Fleet Week: January's U.S. Auto Sales Buoyed By Fleet Volume

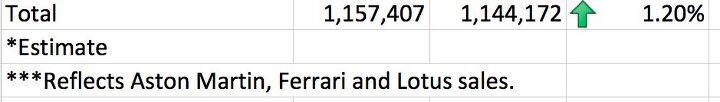

January started strong for several automakers in America, with the industry shifting 1,157,407 cars and light trucks last month. That represents a 1.2 percent increase over this time last year.

More than one company is guilty of padding its numbers with fleet sales, though. In one instance, it represented nearly a third of January’s reported sales for that automaker.

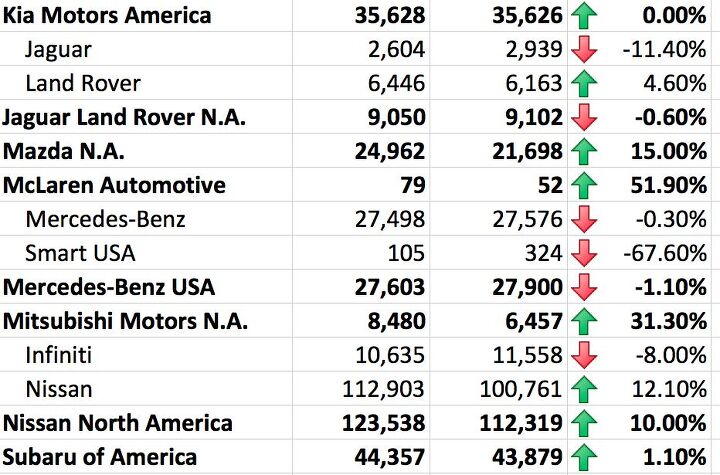

Combined, Nissan and Infiniti moved 123,538 machines last month, marking a full 10 percent increase over January 2017, thanks to the marque’s portfolio of trucks, crossovers, and SUVs. However, according to Automotive News, fleet deliverers surged 48 percent last month for that automaker, cresting the 40,000-unit mark. Basic math tells us, then, that a full 32.5 percent of Nissan’s reported sales were to fleets. That percentage is even higher if one backs January’s 10,635 Infinitis out of the equation.

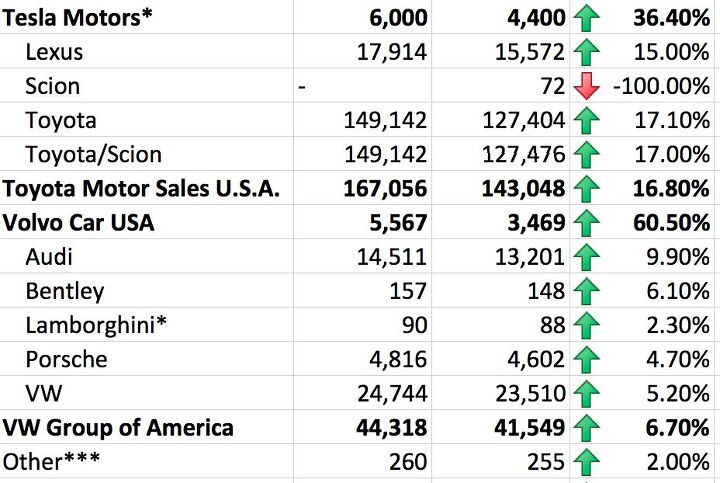

To be fair, this could simply be a case of Nissan fulfilling a huge order at the beginning of the year and the remainder of 2018 will have a much heavier weight on retail sales. Toyota also drank from the smoky fleet cup, with nearly 30,000 of its 149,142 units headed to fleet purchasers. That’s still a lot – nearly 70 percent more than January last year, according to Bloomberg – but again may simply be a case of oddly timed shipments to rental agencies. I wouldn’t expect this trend to continue.

