Boom, Bust, And The New Car Lust

6:30 P.M. and three more cars just pulled up to my place… on a Monday…

Have I just bought a McDonald’s franchise? Not quite. This is the start of what we call “tax season” in the used car business.

A time when tens of millions of Americans who live paycheck to paycheck get a nice four figure lump sum from Uncle Sam and his favorite sub-prime debt dealers.

This money will typically be gone within 72 hours. Cars, electronics, and (cough! cough!) indebted personal obligations will be re-distributed to impersonate economic growth.

None of this matters for me right now because my brand new customers, with tax refunds in hand, are looking at three older cars.

The respective ages of these low money down rides?

17.. a red 1997 Honda Civic EX with 130k miles.

18… a gold 1996 Nissan Sentra with 135k miles.

And 19, a white 1995 Pontiac Bonneville SSE with 160k miles.

Two year notes for three cars that are old enough to have been driven daily when I was young.

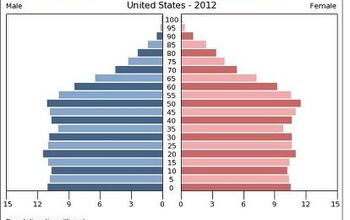

Should all this age scare me? No. Not at all. I’ve financed hundreds of teenage and twenty-something cars over the last several years, and with the average age of a vehicle in the United States slowly creeping towards the twelve year mark, I’m not even sweating it anymore.

So long as I find the right owners, these cars don’t break. At least not in a terminal sense.

The ones who should be sweating it are the manufacturers. Why? Because they overproduced at a torrid pace from the early-2000’s to late 08′, and now that many of these defunct brands and models are headed towards their middle-age, they’re getting depreciated to kingdom come.

Yet they still run fine. Even until recent times this longevity had not been the usual case.

Ten years ago the average old jalopy on the road was usually a rolling piece of junk that drank gas, smoked oil, and hung out with the bad boys. I saw these cars all days long at the auctions and sold tens of thousands of them as a ringman, auctioneer, and remarketing manager for an auto finance company. The wholesale auctions were full of em’ back then, and I still remember getting headaches from all the carbon monoxide and other deadly substances that permeated the air. When it came to older cars, there were far too few manufacturers of quality vehicles. Older Benzes, Toyotas and Hondas were able to handle the long haul. American trucks and gas guzzling body on frame land yachts were pretty good as well. Those were the sweet spots for those wanting car owners who couldn’t do it themselves. Everything else offered a lot more misses than hits.

Now, the average old car… is the family car. The extra car that rarely gets driven. Or even your own car.

It was more than likely designed at a time when lean manufacturing had already become predominant, OBDII diagnostics had become a universal standard, and fuel injection had become a given. Even the recent defunct brands. The Pontiacs, Oldsmobiles, and Mercurys of today are light years ahead of the malaise era inspired, quantity driven metal of yore that rightfully deserved to be recycled into Chinese washing machines.

Your current daily driver, old it may be, is still going to last you for a while. And when it does decide to spit out a part, chances are you can find a cheap replacement for it online or at an auto recycling center. The labor to replace it may no longer be cheap, and your older ride may not have the same tolerance for neglect and abuse than it did when new. But if you drive like everyone else on the road, chances are it’s going to last you well past 200,000 miles, or even 15+ years if you live in a non-rust climate.

We can go on about defunct brands and models that are now overpopulating the used car market thanks to the corporate accounting games of not too long ago. We can even venture forth to the less political causes of what will likely become a golden era for cheap transportation if you keep your eyes sharp on good product. This is in large part thanks to the research engineering advances of the last 15 years, and the amazing convergence of suppliers, standards and even platforms within our industry.

But there is one factor that seems to trump all the others in today’s used car market. Money.

In my world that is running a car dealership, the new car is now matching the eight year old used car when it comes to the monthly payment.

How? Here’s how.

It’s the difference between a two year note for an $8500 eight year old used car at 14%, and an eight year note on a $30,000 new car at 5.9%. The financial difference between those two cars, pre-tax, tag, and bogus add-on fees, is $408.11 a month for the used car, and $392.78 for the new car. You read that right. The monthly payment is now often less for the average new car than it is for the average used car. A lot of consumers who are already used to having a car payment don’t mind paying for a longer period if it means getting a newer vehicle.

Now that automakers and major banks are delving deeper into sub-prime loans, even deeper than they did back in late 2007, used cars are becoming increasingly unmarketable.

The millions of orphaned brands and models with little to no marketing cache are going to help this process advance far faster than you may realize. In fact, many of the largest used car retailers will no longer buy any orphaned brands because they sit at the lot for far longer periods of time than ever before. A lot of declining brands such as Volvo, Mitsubishi and Lincoln are also on that same walking plank of consumer obscurity that leads to an ocean’s worth of cheap inventory.

No overproduced, over-leased or unpopular used car can compete on a level playing field with a new car equivalent that has the better brand name on the front of it. That is unless you’re one one of those customers willing to pay cash one time for an older product.

If that cash customer is you, these next few years will offer a far better bang for the buck when it comes to buying used cars. Once the bad decisions of 2007 and 2009 are removed from the credit histories of consumers who had bad luck back in the day, you will see many of these customers ditch their old rides and buy whatever new car they can find which offers a lower payment, a nicer ride, and better cash flow. At least for right now.

I predict that a lot of these cars will contain technologies that will be far too expensive to fix and repair in the coming years. However, by then I’m sure that the manufacturers will be offering ultra-high mileage, aluminum bodied works of wonder with advanced CVT transmissions and software that will enable electric motors to become a worthy alternative to the internal combustion engine.

Meanwhile, someone out there will still be driving an old Honda Insight. New car smell be damned.

More by Steven Lang

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Ajla A union fight? How retro 😎

- Analoggrotto Finally, some real entertainment: the Communists versus the MAGAs. FIGHT!

- Kjhkjlhkjhkljh kljhjkhjklhkjh *IF* i was buying a kia.. (better than a dodge from personal experience) .. it would be this Google > xoavzFHyIQYShould lead to a 2025 Ioniq 5 N pre-REVIEW by Jason Cammisa

- Analoggrotto Does anyone seriously listen to this?

- Thomas Same here....but keep in mind that EVs are already much more efficient than ICE vehicles. They need to catch up in all the other areas you mentioned.

Comments

Join the conversation

Question for Steve or anyone: Is it still true what you wrote about the average American car being about 12 years old? I ask because I remember hearing/reading that we hit a new record for average age of car on the road (11 years +) a year or two ago, but I also know that new car sales have been quite strong for a year or more now. So have strong new car sales (in the U.S.) moved that "age of average car" to a younger number?

My 04 Z with 170K miles feels better than my 93 Accord did at 92K miles at the same age. Cars have become robust to the point that it is detrimental to the auto manufacturers. If I can keep the shell strong, I can see this thing going to 500K with an engine swap or two.