The Truth About Ford Focus Sales

We’re still waiting to get the final February sales numbers on all automakers, but one emerging story is that the Ford Focus has finally outsold its domestic rival, the Chevrolet Cruze.

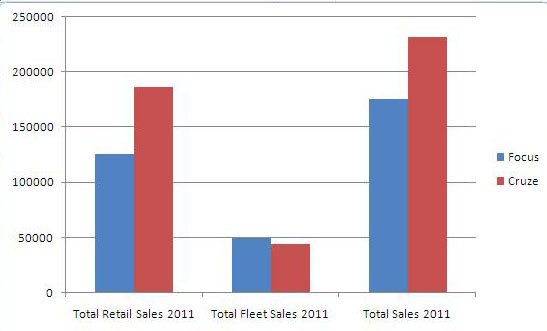

Throughout 2011 and January 2012, the Cruze led the Focus, with the Chevy beating the Ford last year by a substantial margin (231, 860 units for the Cruze versus 175,709 for the Focus). Last month the Cruze did 15,049 units versus 14,440 for the Focus. This month, independent analyst Timothy Cain is reporting that the Focus finally bested the Cruze. Chevrolet moved 20,427 Cruzes versus 23,350 for the Blue Oval’s small car.

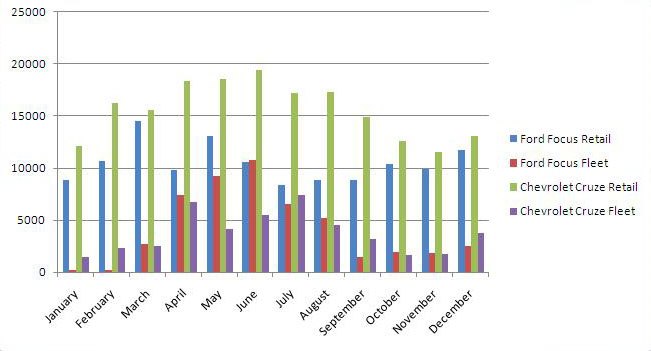

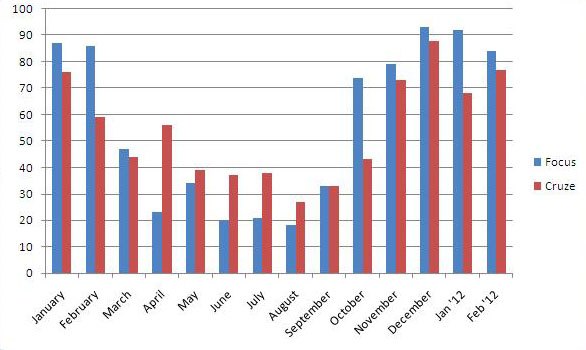

Ford is touting a 115 percent year-over-year gain for the Focus, having sold 10,879 Foci in February 2011, but their fleet percentage back then, according to TrueCar, was just 1.6 percent.. One year later, it’s closer to 20 percent. February wasn’t even over when Ford started sending out press releases claiming that Focus sales are on pace to double this month compared to February of 2011. With reports of Ford Focus fleet sales hovering around 45 percent, we thought that it would be worthwhile to look at the fleet/retail breakdown for the Focus and Cruze in 2011, as a means of providing a bit of context .

Fleet sales, as we all know, cut into margins and hurt resale value. The Cruze and Focus weren’t that far off in the fleet race, but the big gap was in retail sales.

While Ford was complaining about not having enough Focus models to sell last year, the timing of Ford’s decision to dump Foci into their fleets (Ford wouldn’t give us a breakdown of daily rental sales either, stating that their total mix is around 12 percent) is also curious. Was this an attempt to move cars that were prone to quality issues (the MyFord Touch and dual-clutch gearboxes in particular) away from consumer hands? Even when Ford reached a “sales high” of 22,303 units in May of 2011, they were still sending 41.4 percent of Foci to the fleets. Check out the month-by-month charts below for a better breakdown. The first chart represents total sales in 2011 broken down by fleet and retail, while the second chart represents inventory levels from January 2011 to February 2012.

When Focus inventory was at its lowest points, its fleet sales were relatively high. This trend starts to reverse itself as inventory becomes higher. Focus retail sales, assuming the 20 percent fleet number is correct, would be at 18,880. Of course, the missing links here are the Cruze fleet sales numbers for 2012 and the incentives being doled out on both cars.

Looking at the bigger picture, inventory overall bouncing back and the Japanese automakers finally shrugging off their production woes, numbers for the Civic and Corolla should be even higher – the Civic was far and away the leader last year, and Honda barely moved any of them to fleets – by contrast, in June of 2011, Ford sent 50 percent of its Focus volume went to fleets. We’ll know more as the day progresses, but the compact segment as a whole is looking very strong for this month.

Thanks to TrueCar and Timothy Cain for the sales numbers

More by Derek Kreindler

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Analoggrotto Does anyone seriously listen to this?

- Thomas Same here....but keep in mind that EVs are already much more efficient than ICE vehicles. They need to catch up in all the other areas you mentioned.

- Analoggrotto It's great to see TTAC kicking up the best for their #1 corporate sponsor. Keep up the good work guys.

- John66ny Title about self driving cars, linked podcast about headlight restoration. Some relationship?

- Jeff JMII--If I did not get my Maverick my next choice was a Santa Cruz. They are different but then they are both compact pickups the only real compact pickups on the market. I am glad to hear that the Santa Cruz will have knobs and buttons on it for 2025 it would be good if they offered a hybrid as well. When I looked at both trucks it was less about brand loyalty and more about price, size, and features. I have owned 2 gm made trucks in the past and liked both but gm does not make a true compact truck and neither does Ram, Toyota, or Nissan. The Maverick was the only Ford product that I wanted. If I wanted a larger truck I would have kept either my 99 S-10 extended cab with a 2.2 I-4 5 speed or my 08 Isuzu I-370 4 x 4 with the 3.7 I-5, tow package, heated leather seats, and other niceties and it road like a luxury vehicle. I believe the demand is there for other manufacturers to make compact pickups. The proposed hybrid Toyota Stout would be a great truck. Subaru has experience making small trucks and they could make a very competitive compact truck and Subaru has a great all wheel drive system. Chevy has a great compact pickup offered in South America called the Montana which gm could make in North America and offered in the US and Canada. Ram has a great little compact truck offered in South America as well. Compact trucks are a great vehicle for those who want an open bed for hauling but what a smaller more affordable efficient practical vehicle.

Comments

Join the conversation

According to these numbers, Focus sold almost 30% to fleet, while GM sold under 20% of Cruzes fleet, which is where you want to be. In other words, if Ford sold the same percentage fleet as Chevy, they would have only sold 160k Focus last year. What we learned: Ford inflates their sales numbers with a high fleet %. (And it's not just on Focus) BD

BTW, 28.5% fleet is VERY high for a newly-redesigned car. Fleet sales should drop, significantly, after a redesign. If it's this high now, what will it be in 3-4 years, when the car is outdated? BD