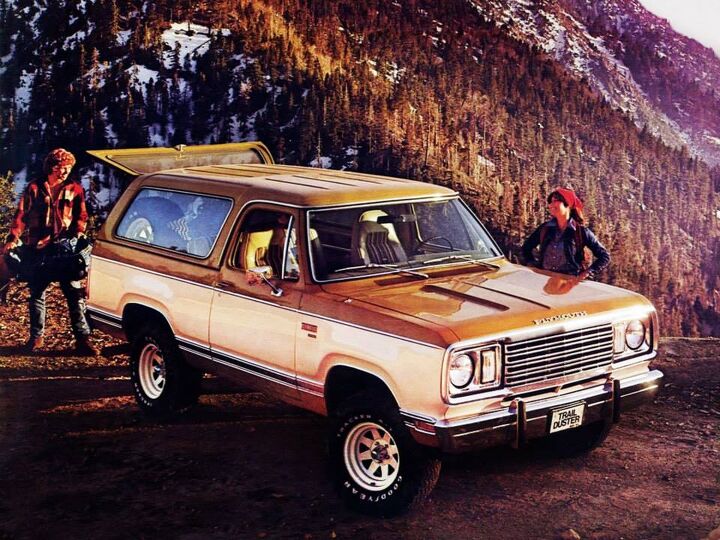

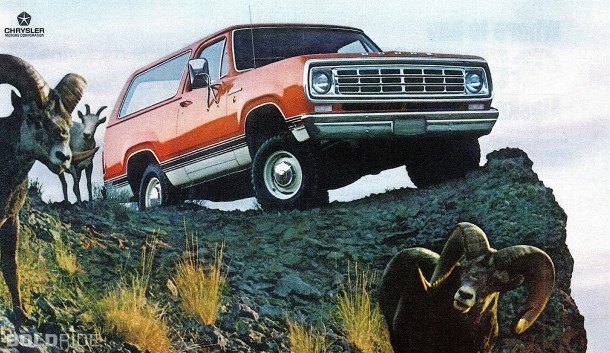

Ramcharger Rebirth

In October, FCA CEO Sergio Marchionne addressed a group of automotive analysts, where he was quoted as follows.

“We have a unique opportunity with renewal of the [Ram] pickup line, with the powertrains we selected, to significantly increase output. We will also be exploring, as a result of that investment, some other segments.”

Speculation related to a full-size Ram 1500-based SUV has been swirling ever since. And there is no denying the allure of $10,000 per unit margins. But what is the business case?

In short, it looks promising.

The analysis begins with the 1500 truck, which is scheduled for a major update in two years. Production will move from Warren Truck Assembly to Sterling Heights with the 2017 to 2018 model year changeover. The larger, more modern facility will enable FCA to meet demand for Ram trucks, which increased 2.6 percent last year to 542,000 units in North America. And excess capacity will also become available when they move from 3.3 million square foot Warren to 5.0 million square foot Sterling Heights.

Platform sharing is an economic necessity. The most effective platform shares are typically those that mask shared origins and enable designers to provide related products with characteristics tailored to their respective segments. For example, few Cadillac CTS drivers would want obvious visual cues that his or her ride shares its underpinnings with the Chevrolet Camaro. Not so in the full-size SUV category, where cross-pollination is more welcome. Consumers who want a full-size SUV are looking for a rugged body-on-frame rear-wheel/four-wheel drive rig. They are less likely than compact and mid-size SUV buyers to avoid a vehicle with a clear truck-based lineage. And FCA is earning a living selling utilities with a strong visual presence. Their design language generally embraces ruggedness and dismisses en vogue apologetic CUV styling. Ram is the ideal candidate to design a full-size SUV.

A full-size Ram SUV will appeal to the same audience regardless of its differentiation with the donor truck. And a 1500 doppelganger would be all the better for Ram; it would save the company hundreds of millions in development cost. A major mid-cycle refresh typically costs a domestic automaker about $500 million, while an all-new product will cost around $1 billion. The development of a long-wheelbase (LWB) and a short-wheelbase (SWB) full-Size Ram SUV would be equivalent to doing a B pillar back refresh, with a price tag between $300 and $400 million.

