Ford to Offer Chinese Version of Mustang Mach-E

Ford announced that a Chinese version of the Mustang Mach-E, also known by some of us cynical scribes as the Mustang Mock-E, will be built in China by Changan Ford.

Junkyard Find: 2011 Mercury Mariner, Last Gasp of the Mercury Brand Edition

Ever since I found one of the very last Oldsmobiles in a Denver car graveyard, I’ve been keeping my junkyard eye open for other final-year-of-marque Detroit machinery. We’ve got the 1998 Eagle, the 2001 Plymouth, and the 2010 Pontiac, and now it’s time for one of the very last vehicles to wear the Mercury badge: this 2011 Mariner Premier.

Deliveries of Mach-E Stall

According to macheclub.com, the arrival of your Ford mock ‘Stang may be delayed, although no reason had been given until now, when the enthusiast site reached out to Ford for comment.

Mach-E Delivers Everything but the Mustang

The first Mach-E delivery took place yesterday, according to macheclub.com. Sam Pack’s Five Star Ford in Dallas, Texas was the dealership, and the vehicle was a California Route 1 Mach-E in white.

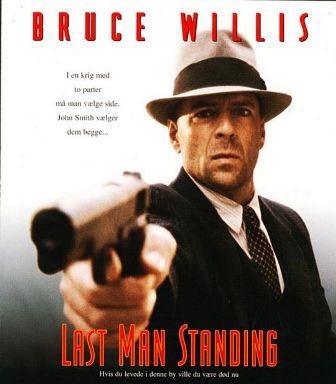

Ford Death Watch 49: Gypsies, Tramps and Thieves

Will Ford go bankrupt? I doubt it. Not while the “bad” automakers that suckled on the federal teat go on and on and on and on. A FoMoCo C11 would expose the government’s Detroit bailout for what it was/is: unfair, ineffective, ill-conceived and unsustainable. Politically, Ford’s failure is not an option. If push comes to shove, Uncle Sam will send Ford more Department of Energy loans, some juicy subsidies and generous tax breaks; anything and everything up to and including cash money. This despite—I mean because of the fact that Ford is guilty of the same sin that sank GM and Chrysler: taking in less money than they spent. Political calculations aside, is it even possible that Dearborn’s darlings will be forced—forced I tell you—to prostrate themselves in front of federal taskmasters? Once again, to answer that question, feel the burn.

Ford Death Watch 48: 'til the Cows Come Home

Speaking of barnyards, someone forgot to tell Ford watchers not to count their chickens until they hatch. The MSM is ready, willing and able to pronounce the Blue Oval Boyz’ turnaround plan for the ailing American automaker as good as done, and skip the “it worked!” part of CEO Big Al Mulally’s canonization. The Detroit News is down with this fait accompli meme. “As one fund manager who controls a sizable chunk of Ford’s stock and bonds put it: ‘The biggest threat to Ford’s future is that Mulally steps off the curb tomorrow and gets hit by a bus.’ Such sentiments, blunt as they may be, are a testament to the progress Ford has made since Mulally took over as CEO in September of 2006. He predicts the company should settle into profitability by late 2011.” So that’s it, then, save “Mulally is no stranger to success” and “He’s been an agent of change” and “For many Ford employees, he has rock-star status” and I think they ought to think it out again.

Recent Comments