GM Wants A Big Revolver For Less

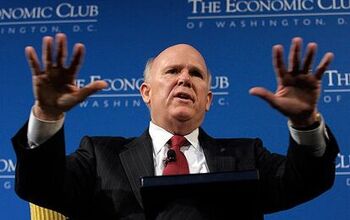

GM wants to double its $5 billion revolving credit line. However, the junk credit rated company does not want to pay junk credit interest for it. “We think we can get it priced as if we’re investment grade, which is kind of one of our goals going into 2013, to achieve investment grade,” GM CEO Dan Akerson told Bloomberg yesterday in Sao Paulo.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Comments

Join the conversation

Can't believe Akerson said "kind of". What a dip.

rats want cheese, even with having to accept mold. GM won't ever change and anyone who loans them money is out of their mind.

@oboylepr....Niether you, nor I,ever loaned GM a nickel. Our democratly elected governments did. At the end of it all, the provincial and federal governments, became share holders and still are. I believe your from Ontario, and you know what the current financial situation is here. I also know you have no time for the CAW....Fair enough. Just inagine where Ontario would be right now, if we had lost the CAW represented plants.What about our, oh so expensive social safety net? Who do you suppose was going to pay for the 100,000 or so that would have found themseves on welfare? You I both know the answer to those questions.

hey mikey: me thinks ive posted on one of your posts before, so ill keep it as short and sweet as possible. There is economic strife everywhere on earth at the moment. Our money is fake. Doesnt matter if its Canada, the States or Europe. As a result of that, when bills can't be paid the loan is in default and, if the borrower borrows again, they will pay higher interest. It seems the guys running the ol' General have forgotten that 2/3 of the North American continent paid (as for me, in protest) for their survival. At least FoMoCo 'cut the fat' on their own. Seems that Akerson just had to run to mommy and daddy when he blew too much $ €? at the bar to balance his bank account back in the day and expects the same now. Not to get political, but Fisker, Karma and A123 also come to mind...