The Truth About Honda's Fleet Sales

TTAC has a long tradition of digging deep into manufacturer sales data, frequently focusing on retail versus fleet sales. It’s become commonly accepted that high fleet percentages are a sign of weakness in product lines, at least as far as retail consumer preference goes. The traditionally low fleet percentages of Japanese brands have been singled out as evidence of those companies’ ability to attract crucial retail dollars, or at least their superiority in matching production to demand. And they were right. For many years, Toyota and Honda in particular could count on strong retail sales of premium-priced products in a way that the Big 3 couldn’t. Changing trends in the American vehicle market are undermining this model, though.

When I wrote about Toyota’s rising vehicle stockpiles, heightened fleet sales, deep discounts, and the resulting collapse of its pricing model, there was plenty of heated discussion. Although I was tarred and feathered by some as a Toyota hater and Detroit homer, they mostly missed the point: it’s no longer valid to think of Toyota as an “exceptional” car company from a business perspective, regardless of your personal opinions about the relative merits of their products. As the Camry debacle shows, the market is no longer willing to reward Toyota simply for the sake of being Toyota. For the sake of fairness, it’s time to ask the same set of questions about the company whose business strategy most nearly matches Toyota’s: archrival Honda. The evidence suggests there are some rather unpleasant fleet skeletons hiding in Honda’s closet, ones that don’t match the traditional image of the company as the retail leader.

On the surface, things look fine. Honda’s incentive spending on the marquee Civic and Accord is significantly lower than rivals. And its much-vaunted strategy of ignoring the fleet market and concentrating on retail sales is usually interpreted as a sign that Honda leads on per-unit profitability and “real” market share. Automotive News puts the Accord at around 1% fleet mix, well behind its rivals. But what if Honda’s position relative to the fleet market isn’t as strong as previously believed?

“Honda is the retail leader” has long been a mantra for that company’s boosters, one that is repeated by a fair number of autojournos. It’s a well-known fact that Honda has no corporate fleet sales department, in contrast to every other mass-market auto company in America. Even so, Honda products have a habit still show up in a variety of fleets. The vehicle-sales sites of several rental car companies have plenty of Hondas for sale. As of this writing, Enterprise Car Sales lists 200 former rental Hondas for purchase. The majority of these are Accords, with Civics not too far behind, and models from the entire rest of the range sprinkled in. For those feeling like something a little fancier, 22 Acuras are also available. Hertz also has hundreds of Hondas available, mostly 2012 Civics and a few Accords. Avis has no Honda products listed; nor does Budget.

It’s also worth noting that there are far fewer Hondas available for sale than, say, Chevrolets, Chryslers, or Fords. However, those makes include substantial numbers of trucks and commercial vans that Honda doesn’t offer. Honda has openly partnered with Zipcar to put hybrids in its fleet. Unfortunately, major fleet vehicle remarketing company Manheim doesn’t provide data on sales to anyone but licensed auto dealers, so I wasn’t able to scan their listed inventory for Hondas. However, salvage-auction company IAAI does provide listings of insurance-totaled Hondas, albeit ones that are difficult to sort and frequently incomplete. Even so, a casual scan through the listings reveals a surprising number of totaled-out Accords and Civics that had titles held by rental car companies or otherwise appear to have been former rentals. So clearly, a decent number of Honda products are winding up in America’s rental fleets. Many of the B&B have offered anecdotes about rental Hondas, but it’s nice to have a few solid numbers to go by. Maybe a reader with Manheim access could help flesh out the data.

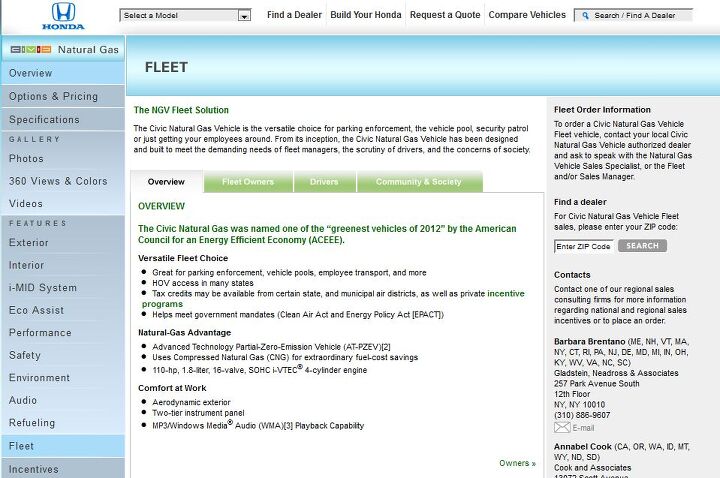

Besides rentals, governments are another important consumer of fleet cars. Honda’s CNG Civic fleet program is well-known, although these make up a tiny fraction of overall Civic sales. Even so, Honda has been enthusiastic about trying to expand this program, with Honda alternative fuel vehicle manager Eric Rosenberg previously quoted as saying “ We’re looking forward to much healthier fleet sales as the economy makes that positive turn.” Civic Hybrids have made their way into government and corporate fleets as well, in far larger quantities. New York State has invested significantly in updating its fleet with hybrids, purchasing large quantities of Civics and the former Accord Hybrid from 2007 onwards.

