#fisker

Delaware Bankruptcy Judge Approves Sale Of Fisker Automotive to China's Wanxiang

Last week, Rueters reported that Wanxiang, a Chinese parts supplier, had won the bankruptcy auction for Fisker Automotive. The bid was valued around $149.2 million. The deal comes to close after a bidding war between Wanxiang and Hybrid LLC — a group who includes Richard Li, a Fisker investor and Hong Kong billionaire. In November, Fisker asked for Hybrid Technology LLC to purchase the bankrupt company for $25 million, but creditors objected the deal in November and brought Wanxiang into the case in December.

Today Delaware, U.S. Bankruptcy Judge Kevin Gross approved of the sale to Wanxiang. He stated that the auction “shows that a fair process is a good thing.”

DOE Head Moniz: Whichever Chinese Company Buys Fisker Must Keep Work in U.S.

United States Energy Secretary Ernest Moniz said the whichever of the two Chinese bidders for the assets of Fisker Automotive wins the court ordered auction on February 12th it will still have to keep Fisker’s manufacturing and research in the U.S. Automotive News reports that Hybrid Tech Holdings LLC and Wanxiang America Corp. are fighting over the remains of Fisker in U.S. bankruptcy court for the remains of Fisker, an Energy Department loan recipient that stopped making its luxury plug-in hybrid cars in 2012.

“I’m not going to pick a winner of the auction,” Moniz said at the Washington Auto Show. “What’s key for us is of course the terms of our loan have to be respected. We have technology transfer limitations first of all. No matter who the winner is we will be looking at both engineering and manufacturing in the U.S. That’s the key for us.”

Just What Assets Does Fisker Have to Buy?

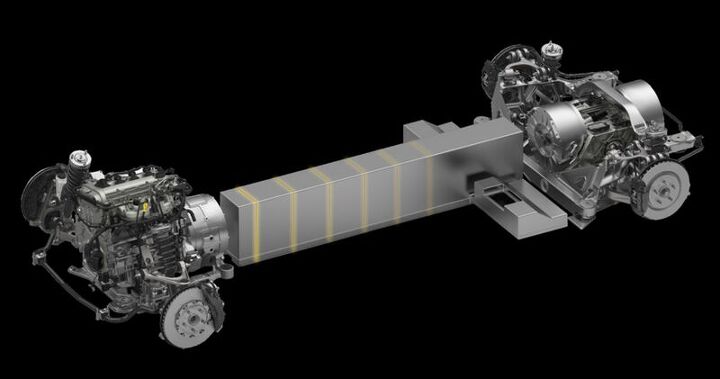

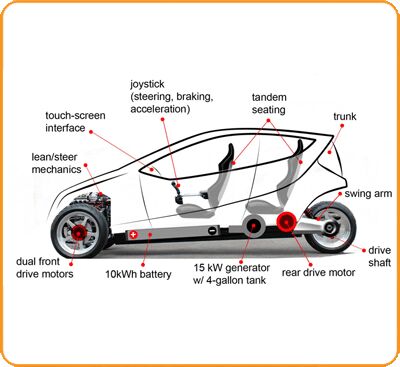

The Fisker Karma’s battery pack and drivetrain, supplied by Quantum Technologies

The Department of Energy today is auctioning off the paper for the $192 million it loaned to Fisker Automotive as part of the Advanced Technology Vehicles Manufacturing loan program. An obvious question is why would anyone want to buy that debt? Many of the press reports about the sale say that by purchasing the debt, a buyer could ultimately gain control of Fisker’s assets including intellectual property, like the extended range hybrid drivetrain and controls thereof. While Fisker may indeed have assets with some value, I’m not sure that anyone’s going to spend at least $30 million, the minimum bid required by the DoE, to be able to duplicate the Fisker Karma’s drivetrain.

Fisker's Dept of Energy Loan to Be Auctioned Off Today

The United States Department of Energy will today auction off Fisker Automotive’s loan from the federal government, on which the moribund hybrid car startup defaulted. Last month the department said that it would hold the auction after “exhausting any realistic possibility” that it could recoup all of the $168 million still that Fisker still owes.

