Still Generous With Incentives, GM Sheds Market Share Nonetheless

GM’s turn-around hinges on a market share above 19 percent, board member Stephen Girsky said at an industry meeting in October 2009. “The public plan is 19 percent and change. That is what everything is being based on,” Girsky said during a panel discussion at a conference at Columbia Business School. Reuters was taking notes.

In the 3rd quarter of 2009, GM had a market share of 19.5 percent. The share climbed to 21.8 percent in January 2011, and eroded ever since.

In January 2012, GM’s market share stood at 18.4 percent, says Edmunds. In the same month, GM CEO Dan Akerson had a change of heart and said that this had been the plan all along:

“I like profitability more than I do market share. We’re a mass producer and scale matters to us, but obviously we’ll look for margin and profitability going into 2012.”

This is what Akerson dictated into the notepad of Reuters at the Detroit auto show. Reuters continued:

“Prior to its 2009 bankruptcy, GM was criticized for loading incentives onto its cars to drive sales and keep its factories operating at high capacity, regardless of what that did to profits. Since its restructuring, GM executives have stressed protecting the company’s ‘fortress balance sheet.’”

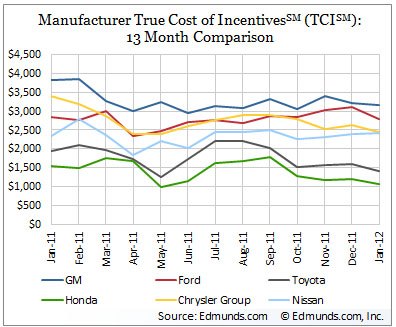

Data collected by Edmunds tell a different story. GM is by far the most generous American maker when it comes to incentives. In January 2012, GM’s Total Cost of Incentives (as calculated by Edmunds) was $3,171 per unit. Ford spent $2,788, Chrysler $2,447. The industry average stood at $2,141. In January 2012, only BMW put ($28) more on the hood of its much pricier cars than GM. GM out-spent Mercedes Benz which had been in a bitter fight with BMW for the luxury sales crown last year, and spent $3,107 in January.

At the same Detroit auto show, GM’s North America chief Mark Reuss promised that GM’s U.S. consumer incentives will remain at or near the industry average. Imagine what would happen if Reuss keeps his promise and drops incentives by $ 1,000.

Analysts polled by Bloomberg predict that U.S. automakers led by GM will lose more market share this year.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Dwford Will we ever actually have autonomous vehicles? Right now we have limited consumer grade systems that require constant human attention, or we have commercial grade systems that still rely on remote operators and teams of chase vehicles. Aside from Tesla's FSD, all these systems work only in certain cities or highway routes. A common problem still remains: the system's ability to see and react correctly to obstacles. Until that is solved, count me out. Yes, I could also react incorrectly, but at least the is me taking my fate into my own hands, instead of me screaming in terror as the autonomous vehicles rams me into a parked semi

- Sayahh I do not know how my car will respond to the trolley problem, but I will be held liable whatever it chooses to do or not do. When technology has reached Star Trek's Data's level of intelligence, I will trust it, so long as it has a moral/ethic/empathy chip/subroutine; I would not trust his brother Lore driving/controlling my car. Until then, I will drive it myself until I no longer can, at which time I will call a friend, a cab or a ride-share service.

- Daniel J Cx-5 lol. It's why we have one. I love hybrids but the engine in the RAV4 is just loud and obnoxious when it fires up.

- Oberkanone CX-5 diesel.

- Oberkanone Autonomous cars are afraid of us.

Comments

Join the conversation

Those incentive "averages" can be misleading. I sometimes go to "true car" just to check how MSRP differs from real world transaction prices and incentives. You want an Impala? You're gonna get some cash on the hood. You want a Cruze or a Verano? Fat chance...

Incentives are neither good nor bad. They are simply a market adjustment to get to the true price of a transaction. The MSRP for GM is a 'wish price.' The market doesn't care. The market pays what it pays. If it takes MSRP-discount-incentives to get 18% market share, that's the market price for that ranking. Want a higher market share? Drop the price more. Consumers are saying the MSRP is too expensive for the product. Set the MSRP more realistically, and you don't need incentives to get to the same strike price. Since GM is saving costs by dropping spare tires all over the place, maybe it can simply drop one more wheel while they're at it.