As municipalities have looked to green their fleets, they’ve turned to Honda hybrids as well. A quick search of industry site Government Fleet turns up hundreds of examples of municipalities and state and local governments acquiring Honda hybrids. Toyota and Ford are also heavily represented in these hybrid fleets, but Honda still makes a strong showing. There’s less evidence that regular-drivetrain Hondas make it into government fleets in any great quantity, although I have personally seen them used by some universities as service vehicles. Many government fleet operators are restricted in their purchases by “Buy American” laws that can exclude foreign-make vehicles, even if they are American-assembled.

Corporate fleet sales are always difficult to estimate, but anyone who’s lived in Central Ohio as long as I have can tell you that Honda products are popular choices for local businesses. The reliability and resale records of the Accord, Civic, and Odyssey no doubt attracts many operators looking to maximize their ROI. And although Honda has no corporate-level program for direct fleet sales, there are plenty Honda dealers who operate their own. Lindsay Honda of Columbus explains that “With 14 acres of more than 700 Honda’s in inventory, Lindsay Honda can manage your order and pricing cost effectively, thus passing the savings to you.” Similarly, Don Carlton Honda of Tulsa promises customers “the benefit and tremendous value of our Honda Fleet Pricing while making the process of buying a new Honda vehicle simple and stress-free,” with a website specifically dedicated to facilitating fleet purchases.

In fact, it’s difficult to find a high-volume Honda dealer that doesn’t operate some kind of fleet program. And virtually all of these programs tout “preferred fleet pricing” and volume discounts for buyers, a seeming contradiction to Honda’s notorious stinginess with incentives. If you’re looking to buy ten Hondas for your fleet, there’s no shortage of dealers willing to cut you a discount, and take care of your service needs afterwards. But these dealers seem to be ignored or downplayed by Honda corporate, which steadfastly maintains that fleet sales are a vanishing percentage of Honda’s business. A press release from Honda on July 2 about rising sales crowed that “These solid results further showcase Honda’s pure, market-driven momentum achieved by customers choosing Honda vehicles one at a time rather than relying on fleet sales to drive volume.” The mantra about retail sales is clearly a big part of Honda’s marketing schtick. It seems that nobody has thought to ask the dealer body what they think about becoming Honda’s default fleet sales program, a role they may not appreciate. I can’t help but be reminded of an earlier episode in Honda’s corporate history where dealers took it on the chin.

Steve Lynch’s Arrogance and Accords is the definitive history of the early-90’s Honda management scandal. Lynch, a Honda insider, describes in detail a culture of malfeasance amongst American Honda executives that led to incredible acts of extortion against the Honda dealer body. Buoyed by the explosive growth of Honda in the go-go 1980’s, many prospective dealers were willing to enter into silent partnerships, kickback schemes, and other fraudulent behavior to secure valuable Honda franchises and a steady supply of cars from the corruption-riddled allocation system. When the market for new Hondas declined in the early 90’s (and dealers could no longer sell the cars for thousands of dollars above sticker), the whole scheme unraveled. Overproduction and flopped model introductions meant that cars sat on lots. A frustrated and abused dealer body finally ratted out the executives wholesale, leading to their firing and eventual federal prosecution after a failed cover-up attempt. But the dealer body didn’t get much out of the prosecutions; many of them lost millions of dollars, and others alleged that their businesses were ruined because they refused to “play the game” with Honda execs.

Obviously, much has changed since then; I’m not accusing Honda or its executives of engaging in criminal malfeasance. However, I do believe it is worth noting that Honda has a history of treating dealers as if they were replaceable; because for many years, they were. Lynch described a corporate culture that saw dealers as a nuisance and an inconvenience, a culture he alleges was facilitated by averted eyes in Tokyo. Now that the market for Honda products has matured, and the dealer body has been stabilized, perhaps it’s worth questioning whether making dealers solely responsible for the disposal of excess stock is a healthy policy. It’s also worth noting that many of the ex-rentals described above were 2012 Civics and Accords. Production of both of these models was stopped by the 2011 Asian tsunami, and for a long time Civics especially were thin on the ground at dealers. Yet despite these shortages, many newly-redesigned Civics still wound up in rental fleets, supposedly the dumping ground of last resort for unwanted models.

