A Ford Fusion Wagon Could Be a Winner, and Here's Why

As an automotive journalist, I’m bound by blood oath to promote the manual transmission and station wagon, preferably together. And I acknowledge that arguments made in support of three-pedals and D pillars are often more emotional than practical.

Not today.

There are no fewer than four sets of logical reasons Ford should reintroduce the midsize, mainstream wagon to American life (though probably with an automatic).

Forty years ago, 62 wagon nameplates existed in the U.S. market. They accounted for 10 percent of overall sales. By 2004 the wagon count had slumped to 26. According to JATO Research, there are presently eight wagons for American consumers to choose from. None are of the full-size mainstream variety, and the only midsize wagon is a crossover. They are compact (VW), premium (Audi, BMW, Mercedes, Volvo), or Subaru. The last product to carry the mainstream torch was the 2008 Dodge Magnum (Charger Wagon). The once common family conveyance is not even an endangered species; it survives only in pre-owned captivity.

Automakers are pragmatic bureaucracies that make decisions based on thorough analysis and long study. That does not guarantee good product decisions, but it does ensure heavy doses of risk avoidance. Combine their abhorrence for taking chances with anemic wagon sales, as well as the decline of the midsize sedan upon which the mainstream station wagon is traditionally based, and few product planners would have the fortitude to suggest their reintroduction.

Why should Ford consider a wagon now?

THE SWAMI

Automakers expend great effort and expense understanding the future of their market. Ford even employs a Futurist, Sheryl Connelly, to assist in improving Ford’s comprehension of long-term trends and how they may impact the Blue Oval.

In spite of these investments, the future is difficult to predict, and notoriously lengthy development cycles for automobiles compound the challenge. As a result, cars are often optimized to fight yesterday’s market battles rather than succeed in the competitive environment in which they are launched. Consider how the domestic manufacturers were caught with a dearth of fuel efficient cars in the 1970s and again in the 1980s. How long it took the European manufacturers to capitalize on the SUV opportunity. How excruciatingly long it took the Japanese OEMs to enter the full-size truck market.

Manufacturers plan tomorrow’s cars based on what consumers tell them they want today. But consumers don’t know what they will want in three, four, or five years. There are powerful externalities impacting consumer preference that do not operate on neat multi-year timelines. For example, fuel cost. The average cost of a gallon of gasoline is presently $2.20. But recent experience demonstrates that fuel prices can fluctuate decisively over a span of quarters or even months. Gas will not always be the inexpensive afterthought it is today. A return to $3.50 or more per gallon will impact buying decisions and the OEMs cannot adjust their product ranges as rapidly as fickle consumers can change their minds. The automakers who thrive over the long-term will be those that do not rely on a crystal ball, but rather those that hedge against a variety of alternative futures with a balanced product range.

SHOWING UP IS 80 PERCENT OF LIFE

Increasingly effective platform sharing and the application of new technologies, such as virtual reality, are being leveraged to shorten vehicle development cycles. But when it comes to market acceptance, there is no substitute for market participation. Creating and maintaining a balanced product mix is the best inoculation against shifting consumer taste.

Consider the case of GM’s two decade dominance in full-size SUVs. We take for granted that GM’s Tahoe/Suburban/Yukon will outsell Ford’s Expedition/Expedition EL at a clip of at least three to one. Yet if one sets aside subjective biases, there are no compelling product or brand-based justifications for GM’s superior segment performance. GM does not sell more full-size trucks than Ford and, as a brand, Chevrolet welcomes fewer customers to its lots than Ford. How did GM come to dominate the segment so comprehensively?

By showing up.

After posting second-place finishes to the Bronco through much of the 1980s, Chevrolet replaced the Blazer with the Tahoe in 1992. The Bronco soldiered on until its replacement by the four-door Expedition four years later. Although GM’s full-size SUVs have not been sales stars every year, the company has supported them and consistently delivered the best sales performance in the segment. What about Sequoia and Armada? They arrived in 2001 and 2004, respectively, leaving Toyota and Nissan to fight over the last eight percent of the full-size market, and lending further support to the value of being a first mover.

What are the mechanics that make being first to market so valuable? In a word, loyalty.

A simple rule of thumb is that half of consumers will be loyal with their next vehicle purchase. The other half will seek a new nameplate. Being first means an OEM has a strong chance at retaining half its customers when their ownership cycles, and thus only needs to conquest half of sales from other nameplates and manufacturers. Conversely, automakers introducing a new nameplate into an existing segment must earn essentially 100 percent of their customers through conquest. Yes, this is an oversimplification, but it underlines the value of being first and can justify the increased investment and patience associated with developing a new market niche.

