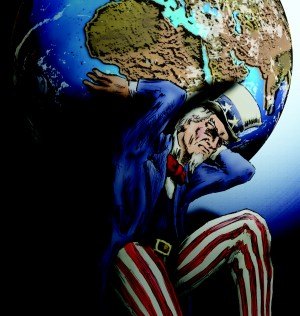

How The GM Bailout Turned Into Foreign Aid

Longtime reader and new contributor Tyler Vandermeulen is a financial analyst by day. He took a deep dive into the EDGAR database to unearth how much of GM’s money flows abroad. Please welcome Tyler with the respect he deserves. Rude comments will not be tolerated.

Before the bailout of General Motors, it was well understood that the world’s largest automaker was losing huge amounts of money in the US and was staying afloat thanks to stronger performance in overseas markets. Since the bailout, however, that dynamic has been turned on its head. Thanks to a leaner manufacturing footprint, debt eliminations and steadily recovering sales, GM’s US operations have generated the lion’s share of the company’s profit since the bailout. And now, as the rest of the world economy slows, GM is spending more and more of its taxpayer-enhanced cash pile to shore up its faltering foreign divisions. In fact, according to an analysis of GM’s SEC filings, the company is likely to incur over $6.5 billion in losses and expenditures overseas in the 2011-2014 period, not counting over $1.6b in foreign potential legal liabilities or several other incalculable expenses that could add up to billions more. Not only are these expenses a challenge to GM’s overall financial health at a time when it also faces billion-dollar expenditures on pensions in the US, it shows the basic problem with national bailouts of global companies. Taxpayers who were told they were saving an American company are now seeing their tax dollars flowing overseas by the billions.

A full calculation of GM’s overseas expenditures since the bailout would be a daunting task indeed. Simply by scouring GM’s latest SEC filings, one finds no shortage of losses and one-time expenditures abroad. In fact, nearly every division of GM’s global empire has required some kind of assistance over the last year or so. These expenditures come in many forms, from tax assessments to investments, from bailouts to severance deals, and due to the complex nature of GM’s global finances they cannot be fully accounted with precision. But they all emphasize the reality that, after years of living off foreign operations, GM’s bailed-out North American division is now bailing out the rest of the world.

Europe: Black Hole Opel, Unions, PSA

GM’s European losses currently get the most attention from analysts, and are nothing new for The General, which has reportedly lost over $14b in Europe over the last decade. Those losses and expenditures continue to add up. In the two full years since GM decided to cancel a planned sale of its European division Opel, GM Europe’s losses have added up to $2.74 billion, with another $617m lost in the first half of 2012 (EBIT). Additional goodwill adjustments of $590m in the first half of 2012 and $621m in 2011 further added to the losses. Additionally, GM has spent some $313m on voluntary severance for European workers, and expects to spend another $100m on the same program through the end of next year. Finally, GM has an undisclosed agreement with European labor unions to spend as much as $265m per year between 2011 and 2014. The company has pledged some $406m in inventory as collateral for that agreement. Not counting the spending agreement with European unions, this puts GM’s losses and outlays on Opel and GME in the last two and a half years at more than $4.25 billion.

GM’s losses in Europe aren’t likely to end there. This year, GM spent $400 million on a 7% stake in Peugeot-Citroen PSA, an investment that GM admits has already lost value. GM says it plans to hold onto that stake for the long term, and has chosen not to write down that loss… yet. Just today, rumors surfaced that GM could spend even more money on its Peugeot tie-up, possibly providing capital for an Opel-PSA joint venture. Meanwhile, the worst-case scenario for Opel involves an estimated $13b outlay to shut down plants and prepare Opel for a sale, according to Morgan Stanley analyst Adam Jonas. In this scenario, GM could spend as much as half of its cash pile extricating itself from its money-losing European operations.

GM losses and outlays in Europe, 2010-June 2012: $4.5b+

Asia: Korea Debt, Murky Hong Kong Dealings

GM’s Asian operations are consolidated as GM International Operations (GMIO), a division that includes Korea, China, Australia, India and other Asian markets. Prior to the bailout, GM’s Chinese operations were widely considered to be a major profit center for the company, while Korea has become increasingly important as a development center and India has potential for future growth. However, GMIO’s profitability has been weak in comparison to the revitalized North American division, generating just $400m in consolidated adjusted EBIT in the first half of 2012. And since 2011, GM has had several expenses associated with its Asian operations.

In 2011, GM spent $100m for 7% of its GM Korea subsidiary, increasing its holding to 77%. This year, GM has recorded a $27m Goodwill impairment related to its Korean operations, and has paid $22m to Korean workers as part of its severance program there. GM Korea also carries significant amounts of short-term and long-term debt to Korean creditors that GM will have to pay down.