First Drive Review: 2014 Honda Accord Hybrid (With Video)

As of October, the most fuel-efficient mid-sized sedan in America is the Honda Accord. Or so Honda says. After all, Ford has been trumpeting a matching 47 MPG combined from their Fusion. Who is right? And more importantly, can the Accord get Honda back into the hybrid game after having lost the initial hybrid battles with their maligned Integrated Motor Assist system? Honda invited us to sample the 2014 Accord Hybrid as well as a smorgasbord of competitive products to find out.

Want To Know What's Wrong With Fisker? Here Are Two Reports

Fisker is at its last gasp. After burning through $1.4 billion, “the company is out of cash,” writes Reuters, “for months, key investors have been footing the car maker’s day-to-day expenses to keep it alive in diminished form.” Reuters has an in-depth report on what went wrong at Fisker. Reuters also has the one sentence version:

Tales From The Cooler: Instant Karma Depreciation

During all the turmoil facing hybrid automaker Fisker Automotive recently, from closing its doors to a possible resuscitation led by Bob Lutz, one thing has remained constant: the rapidly collapsing values of the Fisker Karma cars themselves.

Another One Bites The Dust: Better Place Bankrupt

Better Place “filed a motion in an Israeli court to wind up the company, bringing an end to a venture whose battery charging network had aimed to boost electric car sales,” Reuters says.

Henrik Fisker Called, He Wants His Company Back

Henrik Fisker paired up with Hong Kong billionaire Richard Li to get his company back. Fisker is a co-founder of severely troubled Fisker Automotive. Li and Fisker are trying to buy the U.S. government loan to Fisker at a big discount. Henrik Fisker was ousted in March.

Lutz And Chinese Offer One Penny On The Dollar For Fisker

Fisker is worth around 200 Karmas at retail. “A team including former General Motors Co executive Bob Lutz and China’s largest parts maker is looking to buy Fisker Automotive for $20 million, a fraction of the “green” car company’s estimated worth almost a year and a half ago,” Reuters says.

Reuters: Lutz To Help Chinese Buy Fisker On The Cheap

When former TTAC Editor-in-Chief and now Editor emeritus Edward “Op-Ed” Niedermeyer wrote an op-ed in the Wall Street Journal and warned that GM’s center of gravity shifts more and more to China, GM’s retired multi-role fighter Bob Lutz reamed Ed via Fortune. Now, Bob Lutz himself appears to be an accessory in a deal that transfers U.S. government-financed technology to China for pennies on the dollar. Says Deepa Seetharaman, in-house alternative drivetrain expert at the Reuters Detroit office, in her in-depth article:

Has the Dept of Energy's Advanced Technology Vehicle Manufacturing Program Been a Failure? Not Really

Critics of the current administration have pointed to the impending bankruptcy of Fisker Automotive and the recent suspension of operations at taxi maker Vehicle Production Group as examples of why the government shouldn’t be picking winners and losers in it’s zeal to promote alternative energy. The DoE effort under which those two companies received financing is the Advanced Technology Vehicle Manufacturing Program, ATVM. Putting aside political ideologies, contrary to the image given by the apparent failure of Fisker and VPG, the ATVM program actually has a pretty decent track record when it comes to picking winners and losers.

The Fisker Saga, Courtesy of GigaOM

Most of our readers probably already know the broad strokes of the Fisker story. If you’re interested in the finer details of the history of the extended range EV company that appears to be circling the drain, GigaOM, a site that covers the investment side of tech companies, has published a fairly comprehensive 4,000 word look back at Fisker by Katie Fehrenbacher.

Fisker Taken Out Behind Capitol Hill's Woodshed

Congressional Republicans blasted current and former Fisker executives, as well as an official from the Department of Energy over missed milestones for their Department of Energy loans, which saw the company repeatedly fail to meet obligations while continuing to receive taxpayer money.

DoE Gets Some Money Out Of Fisker

The U.S. government has managed to recover $21 million in cash from Fisker, funds that will go towards repaying the nearly $200 million its received from the government in the form of loans.

Recent Comments