-based commercial product plunged 97 percent.

As for the Grand Caravan and its better-selling Chrysler Town & Country sibling, their plant’s shutdown earlier this year for retooling dramatically hindered their volume in the first-half of 2015. In July, too, they were jointly down 33 percent.

To say these products don’t count is to ignore history. In July 2014, the Fiat brand, Avenger, Ram C/V, and the Windsor-built vans added nearly 30,000 units to FCA’s U.S. sales tally, but setting them aside for a moment allows us to get a clearer picture of the status of the bulk of FCA’s lineup. Jeep set a 22nd consecutive monthly sales record. Dodge sold more Challengers last month than in any July in the model’s history. Chrysler 200 volume jumped 85 percent.

If FCA can’t eventually find minivan recovery, if Fiat sales continue to go down the toilet, if the Ram ProMaster City can’t pick up where the Ram Cargo Van left off, if the 200 can’t continue to make up for the Avenger’s losses, than this snapshot tells us little. Moreover, besides Fiat, minivans, and discontinued models, there are struggling models in the FCA lineup: the Durango and 300 are in decline and Ram P/U growth has slowed considerably of late.

Nevertheless, a closer look at FCA sales figures makes it appear as though the automaker’s growth is even more significant than a first glance suggests. If Fiat and minivans recover, is FCA thus poised to continue its surge? Or will the recent recall/ buyback flap and a product rollout schedule with few all-new product rollouts put an end to the fun and games?

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lou_BC Well, I'd be impressed if this was in a ZR2. LOL

- Lou_BC This is my shocked face 😲 Hope formatting doesn't fook this up LOL

- Lou_BC Junior? Would that be a Beta Romeo?

- Lou_BC Gotta fix that formatting problem. What a pile of bullsh!t. Are longer posts costing TTAC money? FOOK

- Lou_BC 1.Honda: 6,334,825 vehicles potentially affected2.Ford: 6,152,6143.Kia America: 3,110,4474.Chrysler: 2,732,3985.General Motors: 2,021,0336.Nissan North America: 1,804,4437.Mercedes-Benz USA: 478,1738.Volkswagen Group of America: 453,7639.BMW of North America: 340,24910.Daimler Trucks North America: 261,959

Comments

Join the conversation

Any analysis of FCA should start with profit margins. Despite having almost 80% of their sales in trucks (which should have higher margins), FCA has the lowest margins among their peers. Clearly they are buying market share, which is not a valid long term strategy.

The problem with 200 is that it is more a large compact than midsize car. It is based on compact car (like say Avensis/Scion or original Passat) is more appropriate for Europe as a midsize than US. Malibu suffered fro the same issue. And unknown reliability which does not project well from previous model.