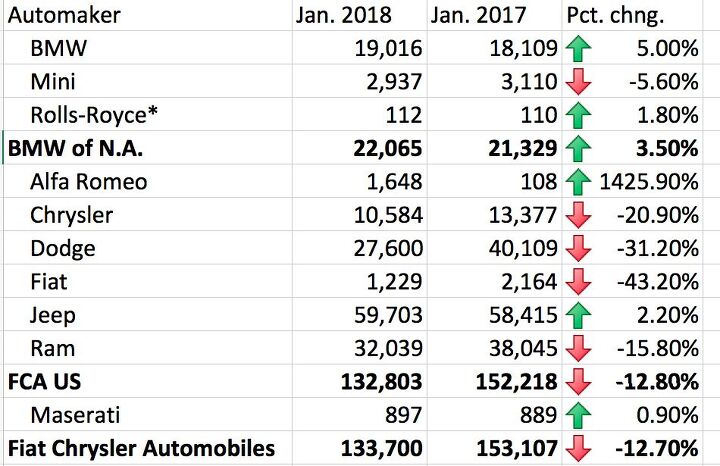

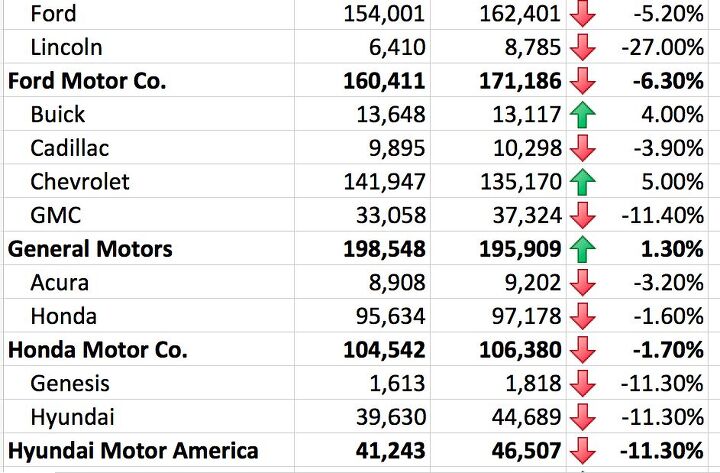

The Detroit Three saw retail deliveries fall in January. FCA was down 12.8 percent to 132,803 units compared to the same time last year, as every brand in that house suffered losses except for Jeep which stayed largely flat. Alfa was technically up but that’s thanks to the fact they only sold 108 units in January 2017.

Ford was off by 6.8 percent, recording 154,001 sales at the Blue Oval and 6410 sales at Lincoln. This is being blamed on a near 25 percent drop in car volume and a 12 percent drop in shipments to fleet customers. Using extrapolation, retail sales were off by 4.3 percent at the Glass House compared to last January.

GM was up by 1.3 percent, reporting 198,548 deliveries. Chevy and Buick saw 5 and 4 percent increases, respectively, while the other two brands brought up the rear. However, it’s worth noting that retail deliveries to actual customers were off by 2 percent, so the increases are thanks to – you guessed it – fleet sales, including commercial, government, and rental accounts.

According to J.D. Power (remember them?), the average new-vehicle incentive was $3,733 in the first few weeks of January. Analysts at ALG estimate the average new-vehicle incentive rose nearly 10 percent to $3,812 compared to the same month last year. GM, Ford, FCA, and Nissan were the biggest spenders on spiffs last month.

“Incentives continue to be a struggle, with automakers once again eclipsing the 11 percent mark in incentive spending as a percentage of average transaction price,” said Eric Lyman, ALG’s chief industry analyst.

The more things change, the more they stay the same, then.

[Image: Nissan]

Matthew buys, sells, fixes, & races cars. As a human index of auto & auction knowledge, he is fond of making money and offering loud opinions.

More by Matthew Guy

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts "And with ANY car, always budget for maintenance."The question is whether you have to budget a thousand bucks (or euro) a year, or a quarter of your income.

- FreedMike The NASCAR race was a dandy. That finish…

- EBFlex It’s ironic that the typical low IQ big government simps are all over this yet we’re completely silent when oil companies took massive losses during Covid. Funny how that’s fine but profits aren’t. These people have no idea how business works.

- Ajla Goldman Sachs 🥂

- Rna65689660 DVR and watch all that are aired. Has been this way for 40 years.

Comments

Join the conversation

Looks like a massive army of RAV4s and three-row RX Ls is coming to devour everyone else.

I see MINI sales are consistently down 5% month-to-month. Funny thing at the auto show I went to last night - lots of people sitting and checking out the MINI, but I bet the local dealership didn't see an uptick in sales. As a general note: the muscle and sports cars got the majority of attention at the show, even the old Challenger. People like the dream of having a fast car but not necessarily the reality of it.