#bankruptcy

Saab Officially Gives A Thumbs Up To GM Facebook Squatters

For more than two weeks, Saabhuggers have taken over GM’s Facebook page, plastering “Let Saab go!” all over the site. Yesterday, the occupation has been officially endorsed by Saab.

GM sources which requested anonymity, citing possible legal implications, mentioned to TTAC that the attacks have “all signs of a coordinated campaign.” That is putting it mildly.

Saab's Supposed Savior Antonov Debanked

Vladimir Antonov, the Russian “financier” who was feted by the acolytes of the zombie Saab as the second (after Victor Muller) coming of the dear Jesus, had his bank taken away from him.

More than $392 million of assets of Antonov-controlled Snoras Bank may be unaccounted for, central bank Governor Vitas Vasiliauskas told Bloomberg. Snoras’s operations were halted, and a state administrator was appointed by the Lithuanian government after the bank ignored recommendations to reduce its credit risk.

As a precautionary measure, government and bank traded accusations of felonious conduct. Reports Reuters:

“The government and central bank said they had found a risk of insolvency and possible criminality. The bank meanwhile has accused the government of ‘robbery’.”

Just to be sure, Swedish Radio mentions that “Antonov lent a large sum to Victor Muller which allowed Spyker to buy Saab.”

Our Daily Saab: With Plans Expired And Dealers Waiting On Cash, GM Takes The Wheel

Saab’s Memorandum of Understanding with PangDa and Youngman expired today, returning Saab to what must by now be a rather comforting, familiar state of limbo. Of course, the MoU in question was already dead, as GM had publicly nixed it, saying it wouldn’t supply parts or license technology to a 100% Chinese-owned Saab. But now, without an official agreement to rally around, Swedish Automobile, PangDa and Youngman are desperately pitching new ownership structures to GM in hopes of approval. Swedish Auto’s Victor Muller tells the WSJ [sub]

We are submitting an information package to GM and we will have to await the feedback that GM has on that package and then we’ll know.

Muller says the lesson of the failed MoU is that GM won’t accept Chinese control, and as a result the new proposed ownership structure is “very carefully crafted” so that none of the three partners has complete control. But since the previous deal, in which PangDa and Youngman would split a 54% stake in Saab, is also off the table, it’s tough to say what Muller’s “carefully crafted structure” entails. And while Saab and its Chinese suitors wait for GM approval that may never come (but don’t tell Keith Crain [sub] that!), it seems both time and money are getting tight. Again. Still.

Our Daily Saab: SWAN Examines The Endgame Options

With Saab’s latest MOU with PangDa and Youngman expiring on Tuesday, the heat is on for parent company Swedish Automobile (SWAN) to hash out the many problems and disagreements between GM and the proposed Chinese buyers. And now that it’s fairly obvious that a deal won’t happen, as GM and the Chinese Government seem fairly well set against it, the question is “what next?” How do you plan an endgame that should have been initiated months, if not years ago? That’s the challenge being considered by the few remaining shareholders in SWAN, who are meeting in Holland to pick through the none-too appealing options.

Our Daily Saab: TTAC On Swedish Radio

Lyssna: Kinesiskt ja kan tvinga fram ett godkännande

“We will try to get clarity about what the decision from GM means and if there is any way ahead,” court-appointed administrator Guy Lofalk told Reuters. “I hope that I will know more before the end of the week.”

For the time being, Lofalk will not recommend to the court to end the bankruptcy protection process. He said it could happen though.

On Monday, GM said they would yank all licenses and oppose the deal if Saab would be sold 100 percent to China’s Pangda and Youngman.

Both Victor Muller and his mouthpiece Saabsunited now say they knew that all along.

We are in rare agreement on that. Last Friday, Sweden’s national publicly funded radio broadcaster Sverigesradio reached me and asked what I think of the deal.

Or Daily Saab: A Wale Of A Botched Sale

GM’s China chief Kevin Wale poured a huge bucket of ice-cold water over hopes that China’s Pangda and Youngman will rescue Saab. The deal needs to be approved by the Chinese government, the European Investment Bank, the Swedish government and – GM.

Wale told Reuters today:

GM Issues Death Sentence To Saab Deal With China

While the flagwavers at Saabsunited wallow in the good news that the Swedish king announced at an annual moose hunt near Trollhättan that Victor Muller is a great guy, far away in Detroit, GM spokesman Jim Cain issued to Reuters what sounds like the death sentence to the sale of Saab to China’s Youngman and Pangda:

“GM would not be able to support a change in the ownership of Saab which could negatively impact GM’s existing relationships in China or otherwise adversely affect GM’s interests worldwide.”

The exactly same statement was sent to the Wall Street Journal, and GM will send it to anyone who asks what GM thinks of the deal. If Muller would have asked before announcing the sale, he most likely would have received the same answer.

Translation:

Our Daily Saab: Dark Clouds Gather Around Saab's White Knight

Pangda, one of Saab’s presumptive white knights, could itself be facing financial difficulties. Both the staid government-owned China Daily and the more outspoken Taiwan-based China Times report strange financial going-ons at PangDa. Says China Times:

“Shareholders and securities analysts are scratching their heads over how a top automobile marketing group in China managed to “burn” a huge fund of 6 billion yuan (US$944 million) in just six months. Many have speculated that Pang Da Automobile Trade Co has shifted to financial leasing services to cope with stalling car sales caused by the government’s credit-tightening regulations.”

