#segments

U.S. Subcompact Car Market Share Fell by Half Since 2016; Subcompact Crossover Segment Tripled Since 2013

No Yaris. No Fiesta. No Sonic. No Mazda2. No Fit.

America’s subcompact car segment is decimated. According to Tyson Jominy, the vice president of data and analytics at J.D. Power, 40 percent of last year’s subcompact sales are gone. Jominy doesn’t mean “fewer sales.” He means that the nameplates responsible for 40 percent of the sales are gone.

And is it any wonder? As recently as 2014, subcompact cars produced 3.8 percent of all U.S. auto sales. Collectively, the few remaining subcompact cars now account for just 1.4 percent of the American light vehicle market.

At the current rate of decline, fewer than 1 percent of the vehicles sold in America in 2022 will be subcompact cars. But we all know the current rate of decline is hardly an accurate harbinger. If subcompacts own 1 percent of the market in 2021, we’d be surprised.

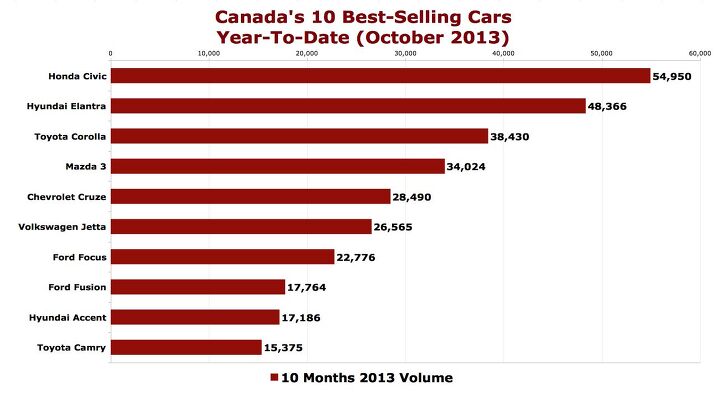

Canada Sales Recap: October 2013

With forecasters calling for another year of improved Canadian auto sales, 2013’s early months didn’t add up. January volume fell 2.2%, February sales were down 3.3%, and March’s results were off the pace by 0.7%. But not since the first quarter ended have the players competing for sales in Canada reported anything but collective improvement.

55,000 more vehicles have been sold during the first ten months of 2013 than during the equivalent period in 2012, a 3.8% increase. 2013’s rise follows three consecutive years of improved Canadian auto sales. The current pace suggests Canadians will end 2013 having registered more than 1.7 million new vehicles for the first time since 2002.

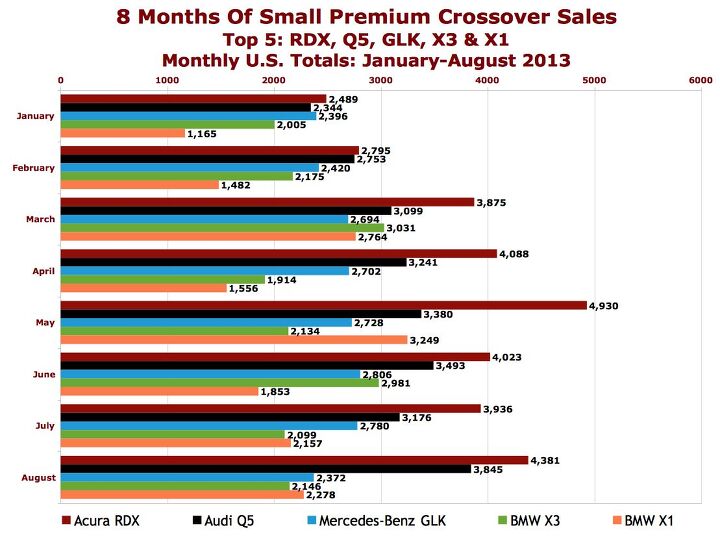

Cain's Segments: Small Premium Utilities – August 2013

We’ll confirm it. Again. America is becoming ever more hungry for small premium brand crossovers, and that’s not simply a result of there being more $40,000 German utility vehicles from which to choose.

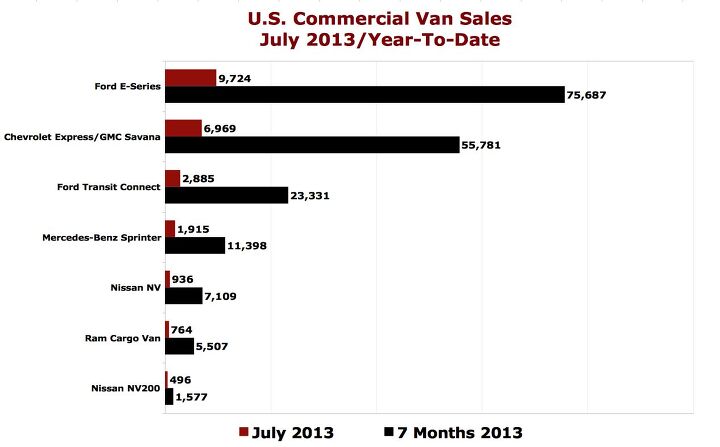

Cain's Segments: July 2013 – Commercial Vans

After abnormally high GM commercial van sales results in the United States a year ago, it wasn’t surprising to see dramatic year-over-year sales declines reported by the Chevrolet Express and GMC Savana in July 2013.

Cain's Segments: July 2013 Mid-Size Cars

In July 2013, America’s three favorite midsize cars combined to sell an extra 10,667 copies than they did a year ago.

Collectively, the best-selling Toyota Camry, second-ranked Honda Accord, and third-ranked Nissan Altima were up 12.5% in July. Midsize cars, as we understand them here, rose 3.4%. The U.S. auto industry reported an overall volume increase of 13.9%.

2011: The Year In Auto Sales

2011 was a fascinating year to follow auto sales. With the overall market up over 10%, and hot new products hitting showrooms, there was definitely room to grow… and yet everyone seems to have an excuse for why growth wasn’t stronger. Japanese automakers, the biggest losers of 2011, had a strong of natural disasters to blame the bad year on. Detroit showed strong volume gains in terms of percentage growth, and earned respect in growing segments where they were previously weak, but couldn’t match the expectations of its perennially over-optimistic boosters. The Korean manufacturers showed strong market share growth but lack of capacity prevented them from bounding into the top tier of the US sales game. In fact, only the European luxury manufacturers could point to 2011’s sales performance with unalloyed satisfaction, as they grew some 29.5% as a group, from an already-strong volume position. So, given these mixed results, what was the lesson of 2011?

Were You Aware?: Half Of All Large Car Sales Go To Fleets

Since ruling Americas roads in the heyday of the US auto industry, sales of large sedans (as a percentage of the overall market) have been in a decades-long slump. More recently, as SUVs have merged with large cars to form the modern crossover, the decline in large car sales has picked up speed. And there’s reason to expect that trend to continue, as a closer look at the data shows that market support for large sedans has eroded farther than even these numbers might suggest. One of TTAC’s well-placed sources reveals that the “large car” segment (admittedly, a notoriously difficult segment to accurately capture) is running at 50% fleet sales, year-to-date through October. That’s right, every second large sedan sold in this country end up as a fleet vehicle, many of them daily rentals.

Recent Comments