The wheelbase from the regular cab 1500 with a six-foot-four-inch bed makes an excellent donor for the SWB SUV. Its 120.5 inch span is four inches longer than Chevy Tahoe and 1.5 inches shorter than Toyota Sequoia. The two remaining wheelbases in the current 1500 range exceed the needs of a LWB SUV, but the foundational engineering work has largely been done. It may be instructive to take note of the configurations with which Ram makes the 2018 1500 available.

The most successful full-size SUVs are sold in both short and long-wheelbase versions. Over the last five years, GM’s SWB Tahoe/Yukon siblings have averaged a steady 60 percent of GM’s full-size SUV build. Neither the Toyota Sequoia nor the Nissan Armada are offered in a LWB, and they also trail GM and Ford by a wide margin in sales. GM sold 213,000 full-sizers in the U.S. last year. Ford moved 41,000, good for 15 percent of the market. Toyota and Nissan split the remaining 25,000 units, for a 4.5 percent market share each. Another disadvantage both Japanese manufacturers have saddled themselves with is a lack of powertrain options. Both Sequoia and Armada are available only with large displacement V8s. The Ram would likely arrive with at least three engine options from the 1500: the modern Pentastar V-6, capable Hemi V-8, and pricey-but-gutsy VM Motori 3.0-liter diesel. If Ram elects to offer only a SWB it will have a leg up on Toyota and Nissan, but it will be swimming in the shallow end of the pool. FCA needs to follow its domestic rivals and offer both wheelbases in order to realize its full sales potential.

A full-size Ram SUV would be no friend to the environment. However, FCA has already announced its strategic pivot toward trucks and SUVs at the expense of cars. And though we do not know how CAFE credits are priced, we can be confident that the company would prefer to develop products it can sell at a $10,000 margin versus vehicles it cannot sell at a $2,000 margin. Ram also has something unique to offer the segment. Its 20 percent take-rate on relatively fuel efficient diesel powered 1500s is a potential advantage. In an SUV, this engine would increase aggregate fuel economy as well as address demand for a corner of the market no other manufacturer is satisfying. Additionally, the industry-first Pacifica hybrid may lead the way in deployments of similar drivetrains in the 1500, as well as in the contemplated SUV. Ramcharger could be the Prius of full-size SUVs.

The welcome collapse in fuel prices is sure to end, and it will likely do so before a revived Ramcharger reaches the market. But full-size SUV buyers do not care. The best year in recent history for full-size sales was 2014, which did not see average fuel prices dip below $3.30 until September. What’s more, even in 2011 when fuel prices were flirting with all-time highs and auto sales were only beginning to rebound, full-size sales were just seven-percent shy of last year’s total. Yes, continued average fuel prices below $2.00 per gallon will help, but demand for full-size SUVs is not strongly correlated with fuel prices — it is relatively inelastic.

One of the most significant questions related to FCA’s decision to revive Ramcharger will be how it complements a corporate lineup including two other three row SUVs, in the Durango and Grand Wagoneer. Automakers are slicing markets ever thinner, and these three products would certainly overlap, particularly considering that across FCA’s dealer network Dodge, Ram, and Jeep products share space. These utilities must be differentiated if they are each to prosper.

Without significant marketing, Durango has been riding the Grand Cherokee’s coattails for five years. It has done so in part because consumers who need three rows of seating are visiting Jeep stores to shop Grand Cherokee, then walked across the lot to Durango. The Dodge offers a well differentiated and similarly masculine exterior. And it may be a unibody design, but it is a rear-drive biased, truck-like SUV, both in appearance and drivability. The current Durango is three to five inches narrower than the current crop of full-size SUVs, and three to six inches shorter. Even the Explorer offers a slightly larger footprint. And Durangos sell. When the Grand Cherokee and Durango are lumped together, as Expedition and Expedition EL are, Durango has accounted for 25 percent of North American sales in each of the last three years.