Auto industry watchers know that the redesigned Civic was harshly reviewed, prompting a quick 2013 refresh in response to criticism. Would it be unreasonable to suggest that dealers pushed many 2012s into fleets, knowing they would be a difficult sell if the much-improved version was right around the corner? The 2012 Accord as fleet car is easier to understand- a model at the end of its run is always a hard sell, and a few fleet sales at rock-bottom prices would have relieved the pressure on dealers to move the metal. But in both of these cases, the dealers were acting alone, with few corporate incentives to help cushion the blow. The marketing department’s retail mantra remains untainted, and the cars move off the lots- but the dealers take the hit. The production recovery after the tsunami is unquestionable, but the sales recovery deserves an asterisk.

The strategy of ignoring or underreporting fleet sales enables Honda to claim that its cars are somehow above and beyond the dynamics that the rest of the market faces. Every manufacturer will eventually face problems of excess inventory caused by a botched model launch or overproduction, no matter how sainted said company might be. It’s getting harder and harder for Honda to maintain this self-image after a series of uncompetitive new offerings has left dealers with large numbers of hard-to-move products. Civics are piling up on dealer lots as consumers gravitate towards the compact offerings of other manufacturers.

Toyota, at least, has acknowledged its difficulties with the Camry and has moved to help out its dealer network with a combination of incentive spending and diverting excess production to fleets. Even if it costs Toyota some credibility, it’s a better strategy than simply throwing cars at dealers and hoping a miracle happens. And it’s not as if fleet sales are an inherent evil; they’re a reality of doing business in the United States, one that no mass-market auto maker can evade forever. It’s impossible to put a solid number on the amount of Hondas currently being pushed to fleet by dealers. Even so, in the face of mounting evidence, the 1-2% figure most commonly put forth by Honda is almost surely too low. Given the state of flux and increasingly competitive nature of the American car market, industry watchers and the press corps need to regard that percentage with skepticism.

More by J.Emerson

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jeff Overall I prefer the 59 GM cars to the 58s because of less chrome but I have a new appreciation of the 58 Cadillac Eldorados after reading this series. I use to not like the 58 Eldorados but I now don't mind them. Overall I prefer the 55-57s GMs over most of the 58-60s GMs. For the most part I like the 61 GMs. Chryslers I like the 57 and 58s. Fords I liked the 55 thru 57s but the 58s and 59s not as much with the exception of Mercury which I for the most part like all those. As the 60s progressed the tail fins started to go away and the amount of chrome was reduced. More understated.

- Theflyersfan Nissan could have the best auto lineup of any carmaker (they don't), but until they improve one major issue, the best cars out there won't matter. That is the dealership experience. Year after year in multiple customer service surveys from groups like JD Power and CR, Nissan frequency scrapes the bottom. Personally, I really like the never seen new Z, but after having several truly awful Nissan dealer experiences, my shadow will never darken a Nissan showroom. I'm painting with broad strokes here, but maybe it is so ingrained in their culture to try to take advantage of people who might not be savvy enough in the buying experience that they by default treat everyone like idiots and saps. All of this has to be frustrating to Nissan HQ as they are improving their lineup but their dealers drag them down.

- SPPPP I am actually a pretty big Alfa fan ... and that is why I hate this car.

- SCE to AUX They're spending billions on this venture, so I hope so.Investing during a lull in the EV market seems like a smart move - "buy low, sell high" and all that.Key for Honda will be achieving high efficiency in its EVs, something not everybody can do.

- ChristianWimmer It might be overpriced for most, but probably not for the affluent city-dwellers who these are targeted at - we have tons of them in Munich where I live so I “get it”. I just think these look so terribly cheap and weird from a design POV.

Comments

Join the conversation

Translation: The real fleet number is probably more like 8-10%, similar to what Toyota sells (10-12% fleet) It may be hard for Honda Motor Sales Inc. to actually put a real number on fleet sales, with each dealer running their own program independently, with little oversight from Honda, and no structured fleet sales network to tie sales together. But this is a very well written, researched article. Would be hard for Honda to say 2% is the number after reading through this. They probably don't know the number themselves, just passing along what fragments of info they do have collected..... BD

TTAC, if you are going to do an article like this, next time provide actual data, not some nebulous guess work. For instance, this is actual data from last month. Here are fleet sales in January. Ford as usual sold the most, 40,900 units giving Ford the highest percentage going to fleet. GM next at 40,400 Chrysler at 27,500 Nissan at 18,000 and a HUGE jump in fleet sales last month. Plus Nissan increase in incentives Hyundai at 14,100 and the HIGHEST jump in fleet sales to offset the poor sales last year Toyota at 14,000 and the biggest DROP in fleet Honda way down at 1,800 units.