According to China Daily, $659 million had been “used to repay bank loans and supplement working capital.” China Times reports a lot of the money as lost and says:

Our Daily Saab: Saab "Saved" As 100% Chinese Firm… Pending Those Pesky Approvals

On the last possible day to work out a deal before being forced into bankruptcy, the Victor Muller era has ended at Saab. The Swedish brand will now become a completely Chinese-owned company… if all goes to plan. A press release explains

Swedish Automobile N.V. (Swan) announces that it entered into a memorandum of understanding with Pang Da and Youngman for the sale and purchase of 100% of the shares of Saab Automobile AB (Saab Automobile) and Saab Great Britain Ltd. (Saab GB) for a consideration of EUR 100 million…

…The administrator in Saab Automobile’s voluntary reorganisation, Mr. Guy Lofalk, has withdrawn his application to exit reorganisation. The MOU is valid until November 15 of this year, provided Saab Automobile stays in reorganisation.

But remember, this is Saab… and its fate rests in the hands of many, many people not named Victor Muller. Despite the air of finality that is surrounding some of the media coverage of this latest announcement, this is not a done deal. The Saab saga rolls on…

Our Daily Saab: Chengdu Noodles

There was no better place to clear up some questions about Saab than in Chengdu. After all, nowhere can you find the CEOs of all major Chinese carmakers and government officials all under the same roof, or even at your dining table. There also was no better place to get entangled in the messiest web of facts and fiction. Here is some local color:

Our Daily Saab: Youngman Prolongs The Agony, As "Criminal Consequences" Loom

Death with Dignity apparently does not exist in Victor Muller’s vocabulary, as Reuters reports that the CEO of Saab’s parent company will receive loans from prospective investor Youngman in order to ward off liquidation in Swedish bankruptcy court. Youngman has committed some $97m in bridge loan financing to the troubled Swedish automaker, of which Saab has received $15m so far and will receive more payments this week in order to pay salaries and other expenses. Saab spokeswoman Gunilla Gustavs explains

“We are putting bridge financing in place so we can fund business during the reorganisation — so we don’t incur new debt. We have running costs, such as electricity, that we need to take care of. There are a number of business-critical operations that need to be funded”

Saab’s salaries are currently guaranteed by the Swedish government as part of Saab’s bankruptcy protection, but that guarantee expires on October 21, just before October salaries are due. Missing that payment would likely have spelled the end of Saab, but with Youngman’s money arriving in dribs and drabs it seems that we may be documenting the firm’s undignified collapse for another month or so.

Our Daily Saab: Possibly Last Supper

The Chengdu meeting might ruin the appetite of the Saab faithful. Saab wasn’t a topic during the proceedings, although Volvo was mentioned a lot. On the sidelines of the conference however, death sentences to Saab where handed out by the truckload.

Jim Holder, Editor of the U.K. magazine AutoCar is at the meeting. He scooped me by learning from a highly reliable source:

“A last-minute rescue deal to save Saab is virtually certain to be blocked by the Chinese government, meaning the company is almost certain to be declared bankrupt – possibly as soon as later today.

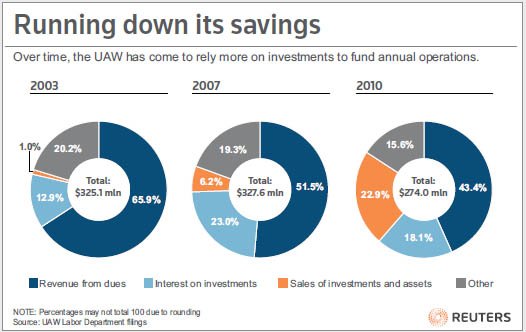

Carpocalypse, Now At The UAW

A bloated management, run-away costs, declining market share, imploding volume, a sell-off of assets and investments, headquartered in Detroit – what is it? No, it’s none of the Detroit automakers. It is their former nemesis and current co-owner, the United Auto Workers.

“Two years after the wrenching restructuring of the U.S. auto industry and the bankruptcies that remade General Motors and Chrysler, the UAW is facing its own financial reckoning. America’s richest union has been living beyond its means and running down its savings, an analysis of its financial records shows. Unless King and other officials succeed with a turnaround plan still taking shape, the next financial crisis in Detroit may not be at one of the automakers but at the UAW itself.”

This is the beginning of a special report written by the best in the reporting business, by Deepa Seetharaman and her boss, Kevin Krolicki, Chief of the Detroit Bureau of Reuters, with the help of their team of combat reporters from the Detroit front-lines.

Our Daily Saab: Do Not Resuscitate Order Rescinded

Saab is on court ordered life support. On appeal, the Court of Appeals for Western Sweden has approved Saab’s request for protection from creditors. Saab can now attempt a business reconstruction without the threat of imminent bankruptcy, The Local reports.

Our Daily Saab: A Very Iffy Situation

Writing these Saab stories is becoming as much fun as visiting a fading relative in a hospice: You have to do it, but you want to get it behind you, quickly. Today is the day a court in Sweden will decide whether it admits Saab’s appeal of a prior court decision that would have forced the Swedes into bankruptcy. In the meantime, Victor Muller came up with another plan.

Recent Comments