The confirmed Grand Wagoneer will, like Durango, be based on a shared architecture with the next generation Grand Cherokee. This likely means a shared wheelbase and proportions with Durango. Sergio has been telling anybody who will listen that the Grand Wagoneer will be aimed at Range Rover. As difficult as it may be to imagine a Jeep starting at $85,000, his point has been made. Grand Wagoneer will likely be positioned above much of the Grand Cherokee range, and will offer a third row. It will be thematically aimed at Range Rover, yet priced on par with BMW X5, Volvo XC90, and Mercedes GLS. Moreover, Jeep has demonstrated with the Grand Cherokee that it can sell the $30,000 Laredo alongside the $60,000 Summit. It can just as effectively sell the up-scale three row Grand Wagoneer at a $20,000 premium versus Durango.

There is space, based on size and price, for a full-size Ram SUV. The differentiation challenge is similar at Ford, where the Explorer and Expedition have coexisted for two decades. And perhaps offering a more complete range of SUVs will provide positive network effects across FCA’s mid and full-size utility range. One can imagine an SUV tug-of-war at the most senior levels inside FCA — how can Ram compete in a utility crazed market without a single SUV? Cleaving Ram from Dodge in 2010 may or may not have been a good idea, but if FCA plans to stand by that decision it needs to set the Ram brand up for success and a full-size SUV is essentially prerequisite.

How many Ramchargers can FCA sell? Assuming they offer two wheelbases, sales will exceed those of Sequoia and Armada, but will probably be less than the well entrenched Expedition. Some Ramcharger sales will be conquested and others will be new to the segment. First year sales may total somewhat less than half of Expedition sales, or 20,000 units. Second year sales will benefit from greater consumer awareness and dealer inventory, resulting in growth to perhaps 25,000 units.

What financial hurdles does FCA require to green light a new vehicle program? This is proprietary, but two rules of thumb are a 20-percent-per-unit profit margin and a maximum 18 month payback on development. If Ram moves 20,000 Ramchargers at an average transaction price of $50,000, with a $10,000 margin, the 20-percent profitability hurdle would be met. It would take a little less than 18 months to earn back $300 million, and about 22 months to earn back $400 million.

We don’t need a focus group to know the Ramcharger nameplate lacks recognition. We would, however. require a focus group to know what other names Ram may be contemplating and how they would be received. Nonetheless, given the lack of cache in the Ramcharger name, the chances of its resurrection are lower than the chances of FCA green lighting a full-size Ram SUV.

Will FCA enter the full-size SUV segment? We can only speculate. But we do know there will be a hard-fought internal debate. Ultimately, the decision will depend on how the Ramcharger opportunity stacks up against other projects competing for limited capital, design, and engineering resources. It appears to fit well with FCA’s corporate strategy. Only time will tell.

Twenty year auto industry professional. Currently CEO at Turbo International, the premier American manufacturer of OEM replacement turbochargers for the global aftermarket.

More by Seth Parks

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- NotMyCircusNotMyMonkeys so many people here fellating musks fat sack, or hodling the baggies for TSLA. which are you?

- Kwik_Shift_Pro4X Canadians are able to win?

- Doc423 More over-priced, unreliable garbage from Mini Cooper/BMW.

- Tsarcasm Chevron Techron and Lubri-Moly Jectron are the only ones that have a lot of Polyether Amine (PEA) in them.

- Tassos OK Corey. I went and saw the photos again. Besides the fins, one thing I did not like on one of the models (I bet it was the 59) was the windshield, which looked bent (although I would bet its designer thought it was so cool at the time). Besides the too loud fins. The 58 was better.

Comments

Join the conversation

I just found this..... Ram had unveiled a concept "RamCharger" at the Moab Jeep Rally last Easter. Looks real good. http://www.fourwheeler.com/moab-experience/2015/1504-ram-unveils-2017-ramcharger-concept-at-easter-jeep-safari-2015-in-moab/

Question for the TTAC team: Why isn't FCA contemplating a full-sized Chrysler nameplate SUV? Something to compete with Escalades/Suburbans/Navigators? Limo industry has seen the death of towncars and the rise of the MKT-TownCar edition to fill the void. Is FCA thinking that segment is already saturated? Go for the "macho" Ram segment because that market has growth?