Analysis: PSA Debuts EMP2, Their Own Modular Platform System

We at TTAC are very excited by modular platforms, and it has nothing to do with undiagnosed autism spectrum disorders or a lack of interest in the wider world outside autos. Modular platforms are the next great leap forward for auto makers; green cars help save cute animals, and thus get all the attention, but guess what underpins the Nissan Leaf? A version of Renault-Nissan’s B Platform, which underpins everything from the Cube to the Clio to the Sandero.

The driving force behind modular platforms is scale. Auto makers are competing in a global marketplace selling an extremely complex commodity product with high R&D costs and low profit margins. Modular platforms help by creating a standard platform and component kit across a number of model lines, making the car less complex to manufacture and allowing for the platform itself to be amortized across a number of model lines.

One could argue that BMW was one of the pioneers of modular platforms, building the 3, 5 and 7-Series in the familiar “one sausage, many lengths” format that we all know and love (or loathe, depending on how much you emotionally invest yourself in the brand). Recently, Volkswagen has taken modularity to another level with their MQB platform. Different components can be added or removed depending on the vehicle’s footprint or engine size, but the distance between the front axle and the pedal box remains fixed. This allows VW an unprecedented amount of flexibility to build pretty much every transverse, front-wheel drive vehicle off of one platform, at any of its global factories that is configured to build MQB-based cars. The advantages as far as scale goes are unprecedented.

PSA, the struggling French automaker behind Peugeot and Citroen, has just released their own version of a modular platform, dubbed EMP2, as a means of capitalizing on that trend. From a product standpoint, EMP2 will cover the C and D segment cars in the PSA range, which are fairly large for Europe, but account for about half of PSA’s sales.Crucially, EMP2 will not be applicable to B segment cars, while VW’s MQB platform will, a major oversight given that PSA relies on markets like Europe, Africa and South America, where B segment cars are most important.

Instead, EMP2 will be the building blocks for vehicles like the Citroen C5 mid-size sedan, the DS4 and DS5 premium hatchbacks and the Peugeot 308 and 508, which compete in the C and D segment respectively. EMP2 will also be used to build station wagons, SUVs (which PSA currently sources from other OEMs) MPV-type vehicles (minivan type cars that are smaller than North American minivans, a popular segment in Europe that PSA has traditionally been an innovation leader) such as the next generation Citroen C4 Picasso and the all-important light commercial vehicle segment.

PSA is touting weight savings of 154 lbs versus outgoing models, with a 22 percent reduction in CO2 emissions thanks to technologies like start-stop systems, electric power steering, lightweight construction materials and low rolling resistance tires. Other advanced features like electronic parking brakes, active aerodynamics and radar-guided cruise control were also touted in a short video released by PSA.

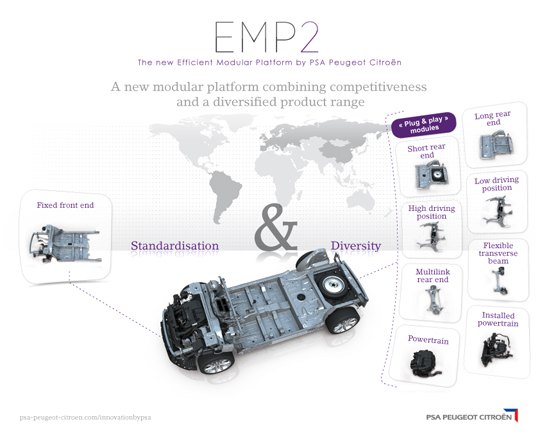

From a manufacturing standpoint, PSA appears to have emulated a number of VW’s innovations with EMP2, while making some interesting advancements. Much like MQB, EMP2 relies on a series of “plug and play” modules, with some interesting differentiations. For example, EMP2 offers two rear suspension options; a beam axle or a multilink independent system can be optioned, depending on whether PSA wants to keep costs down or to provide a superior driving experience. A high or low driving position and a short or long rear section can be substituted, allowing for an easy transition between a passenger car or something like an MPV or commercial vehicle that requires more cargo room and a higher seating position.

