5 Views

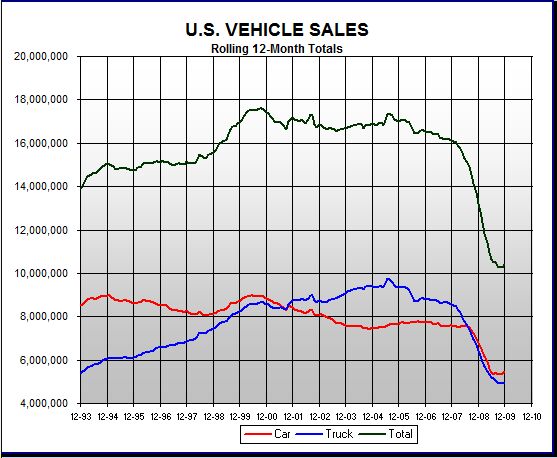

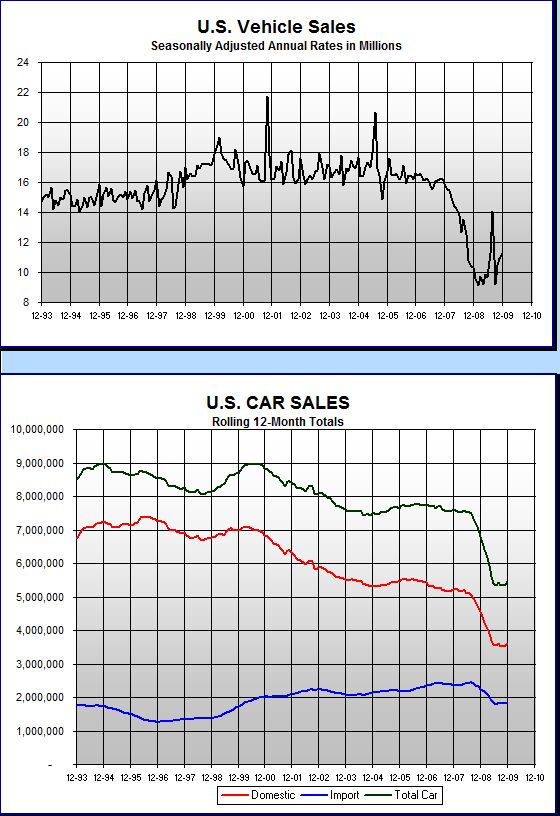

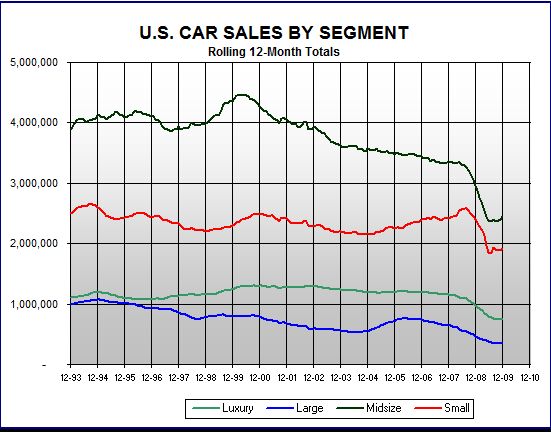

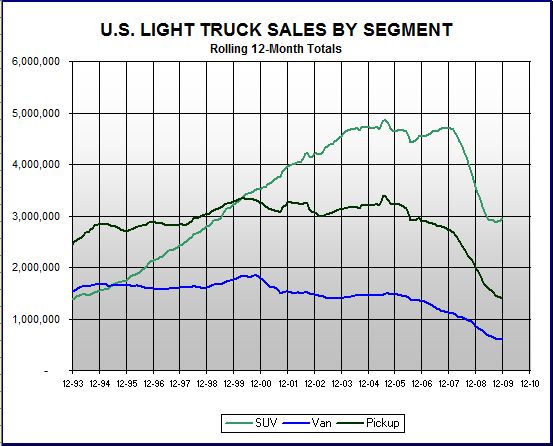

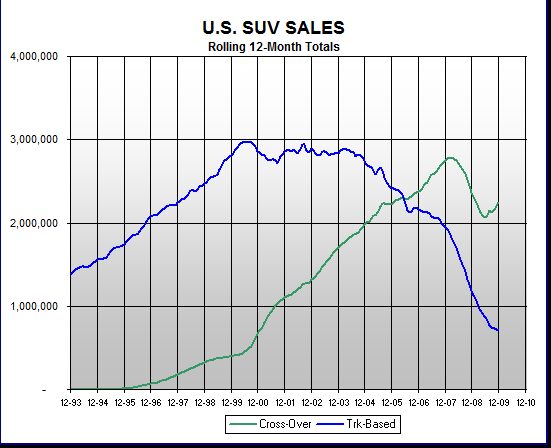

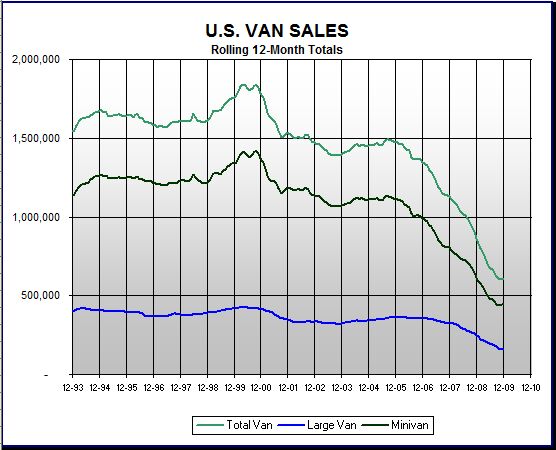

Sales Analysis Eye Candy: Market Segment Trends Charts

by

Paul Niedermeyer

(IC: employee)

Published: January 21st, 2010

Share

Paul Niedermeyer

More by Paul Niedermeyer

Published January 21st, 2010 1:54 PM

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- BlackEldo Why even offer a Murano? They have the Rogue and the Pathfinder. What differentiates the Murano? Fleet sales?

- Jalop1991 Nissan is Readying a Slew of New Products to Boost Sales and ProfitabilitySo they're moving to lawn and garden equipment?

- Yuda I'd love to see what Hennessy does with this one GAWD

- Lorenzo I just noticed the 1954 Ford Customline V8 has the same exterior dimensions, but better legroom, shoulder room, hip room, a V8 engine, and a trunk lid. It sold, with Fordomatic, for $21,500, inflation adjusted.

- Lorenzo They won't be sold just in Beverly Hills - there's a Nieman-Marcus in nearly every big city. When they're finally junked, the transfer case will be first to be salvaged, since it'll be unused.

Comments

Join the conversation

Data is cool.

Visually, a definite improvement over Morgan and Co.’s previous graphs for TTAC. Two suggestions: identify the source of the data (R.L. Polk perhaps?) and overlay the raw series whenever plotting a rolling average.