#financing

TTAC News Roundup: Nissan's LeMans Project Garaged, UAW Wants To Talk to VW, and How Much For Pep Boys?

From DNF to DNS, the Nissan GT-R LM project has finally been retired.

That, and it’s lights out for some Crown Vics, the UAW just wants to talk, Hyundai will spend more to lend more, and more … after the break.

Hammer Time: A Shotgun Hit & Run

“Honey? I just got into an accident!” she said.

My body experienced an instant adrenaline rush as my mind wandered through the worst “what if?” possibility of that moment, something like the image above.

My wife… Hospital… Pain… Medical bills… The other driver…

“Is everyone okay?” I asked in reply.

Should I Pay Cash for a New Car? Probably Not.

You have worked hard to save the $20,000 you need to purchase the car of your dreams. You’re ready to step into the dealership, walk straight to the manager in the back, plunk down those greenbacks, and say, “I have cash! Give me your best price!”

This may have worked in the days before electronic banking and factory rebates, but paying cash today will likely cost you more.

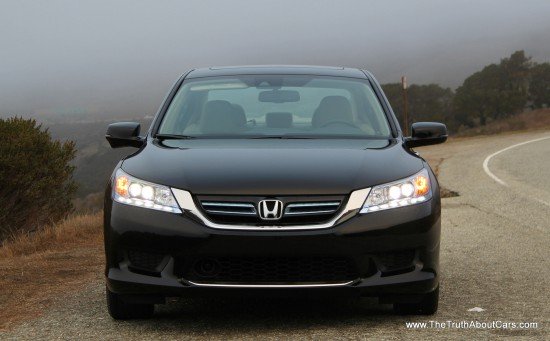

Honda's Sales Chief Warns Of "Stupid Things" As Accord, CR-V Top Retail Sales Charts

In this year’s red hot new car market, the Honda Accord and CR-V have apparently captured the top spot in both new car and SUV retail sales through the first half of 2014, according to Polk registration data. But John Mendel, Honda’s head of sales, had some pointed words for the industry as a whole, and the state of the American auto market.

NEVS "Not Insolvent," Will Pay When Possible

Remember when Saab’s new parent company was close to being taken to court and forced to declare bankruptcy by one of its suppliers? New information may have helped changed course.

Say Hello To 144 Month Financing

One year ago, we reported on the alarming trend of 97 month loans for new car sales. It turns out that these have now been supplanted by a substantially longer term. Say hello to the 144 month loan.

Boom, Bust, And The New Car Lust

6:30 P.M. and three more cars just pulled up to my place… on a Monday…

Have I just bought a McDonald’s franchise? Not quite. This is the start of what we call “tax season” in the used car business.

A time when tens of millions of Americans who live paycheck to paycheck get a nice four figure lump sum from Uncle Sam and his favorite sub-prime debt dealers.

New Or Used? : A Young Driver Wants His Milk & Cookies… Right Now!

I just got a job that involves a fair amount of driving and I am looking to spend about 11-13k on a car that is fun to drive but at the same time practical and reliable.

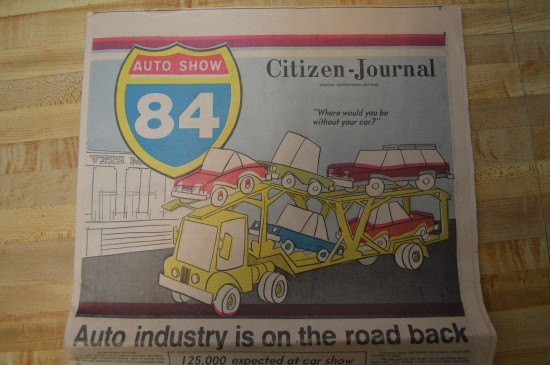

Maroon Velour, Coupes Galore, And An Important Four-Door for 1984

Haven’t you heard the exciting news? There’s a new Corvette out this year! Cadillac is building convertibles again! The VW Vanagon has a water-cooled engine! Oldsmobile is offering some kind of voice warning doohickey and the FIRENZA HAS NEW TRIM OPTIONS!1!!11! All with interest rates hovering just under 13%! It’s 1984, and I just can’t wait to check out the goods at the auto show.

Mainstream Press Finally Worried About Cheap Car Loans

Months after TTAC started to relentlessly bleat about the glut of money flowing into the auto loan sector, the mainstream media is finally taking notice. Automotive News is finally expressing some worry over the factors that we’ve been discussing for some time: car loan terms are getting longer ( to help keep payments low), subprime lending is increasing and an expected rise in interest rates could put an end to the new car market’s exuberant performance.

Leasing Accounts For A Quarter Of New Vehicle Sales As Payments, Residuals Stay Low

While the engine behind the exceptional growth in new car sales is a hotly debated topic, leasing is proving to be an undeniable catalyst behind this year’s impressive new car sales numbers. Through June of this year, leasing accounted for 25.7 percent of new car sales, versus 22.2 percent in 2012. A decade ago, that number stood at just 17.5 percent.

"All Is Fine In Sub-Prime Land," Says Someone With A Vested Interest In Its Success

The Detroit Free Press paints a pretty clear picture of the automotive lending landscape: auto loan terms are rising, with 1 in 5 loans now lasting longer than 6 years. At the same time, the average credit score for those taking out loans is dropping. Ominous signs for a car market that’s running on the hype of a perpetually increasing SAAR, right? Well, not according to some.

Auto Loan Delinquencies, Reposessions Up In Q1 2013

Bad news on the subprime front, as credit rating agency Experian reports a rise in delinquencies and repossessions for auto loans in Q1 2013.

Melinda Zabritski offered a rather dubious explanation for the nearly 17 percent rise in repos (as well as the 1.3 percent uptick in 30 day delinquencies and 12.4 percent rise in 60-day delinquencies)

97 Months And Running

8 years to pay off a car? A report by the Wall Street Journal claims that in Q4 of 2012, the average car loan stretched out to 65 months, or just over 5 years. Loan terms were being stretched out over increasingly longer terms too, with credit firm Experian reporting that nearly 1 in 5 car loans had terms between 73 and 84 months long, with some stretching for as long as 97 months.

Car Loans: The Borrow Time Gets Longer And Longer

When Lee Iacocca was a Ford regional manager, he helped pioneer auto loans. Consumers could buy a 1956 Ford for 20% down and $56 a month. The loans were paid off in just 36 months. In the final quarter of 2012, the average term of a new car note stretched out to 65 months, says Experian. 17% of all new car loans in the past quarter were between 73 and 84 months. A few were as long as 97 months. This trend bears huge risks for consumers and industry, says the Wall Street Journal.

Recent Comments