More puzzling is GM’s strange Indian joint venture with its Chinese partner SAIC. In late 2009, GM rolled its Indian operations into a 50-50 joint venture with SAIC, known as the Hong Kong Joint Venture, or HKJV. By the first quarter of 2011, that venture had lost enough value for GM to record an impairment of $39m and “other charges totaling $67m.” From there things get strange. According to GM’s 10-Q:

“We were informed of SAIC-HK’s intent to exercise its right to not participate in future capital injections in HKJV. If this occurs we plan to settle the promissory note in the three months ending September 30, 2012 and provide an additional equity investment of $125 million into HKJV. As a result SAIC-HK’s interest in HKJV would be diluted from 50% to 9%. We also anticipate that the shareholders agreement would be amended such that we obtain control of and consolidate HKJV.”

It would seem that GM is buying its partner out of the Indian arrangement at a cost of $125m, however, GM has had several convoluted transactions with SAIC in the past, most notably in the sale of its “Golden Share” in the Shanghai-GM joint venture, which was offset by a Chinese bank loan and was eventually rolled back. It’s too early to say for sure whether GM will purchase the controlling stake in HKJV, and thereby regain full control of its India business. It is unlikely that SAIC will relinquish its grip on India, just because it suddenly can’t service the capital requirements of the HKJV. Possibly, more information will become available when GM files its Q3 paperwork, or possibly later. With some 30% of GM’s global sales in China, GM shareholders deserve more visibility into this byzantine part of GM’s world.

GM Outlays on GMIO, 2011-2012: ~$380m

South America: Tax Assessments

GM’s South American unit dipped into the red in the second quarter of this year, and its $64m net EBIT through the first half of 2012 is just $7m better than its Q1 2011 performance alone. But even if GMSA’s performance improves this year, it has paid out around $100m this year between the purchase of GMAC’s Venezuelan financing operation and a worker severance program in Brazil. $700m was also spent in 2011 to retire debt facilities at GMSA. Furthermore, GM has run into several tax assessments in South America, including a $292m assessment for the years 2002-2004 by the Mexican government and a $180m assessment for 2007 by the Brazilian government. GM says it has “adequate reserves” to meet these obligations, but notes:

“Certain South American income and indirect tax-related administrative proceedings may require that we deposit funds in escrow or make payments which may range up to $0.9 billion.”

GM Outlays in South America, 2011-2012: ~$1.7b

Legal Liabilities

Due to the unpredictable nature of legal disputes, the amount of overseas legal liability carried by GM may not result in actual expenditures. That said, the following legal liabilities are noted in GM’s SEC filings:

Settlement of class action suits regarding Canadian pricing policy: $21m

GM Canada “Lock up agreement” lawsuit: potential liability $918m

Korean labor law suit: $152m in accrual, $556m in further potential liability.

Potential overseas legal liability: ~$1.65b

Without including potential liability costs or the more inevitable costs associated with Opel’s restructuring, GM has spent or lost in excess of $6.5b overseas in the last 30 months or so. With more losses and expenses coming, taxpayers can expect to see their investment in GM’s North American operations continue to support a steady flow of cash to GM’s overseas operations. Perhaps taxpayers should have been told that they weren’t simply bailing out an American automaker, but a variety of overseas operations as well.

More by Tyler Vandermeulen

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Master Baiter There are plenty of affordable EVs--in China where they make all the batteries. Tesla is the only auto maker with a reasonably coherent strategy involving manufacturing their own cells in the United States. Tesla's problem now is I think they've run out of customers willing to put up with their goofy ergonomics to have a nice drive train.

- Cprescott Doesn't any better in red than it did in white. Looks like an even uglier Honduh Civic 2 door with a hideous front end (and that is saying something about a Honduh).

- Kwik_Shift_Pro4X Nice look, but too short.

- EBFlex Considering Ford assured us the fake lightning was profitable at under $40k, I’d imagine these new EVs will start at $20k.

- Fahrvergnugen cannot remember the last time i cared about a new bmw.

Comments

Join the conversation

"GM has run into several tax assessments in South America, including a $292m assessment for the years 2002-2004 by the Mexican government and a $180m assessment for 2007 by the Brazilian government" While it is clear that Brazil in located in South America, it should also be clear that Mexico is not. If you look at the American continent, Mexico is clearly in North America...

General Motors should have been allowed to die and go to the corporate dustbin. The past 90 years of US history would have been better had GM died at birth. Their sins are many including bribery, mob connections, destruction of the US interurban electric lines, the demise of the steam locomotive, corruption of government on all levels,the paving of our cities with freeways, unsafe products the list goes on and on. They exemplify the worst of corporate America for the last 90 years. Albert Sloan should have died at birth and MIT should be burned to the ground for teaching him how to destroy America.