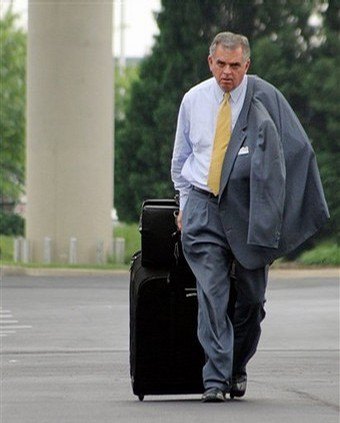

Transportation Secretary Considers Pay-Per-Mile Tax

Transportation Secretary Ray La Hood is considering a transportation tax based on miles driven, to replace gasoline tax revenue. “We should look at the vehicular miles program where people are actually clocked on the number of miles that they traveled,” La Hood tells the Freep, echoing proposals being considered by Oregon, Idaho, Rhode Island, Massachusetts and North Carolina. La Hood argues that gasoline tax revenues “can not be relied on” to fund infrastructure maintenance, presumably because relatively high prices have caused a downturn in gas tax revenue. “One of the things I think everyone agrees with around reauthorization of the highway bill is that the highway trust fund is an antiquated system for funding our highways,” LaHood said. “It did work to build the interstate system and it was very effective, there’s no question about that. But the big question now is, We’re into the 21st Century and how are we going to take care of our infrastructure needs … with a highway trust fund that had to be plused up by $8 billion by Congress last year?” For La Hood the answer to that rhetorical question is “by putting GPS chips in your car and charging you by the mile.”

LaHood has firmly ruled out increasing the gas tax “in a recession,” but Vehicle Miles Traveled (VMT) is hardly a short-term solution. According to Rob Atkinson, president of the National Surface Transportation Infrastructure Financing Commission (the guy who figures out how to fund infrastructure) says it will take the better part of a decade to impliment a national VMT scheme. By then the “recession” argument against increasing the gas tax should be gone, and conveniently that method would avoid having to build, maintain and monitor millions of GPS chips. Meanwhile, the only real argument against raising the tax on gas (for which demand is quite inelastic) is political cowardice. La Hood might consider the VMT scheme “thinking outside the box,” but an enormous infrastructure of GPS chip makers, monitors, maintenance, and assessors (not to mention the possibility of privacy intrusions, a notion La Hood airly dismisses) is hardly a streamlined, efficient approach to the problem.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Probert Captions, pleeeeeeze.

- ToolGuy Companies that don't have plans in place for significant EV capacity by this timeframe (2028) are going to be left behind.

- Tassos Isn't this just a Golf Wagon with better styling and interior?I still cannot get used to the fact how worthless the $ has become compared to even 8 years ago, when I was able to buy far superior and more powerful cars than this little POS for.... 1/3rd less, both from a dealer, as good as new, and with free warranties. Oh, and they were not 15 year olds like this geezer, but 8 and 9 year olds instead.

- ToolGuy Will it work in a Tesla?

- ToolGuy No hybrid? No EV? What year is this? lolI kid -- of course there is an electric version.

Comments

Join the conversation