Where EMP2 appears to fall flat is in the front section – while MQB offers an exceptional degree of customization up front (with only the one fixed point) it appears that PSA has kept the front section fixed, with various powertrains able to be installed. Given the size and profitability delta between PSA and VW, it’s understandable that PSA would opt for a simpler, less expensive solution, though the importance of scale and flexibility suggests that VW will continue to have the upper hand with MQB. It’s likely that the fixed front section is one of the key stumbling blocks preventing EMP2 from being used as a B-segment platform, since the single fixed point of MQB allows for different wheelbases as well, something EMP2 is not capable of.

From a manufacturing standpoint, PSA has also given up much of the flexibility that Volkswagen enjoys with MQB, in exchange for what is ostensibly a cheaper and less complex architecture. PSA simply does not have the R&D budget and global scale to embark on something as ambitious as MQB, and therefore must make tradeoffs in certain areas. On the other hand, PSA doesn’t require such an overarching modular architecture like VW does, and can tailor its factories to produce popular models that align closely with local tastes (such as high-end crossovers and larger sedans in China, MPVs and C-Segment cars in Europe), whereas Volkswagen must manage multiple brands and product lines across a greater number of markets.

The first EMP2 products will be the Citroen Picasso MPV and the new C-segment Peugeot 308 – which will compete against the MQB-based Golf, as well as its Skoda and SEAT siblings. Worth noting is that both VW and PSA are debuting these products at a time when the mainstream car market is eroding in Europe. The real threat may come from the low-cost entries, specifically Renault’s Dacia line, which offers B and C segment sedans and hatchbacks, as well as compact SUVs and MPVs, at cut-rate prices, with little appreciable difference in quality. While high-content features like start-stop and radar-guided cruise control may be absent, the basic features that many motorists require, like air-conditioning and central locking are still available. And given Europe’s precarious economic state, the price – frequently under 10,000 euro – is right. Meanwhile, Renault, taking advantage of their own modular platform system, is making as much as 9 percent profit on the cars, margins that PSA can only dream of.

More by Derek Kreindler

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- FreedMike If Dodge were smart - and I don't think they are - they'd spend their money refreshing and reworking the Durango (which I think is entering model year 3,221), versus going down the same "stuff 'em full of motor and give 'em cool new paint options" path. That's the approach they used with the Charger and Challenger, and both those models are dead. The Durango is still a strong product in a strong market; why not keep it fresher?

- Bill Wade I was driving a new Subaru a few weeks ago on I-10 near Tucson and it suddenly decided to slam on the brakes from a tumbleweed blowing across the highway. I just about had a heart attack while it nearly threw my mom through the windshield and dumped our grocery bags all over the place. It seems like a bad idea to me, the tech isn't ready.

- FreedMike I don't get the business case for these plug-in hybrid Jeep off roaders. They're a LOT more expensive (almost fourteen grand for the four-door Wrangler) and still get lousy MPG. They're certainly quick, but the last thing the Wrangler - one of the most obtuse-handling vehicles you can buy - needs is MOOOAAAARRRR POWER. In my neck of the woods, where off-road vehicles are big, the only 4Xe models I see of the wrangler wear fleet (rental) plates. What's the point? Wrangler sales have taken a massive plunge the last few years - why doesn't Jeep focus on affordability and value versus tech that only a very small part of its' buyer base would appreciate?

- Bill Wade I think about my dealer who was clueless about uConnect updates and still can't fix station presets disappearing and the manufacturers want me to trust them and their dealers to address any self driving concerns when they can't fix a simple radio?Right.

- FreedMike I don't think they work very well, so yeah...I'm afraid of them. And as many have pointed out, human drivers tend to be so bad that they are also worthy of being feared; that's true, but if that's the case, why add one more layer of bad drivers into the mix?

Comments

Join the conversation

Is a C5 without Hydractive suspension really a Citroen?

Just found this article after doing a search on B-platform and should say that the modular architecture now being rolled out across Renault and Nissan (first examples, Qashqai, Rogue, X-trail) is referred to as the Common Module Family, or CMF. There are two major versions, CMF1 and CMF2, with the former for D-seg and the latter for C-seg models, although there is some flex there.