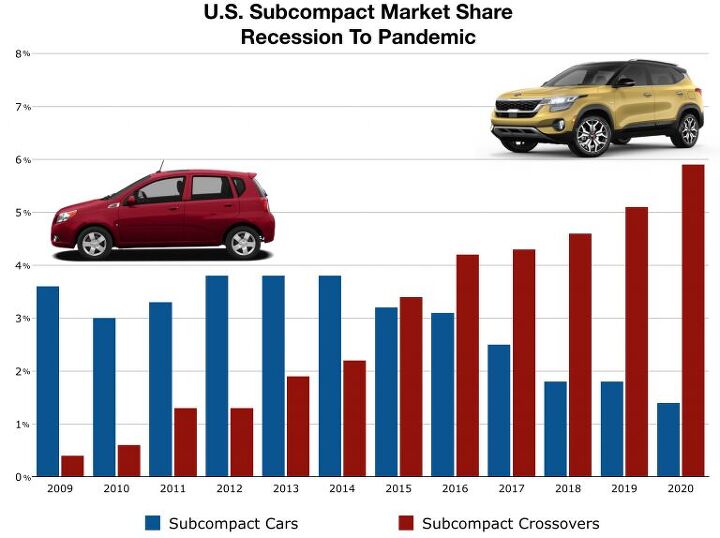

U.S. Subcompact Car Market Share Fell by Half Since 2016; Subcompact Crossover Segment Tripled Since 2013

No Yaris. No Fiesta. No Sonic. No Mazda2. No Fit.

America’s subcompact car segment is decimated. According to Tyson Jominy, the vice president of data and analytics at J.D. Power, 40 percent of last year’s subcompact sales are gone. Jominy doesn’t mean “fewer sales.” He means that the nameplates responsible for 40 percent of the sales are gone.

And is it any wonder? As recently as 2014, subcompact cars produced 3.8 percent of all U.S. auto sales. Collectively, the few remaining subcompact cars now account for just 1.4 percent of the American light vehicle market.

At the current rate of decline, fewer than 1 percent of the vehicles sold in America in 2022 will be subcompact cars. But we all know the current rate of decline is hardly an accurate harbinger. If subcompacts own 1 percent of the market in 2021, we’d be surprised.

Subcompact crossovers are hardly the only factors at play in the decline of subcompact cars. True, there’s an industry-wide shift from passenger cars to SUVs and crossovers, whether it’s Camry-to-RAV4, 3 Series-to-X3, or Impreza-to-Crosstrek. But beyond prevailing winds, subcompact cars also painted themselves into a corner.

Take fuel economy as an example. The most efficient Honda Fit and the most efficient Honda Civic will both cost $75 to run, the EPA says. What about actual payments? According to Toyota.com, leasing the least costly automatic-shift 2020 Corolla Hatchback will cost a grand total of $73 more less per month than the least costly 2020 Yaris Hatchback.

In other words, subcompact cars are typically less refined than compact cars. They’re usually slower. They’re rarely as nicely equipped. To counteract their demerits, subcompact cars offer the unique privilege of draining bank accounts at a more rapid rate.

Oh, the joy of tight turning circles.

Regardless of their own inadequacies, subcompact cars were selling at reasonable levels. Between 2012 and 2016, there were nearly 600,000 annual subcompact car sales in America, on average. 2015, however, represented a major swing in the market. It was the first time subcompact crossovers sold in greater numbers than subcompact cars. And there was no going back. Subcompact crossover market share (not including the Rogue Sport that Nissan folds into total Rogue volume) will soon be twice as strong as it was in 2015; subcompact cars will soon generate less than one-third the share they produced in 2015.

The shock-to-the-system of a pandemic-altered first-half did the dwindling subcompact car market no favors in early 2020. The ensuing incentives, such as interest rate drops that obviously lend far more favor to more costly products, have done virtually nothing to spur sales of America’s smallest cars. As auto sales fell 24 percent overall in 2020’s first six months, subcompact cars were down 51 percent, greater than twice the rate of decline.

Subcompact crossovers, meanwhile, lost only 7 percent of their volume while the overall market tumbled at more than three times the rate.

The die is cast.

[Images: Nissan, Hyundai]

Timothy Cain is a contributing analyst at The Truth About Cars and Driving.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy If these guys opened a hotel outside Cincinnati I would go there to sleep, and to dream.

- ToolGuy Michelin's price increases mean that my relationship with them as a customer is not sustainable. 🙁

- Kwik_Shift_Pro4X I wonder if Fiat would pull off old world Italian charm full of well intentioned stereotypes.

- Chelsea I actually used to work for this guy

- SaulTigh Saw my first Cybertruck last weekend. Looked like a kit car...not an even panel to be seen.

Comments

Join the conversation

It seems that the 2013 Buick Encore was the pioneer in the "tiny SUV/CUV" class. It brought unforeseen customers into GM showrooms, and it had little competition for a while. Primitive as the Encore seems now, it's still a strong seller, when the deal is sweetened with generous discounts. The tiny CUVs are loved because of the refreshing combination of hatch utility, a slightly elevated seating position, and a relatively nimble handling feel.

Funny that Mazda, after many years, decided to bring the 2 to the US just to see it parked for a long time on dealer lots, even Toyota could not sale many of them in Yaris form.