EV Startup Scores $25m, Ford Still Banking With Uncle Sam

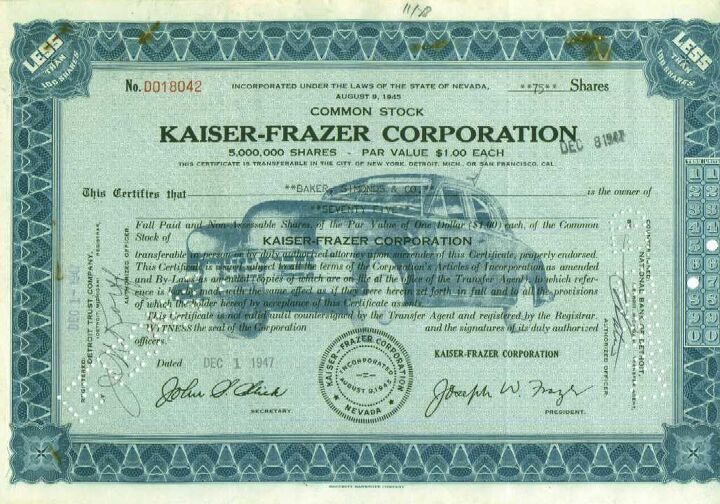

According to Detroit lore, Henry Kaiser once loudly threatened to throw one hundred million dollars in 1940s money towards the greater glory of Kaiser Motors, drawing a bemused chuckle from GM Chairman Alfred Sloan who quipped “give the man one chip.” Fast forward to 2009, and Coda Automotive, a firm hoping to sell Californians a $45k EV-ified Hafei Saibao Sedan, just scored $25m in funding reports Earth2Tech. That gives the firm a total of $74m raised so far, although the current round of funding won’t closed for another few months, say spokespeople. The latest money, from Aeris Capital, will be spent on “final safety certification testing,” as well as scaling up battery production. In short, Coda is almost-not-quite all the way to one chip in the car game… but that’s still only good for one roll of the dice. Even the weakest automakers have many multiples of that sum in their Treasury escrow accounts. And even the allegedly “bailout free” automakers get to raise debt with a little help from their government friend, TALF.

According to BusinessWeek, Ford Finance is planning on raising a cool half-billion in dealer floorplanning bonds through the government’s Term Asset-Backed Securities Loan Facility program known as TALF. Through TALF, buyers of Ford Finance’s floorplan bonds will qualify for low-cost loans from the Fed, essentially making the debt more valuable than it would otherwise be. Meanwhile, NADA is pushing for an extension of TALF past its planned March 31 expiration, as over $5b in automotive floorplanning could come due this year. Without TALF, NADA worries that dealers could have a tough time finding financing on the open market. Which, given the uncertainty surrounding the future of America’s car market, is not wildly surprising.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jimbo1126 Supposedly Messi has reserved a unit but he already got a big house in Fort Lauderdale... I guess that's why :)

- El scotto Dale Carnegie had his grandkids do some upgrades?

- El scotto Work it backwards. How many people use Tesla Super Chargers: Primary Charging Point - this is my normal charging station; Secondary charging station - at a retail location or planned on trips, Rarely or Not at All.

- FreedMike Some clarification would make sense here: Tesla is laying off the team responsible for BUILDING NEW Supercharger stations. Apparently the ones already being built are going to be completed. The folks who maintain the current network are apparently unaffected. https://www.nytimes.com/2024/04/30/business/tesla-layoffs-supercharger-team.htmlAlso, many other other manufacturers are switching to NACS in the upcoming years, and some of those companies are already providing Supercharger adaptors for their non-NACS vehicles. Some Superchargers can already accomodate non-Tesla vehicles with a built in adaptor called the "magic dock."Given all this, my guess? They're trying to maximize utilization of the current system before building it out further.

- Dartman Damn Healey! You can only milk a cow so many times a day! Don’t worry though I bet Flex, 28, 1991, and all the usual suspects are just getting their fingers warmed up!

Comments

Join the conversation

Makes sense - no floor, no dealer. Until the credit market recovers this is probably one of the few ways to keep the system going.

Perhaps someone wanting to enter the car business should first open a bank... Ford Finance? Is this the same as Ford Credit, or is it a new name for it?