Stellantis Merger Now Playing at a Dealer Near You

Stellantis, the merger between Peugeot and Fiat Chrysler Automobiles, became effective on Saturday, January 16th. The world’s fourth-largest carmaker has emerged, a surprise to no one.

Mike Manley FCA CEO to Head Americas for Stellantis

Mike Manley will head Americas operations for Stellantis, as FCA chairman John Elkann said in a letter to employees today.

What's to Become of Chrysler?

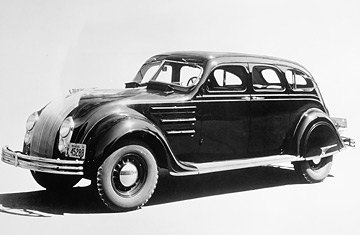

Chrysler has certainly changed since emerging from the ashes of the Maxwell Motor Company in 1925, spending the better part of the 20th century purveying all manner of car to the American public. The current century has seen the company merge with Daimler, followed by Fiat. Now it’s cozying up to PSA Group, leaving many to wonder what purpose Chrysler serves beyond being the corporate namesake.

Officially, the merger isn’t supposed to impact any FCA or PSA brands. But the Chrysler brand isn’t exactly a model of industrial health. Its current lineup consists of four vehicles, one of which (Voyager) is just the lower-trim version of the non-hybrid Pacifica. The minivan sales are enviable, comprising over half of all vehicles sold within the segment for the United States last year — if you incorporate the Dodge Caravan — but Chrysler’s overall trajectory leaves much to be desired.

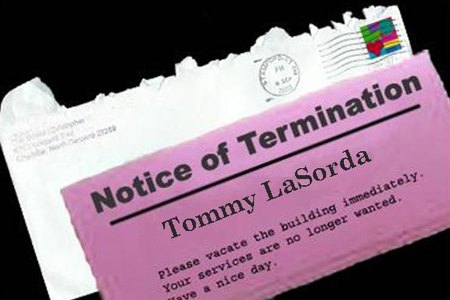

Chrysler Zombie Watch 1: Fiatsco!

Chrysler Suicide Watch 49: Official Statement

Editorial: Chrysler Suicide Watch 48: Die Another Day

Editorial: Chrysler Suicide Watch 47: Chrysler Financial Flames Out

Editorial: Chrysler Suicide Watch 46: Private Capital Vs. Uncle Sam

Editorial: Chrysler Suicide Watch 45: By Executive Fiat

Editorial: Chrysler Suicide Watch 44: Will the Last One Out of the Building…

Chrysler Suicide Watch 43: Reality Check on the Fiat Deal

Editorial: Chrysler Suicide Watch 42: La Grande Bugia

Editorial: Chrysler Suicide Watch 40: GM Merger A Done Deal. Or A Breakup. Or Something.

Chrysler Suicide Watch 39: "Partnership for Technology Transformation"

Chrysler Suicide Watch 38: Nissan Comes A-Courtin'

Chrysler Suicide Watch 36: Ghosn Fishing

Chrysler Suicide Watch 35: Reason to Be Cheerful

Chrysler Suicide Watch 34: End Game

Chrysler Suicide Watch 32: Slumlords

Chrysler Suicide Watch 31: False Dawn

“It’s a New Day.” Unless you’re terminally ill or the guest of a terrorist cell, this observation won’t come as much of a surprise or, in itself, cause much delight. And yet that’s the tagline for the [now] combined Chrysler, Dodge and Jeep brands. In an explanatory TV ad, an animated child tells viewers that the American automaker will [now] listen to YOU and build cars the cars YOU want. The ad is an excellent example of what Adolph Hitler called The Big Lie: a falsehood so “colossal” that no one would believe that someone “could have the impudence to distort the truth so infamously”. To wit: if any single automaker ISN’T building the cars YOU want, it’s Chrysler.

Ipso facto. Chrysler’s U.S. market share is swirling around the toilet bowl. Although they’re now a privately-held company exempt from full public financial disclosure, analysts reckon Auburn Hills accounts for just 14 percent of the America’s new car sales pie– and falling. Not to mention the bulk sales propping-up that share. And no wonder: Chrysler’s three brands are suffused with poorly-built, hugely discounted, high-depreciation product that YOU would be crazy to buy.

The timing of Chrysler’s new day new tagline adds to the cognitive dissonance. Why would Chrysler announce its newfound desire to build cars customers want (sounds crazy but it just might work) just as it’s about to decimate its entire model lineup? This forthcoming execution of ten or more Chrysler losers makes perfect sense: the first part of making the cars YOU want is shit-canning the cars YOU don’t want. But it’s a PR nightmare. Customers will [rightly] see the bloodletting as an abject admission that Chrysler isn’t clued-in to its customers’ need.

Don’t worry! It’s a New Day! (How Mein Kampf is that?) Yes, well, what about all those customers who helped keep Chrysler alive by buying all the models that the company is now killing? Unless these owners plan to take their lame duck car or truck to the grave (via their very own personal lifetime warranty), Chrysler’s producticide will add depreciation insult to depreciation injury. Should old acquaintance be forgot, and never brought to mind? Guess so.

The discrepancy between Chrysler’s New Day sloganeering and its past and current predicament isn’t the only reason that their new tagline is a Big Lie. The automaker’s inability to implement this consumer-centric philosophy in the future also puts paid to their Napoleonic declaration that history begins… now.

Let’s set aside the fact that Chrysler’s new owners’ intention to sell the company to someone else (talk about commitment: we’re going to build the cars YOU want until we can get SOMEONE ELSE TO DO IT). To bring meaning to Chrysler’s New Day promise to listen and respond to customers’ needs, they’ve got to change they way they do business.

Hence the tagline’s tagline: “you talk, we listen.” The evidence for this communications revolution is weak. The official website proclaims the New Day and invites customers to “see the difference” on 12 models. The majority of the enhancements are options (i.e. extra expense), rather than new “you asked for it, you got it” standard features. Are we really to believe that Charger customers clamored for “Cool Vanilla” paint? At best, these changes result from the same old focus group filtration. At worst, Chrysler’s spinning to create a false sense of consumer “empowerment.”

For evidence of Chrysler’s supposed desire to “get close to the customer,” we turn to their official blog. Not only is Chrysler leaving this electronic forum to rot on the [not Jason] vine, but even a cursory glance reveals that it’s nothing more than corporate propaganda written by insiders, hacks and Spinmeisters. “Yes a truck can be a family vehicle;” “A new day dawns at our dealerships;” “Unleashed.” In a web swimming with millions of car buyers and enthusiasts, most blog posts get single digit (including 0) responses. ‘Nuff said?

It’s too bad that Chrysler’s New Day is a Big Lie. They’ve missed a huge opportunity to make an enormous competitive leap. If Chrysler really wanted to revolutionize its business, to create a genuine new dawn, they could do so by throwing open the company to its customers, dealers and workers. They could use the net to destroy the walls separating “us” and “them,” and establish a sophisticated feedback loop where the company COULD listen to its customers— and act upon that information in a timely way.

Yeah right. Chrysler is owned by Cerberus, a private equity company known for its obsessive, Kremlin-like secrecy. Of all the automakers in the world, Chrysler is the LEAST likely to let its guard down. There will be no Glasnost in Auburn Hills. Chrysler’s New Day is nothing more than a false dawn for those gullible– or desperate– enough to believe that the sun will come out tomorrow for the product-challenged, financially troubled American automaker.

Recent Comments