2011 New Car Sales Around The World: Divided Europe

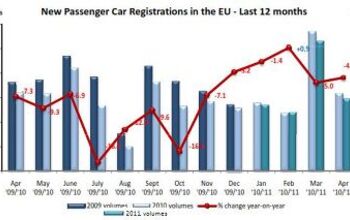

Allegedly a basket case, Europe finished the year without major losses, at least as far as new car sales go. 13.1 million cars were registered in the EU last year for aslight 1.74 percent loss compared to 2010. That according to data released today by the European auto manufacturer’s association ACEA. If the common market EU would count as one common car market, then Europe would rank second, after China with 18.5 million, and before the U.S.A. with 12.8 million (excl. heavy trucks & buses.) But fear not, the EU does not count as one market, at least not as far as heavy metal is concerned.

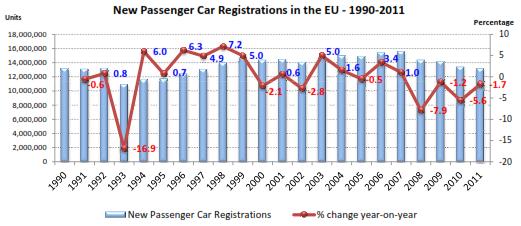

Basically, new car sales in Europe have been going sideways for decades. (Forget the irritating red percentage change line. Look at the bars.) The downward tenor since 2007 is more a reflection of ageing and shrinking populations in Europe’s volume markets than a result of booms or busts. Europe as a whole does not have the wild swings of the U.S., where many people have three cars, or of China, where most people still don’t have a car. Europe is filled with capable carmakers who defend their territory with tooth and nails.

(Note to the crowd that likes to blame miserable sales elsewhere on secret import restrictions: The “non-EU” brands – no matter where the cars are made – have a share of 16.6 percent of the European market. It’s been like this as long as I can remember.)

New car registrations 2011, EU 27Jan – DecJan – Dec% Chg1110GERMANY3,173,6342,916,2608.83%FRANCE2,204,2292,251,669-2.11%UNITED KINGDOM1,941,2532,030,846-4.41%ITALY1,748,1431,961,579-10.88%SPAIN808,059982,015-17.71%BELGIUM572,211547,3474.54%NETHERLANDS556,123482,54415.25%AUSTRIA356,145328,5638.39%SWEDEN304,984289,6845.28%POLAND277,430315,858-12.17%CZECH REPUBLIC173,282169,2362.39%DENMARK168,707153,8589.65%PORTUGAL153,433223,464-31.34%FINLAND126,123111,98912.62%GREECE97,682141,499-30.97%IRELAND89,89688,4461.64%ROMANIA81,71994,541-13.56%SLOVAKIA68,20364,0336.51%SLOVENIA58,41759,226-1.37%LUXEMBURG49,88149,7260.31%HUNGARY45,09743,4793.72%BULGARIA19,13615,64622.31%ESTONIA15,3508,84873.49%LITHUANIA13,2237,97065.91%LATVIA8,8494,97677.83%EUROPEAN UNION (EU27)13,111,20913,343,302-1.74%EU1512,350,50312,559,489-1.66%EU10760,706783,813-2.95%ICELAND5,0383,10662.20%NORWAY138,345127,7548.29%SWITZERLAND318,958294,2398.40%EFTA462,341425,0998.76%EU27+EFTA13,573,55013,768,401-1.42%EU15+EFTA12,812,84412,984,588-1.32%More than 80 percent of all EU sales are generated in a special part of Europe called “the volume countries” in the EU car biz. The volume countries are Germany, France, the UK, Spain, and Benelux. What happens here shapes the market. You see nearly 9 percent growth in Germany, single digit losses in France and the UK, double digit losses in Italy and Spain.

