New Car Sales Europe 2010: Down A Bit After Uncle Sugar High

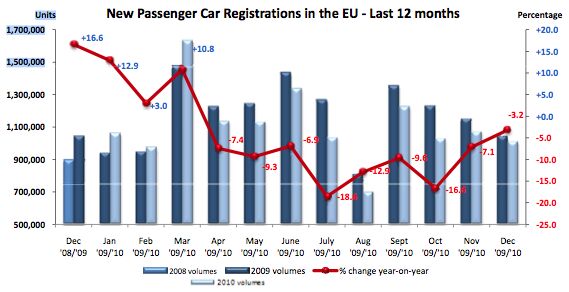

Europe’s car manufacturer association ACEA finally got around to tallying-up the car sales in all 27 EU states, and while they were at it, those of the EFTA (Iceland, Norway, Switzerland) as well. Overall, the EU market is down 5.5 percent – compared to 2009. In 2009 many EU states had pushed up the market with generous cash for clunker money. Most of these programs came to an end in 2010, just not at the same time everywhere. The picture tells it best.

From country to country, it’s a mixed bag. The countries that had clunker programs look bad in comparison, but keep in mind, some of them had been on such an uncle sugar high in 2009 that one could scratch them from the ceiling. The countries that didn’t have programs suffered in 2009, and look peachy this year.

Actually, Europe’s “volume markets”, Germany, Italy, France, UK, are responsible for most of the drop. All had cash for clunker programs. Germany had the most massive program. Germans usually buy 3 million cars a year. During 2009, with the program in effect until late summer, Germans bought 3.8 million cars. In 2010, they were back to 2.9 million. Without that 890,000 unit difference, Europe would report a gain. Italy also discontinued a program to the tune of 200,000 units less in 2010. France showed expertise with addictive substances and weened its populace off slowly. The UK actually shows a small gain.

All in all, the cash for clunker programs were a success. Europe survived carmageddon with minor bruises. In 2008, 14.3 million new cars were sold in the EU27. In 2009, it was 14.1 million. In 2010, it was 13.4 million. Keeping in mind that many had predicted that the EU would fall apart, that’s not a bad series of numbers.

New Car sales EU 27 2010CountrySales 2010Percent changeAUSTRIA328,563+2.9BELGIUM547,347+14.9BULGARIA16,257-28.9CZECH REPUBLIC169,236+4.7DENMARK151,550+34.8ESTONIA8,848+7.5FINLAND111,968+23.6FRANCE2,251,669-2.2GERMANY2,916,260-23.4GREECE141,499-35.8HUNGARY45,081-25.1IRELAND88,373+54.7ITALY1,960,282-9.2LATVIA4,976+32.9LITHUANIA7,970+13.8LUXEMBURG49,726+5.2NETHERLANDS483,619+24.9POLAND333,539+4.1PORTUGAL223,491+38.8ROMANIA94,541-18.5SLOVAKIA64,033-14.3SLOVENIA59,226+6.3SPAIN982,015+3.1SWEDEN289,684+35.7UNITED KINGDOM2,030,846+1.8EU 2713,360,599-5.5On the manufacturer front, not much has changed. VW remains the unassailable king of the hill. Considering that Opel had been pronounced as good as dead, GM performed well and increased its market share from 8.4 percent to 10, putting Ford into 5th place. Fiat is hurting. BMW is recovering. Daimler is treading water.

All data can be found here as PDF and here as Excel spreadsheet.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- FreedMike Your Ford AI instructor:

- Jeff Good find I cannot remember when I last saw one of these but in the 70s they were all over the place.

- CoastieLenn Could be a smart move though. Once the standard (that Tesla owns and designed) is set, Tesla bows out of the market while still owning the rights to the design. Other companies come in and purchase rights to use it, and Tesla can sit back and profit off the design without having to lay out capital to continue to build the network.

- FreedMike "...it may also be true that they worry that the platform is influencing an entire generation with quick hits of liberal political thought and economic theory."Uh...have you been on TikTok lately? Plenty of FJB/MAGA stuff going on there.

- AZFelix As a child I loved the look and feel of the 'woven' black vinyl seat inserts.

Comments

Join the conversation

Good to see the data. Also interesting that cash for clunkers did seem to work - maybe some Government intervention isn`t always bad/evil! Interesting that GM grew well even with the loss of Saab (admittedly only 0.1% loss from Saab). Also surprised to see Lexus only sold 17000 vehicles in the whole of Europe in the whole of 2010 - so much for the much vaunted brand. Hyundai/Kia now easily outsell Toyota/Lexus and Honda is an also ran with 1.3%. I am surprised though by Ford's drop especially as they have a pretty good line up of cars.

Great data...it's always interesting to see this kind of info