New car registrations 2011, EU 27 by manufacturer group January – December %ShareUnitsUnits% Chg11101110ALL BRANDS**13,111,20913,343,302-1.7VW Group23.221.23,045,0002,832,799+7.5VOLKSWAGEN12.411.21,622,0451,491,421+8.8AUDI5.04.5654,337600,120+9.0SEAT2.32.2297,416294,292+1.1SKODA3.63.3469,221445,163+5.4Others (1)0.00.01,9811,803+9.9PSA Group12.513.51,643,1601,805,375-9.0PEUGEOT6.87.4889,073983,969-9.6CITROEN5.86.2754,087821,406-8.2RENAULT Group9.710.41,272,5601,389,340-8.4RENAULT7.88.51,026,1791,130,124-9.2DACIA1.91.9246,381259,216-5.0GM Group8.78.71,141,3801,164,111-2.0OPEL/VAUXHALL7.47.4968,728986,948-1.8CHEVROLET1.31.3172,212176,093-2.2GM (US)0.00.04401,070-58.9FORD8.08.11,046,7111,081,778-3.2FIAT Group7.17.9928,3901,056,399-12.1FIAT5.16.1671,131811,774-17.3LANCIA/CHRYSLER0.80.8102,099108,432-5.8ALFA ROMEO1.00.8125,794105,663+19.1JEEP0.20.122,17713,663+62.3Others (2)0.10.17,18916,867-57.4BMW Group6.05.4780,981726,040+7.6BMW4.74.4617,906588,816+4.9MINI1.21.0163,075137,224+18.8DAIMLER5.04.9652,790651,515+0.2MERCEDES4.44.3575,243570,884+0.8SMART0.60.677,54780,631-3.8TOYOTA Group4.04.2523,418559,251-6.4TOYOTA3.84.1497,928542,677-8.2LEXUS0.20.125,49016,574+53.8NISSAN3.42.9443,300390,403+13.5HYUNDAI2.92.6382,255346,310+10.4KIA2.21.9286,792257,923+11.2VOLVO CAR CORP.1.81.6234,613213,324+10.0SUZUKI1.31.4166,535184,597-9.8HONDA1.11.3141,705177,453-20.1MAZDA1.01.3128,238172,042-25.5MITSUBISHI0.80.7101,13898,065+3.1JAGUAR LAND ROVER0.70.795,22591,863+3.7LAND ROVER0.60.572,63465,468+10.9JAGUAR0.20.222,59126,395-14.4OTHER**0.71.197,017144,714-33.0No breathtaking changes on the manufacturer front. Volkswagen continues to grow. It gained 2 percent more market share. No other carmaker gained (or lost) that much of the European market. Hyundai & Kia grow steadily. Nissan is the Japanese surprise.

Imported cars from the U.S. are unsalable: GM had imported 1070 U.S. cars in 2010 . That dropped to 440 in 2011. The 172,000 “Chevrolets” come from Korea.

If you give the data a good read, then you will see a divided Europe. Northern and most of Eastern Europe are doing just fine, thank you. Vacation lands Italy, Spain, Portugal, Greece are hard hit.

OIf there is so much bleeding, why is there so much foot-dragging about saving the Euro? The low Euro powers the export machine in the north. The stellar earnings of Volkswagen, Daimler, BMW et al are driven by strong exports and strong sales in foreign markets. The weaker the Euro, the better for them.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Brandon I would vote for my 23 Escape ST-Line with the 2.0L turbo and a normal 8 speed transmission instead of CVT. 250 HP, I average 28 MPG and get much higher on trips and get a nice 13" sync4 touchscreen. It leaves these 2 in my dust literally

- JLGOLDEN When this and Hornet were revealed, I expected BOTH to quickly become best-sellers for their brands. They look great, and seem like interesting and fun alternatives in a crowded market. Alas, ambitious pricing is a bridge too far...

- Zerofoo Modifications are funny things. I like the smoked side marker look - however having seen too many cars with butchered wire harnesses, I don't buy cars with ANY modifications. Pro-tip - put the car back to stock before you try and sell it.

- JLGOLDEN I disagree with the author's comment on the current Murano's "annoying CVT". Murano's CVT does not fake shifts like some CVTs attempt, therefore does not cause shift shock or driveline harshness while fumbling between set ratios. Murano's CVT feels genuinely smooth and lets the (great-sounding V6) engine sing and zing along pleasantly.

- JLGOLDEN Our family bought a 2012 Murano AWD new, and enjoyed it for 280K before we sold it last month. CVT began slipping at 230K but it was worth fixing a clean, well-cared for car. As soon as we sold the 2012, I grabbed a new 2024 Murano before the body style and powertrain changes for 2025, and (as rumored) goes to 4-cyl turbo. Sure, the current Murano feels old-school, with interior switchgear and finishes akin to a 2010 Infiniti. That's not a bad thing! Feels solid, V6 sounds awesome, and the whole platform has been around long enough that future parts & service wont be an issue.

Comments

Join the conversation

Figures in the Netherlands are up, but unfortunately it doesn't tell the complete story. A lot of the cars sold are due to government regulations to promote the sale of eco-boxes and discourage the sale of actual cars. They do this mostly by taxing regular cars into oblivion instead of subsidies on smaller, economical cars. The breakdown of the mos popular car models is as follows: VW Polo (B-segment car) Renault Twingo (A-segment) Peugeot 107 (A) Toyoa Aygo (A) Opel Corsa (B) SEAT Ibiza (B) VW Golf (C) Ford Fiesta (B) Opel Astra (C) Citroen C1 (A) It used to be the C-segment cars that made the volume but even those are deemed to big by our government now for Jan Modaal (Joe Average). In fact the first D-segment car is the VW Passat in P16 and I bet even those are mostly 1.6TDI Bluemotions. It's a sad state of affairs for the car enthusiast here...It has been for a long time (ever since 1978 when BPM was introduced really) but it's getting worse and worse...It's getting to the point where it's a real reason to leave the country.

Wow, what's up in Iceland? Did they lose that many cars to the volcano, or is everyone going on a binge?