GM dominates the full-size SUV segment today largely because they were the first ones there. Ford could earn a similar advantage by simply showing up with a station wagon when nobody else will.

CHARLIE DELTA FOUR

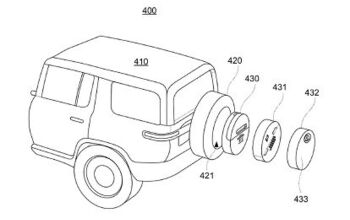

Ford does not need to develop a new Fusion-based wagon. It already exists as the Fusion CD4 platform mate, Mondeo. And a sleek, well-proportioned estate it is. The Mondeo wagon is produced in one of Ford’s largest, most flexible, state-of-the-art production facilities in the world. And the Valencia, Spain, plant has capacity to spare after its recent $2.6 billion expansion to accommodate the production of up to 450,000 cars per year. Moreover, Ford already exports another Spanish built, low-volume car to the U.S.: the Transit Connect Wagon.

The expense associated with introducing a Fusion Wagon to the U.S. would thus be limited compared to a clean sheet design. Some engineering adjustments would likely be necessary to meet U.S. safety regulations, though Fusion has already earned the NHTSA’s sought after five-star overall safety rating. Aside from the partial homologation required to bring the car to market, Ford would need to provide some marketing support.

As long as the Mondeo and Fusion are badge-engineered cars and the Mondeo estate exists to satisfy existing demand in other markets, Ford can introduce a Fusion wagon on less than 18 months’ notice. However, waiting for the market to demonstrate demand puts Dearborn behind the curve of consumer awareness. Leveraging the company’s global assets to nurture the wagon niche in North America would build consumer awareness over the long-term while delivering incremental sales in the near-term. Maintaining a wagon would be a relatively low-cost, low-risk project with limited downside, but the potential for future segment dominance.

FILLING THE WHITE SPACE

Introducing a Fusion Wagon is hardly a wacky idea. The Germans are extending their product ranges through myriad variations of the back third of their cars and SUVs. They are finding white space where no one knew it existed and proving that American consumers are open to a variety of form factors. Ford need not go as far as BMW or Audi in their creativity, but there is a clear space between the ultra-competitive midsize sedan segment and compact to midsize crossovers. The fact no automaker is there does not prove there is no demand. It simply demonstrates that no competitor is willing to make a commitment to the market. And if you’re a full-line global automaker like Ford, one of the most logical white spaces to color in is where the competition is absent.

What’s more, when will consumers begin to get frustrated with their need to move down a class to acquire a crossover at the same price point as the sedan they can afford? A fully equipped, front-wheel-drive Fusion Titanium with a 2.0-liter Ecoboost carries an MSRP of $35,000, the same price as a similarly equipped Escape. However, the crossover equivalent of the Fusion in the Ford product range is not the Escape; it’s the Edge, which tops $40,000 in corresponding trim. If I’m a Fusion driver, I don’t feel at home in an Escape — I want an Edge. If there were a Fusion Wagon, I would have an additional class equivalent option in my budget.

How many consumers would select a Fusion Wagon? As discussed above, the nearest comparable product, the 2004-2007 Dodge Magnum, averaged 44,000 units annually. But given today’s market dynamics and the fundamental differences between these cars, 44,0000 units does not seem attainable. Instead, the bottom end of Ford’s sales projection for its other segment exclusive Fusion, the Fusion Sport, can be used as a surrogate to forecast wagon sales volume. Ford is projecting 5 to 10 percent of Fusion sales will be Sports. At 5 percent of overall Fusion sales, Ford may therefore anticipate selling 15,000 wagons, which is likely right around the volume threshold necessary to justify the car on a purely financial basis. However, when the near-term opportunity is combined with the low-cost, low-risk nature of the exercise and its potential long-term market building advantages, the Fusion Wagon represents a compelling opportunity.

The business case for reintroducing the mainstream station wagon does not rest on how fun a Sport or ST Fusion wagon might be, though that does sound entertaining. Nor is this a prediction that the wagon will rise to supplant the crossover. Rather the argument in favor of the Fusion-based wagon is about the fragmentation of the automotive marketplace, the unknowable future, and how well positioned Ford is to benefit and even extend its leadership with limited downside risk and significant upside sales potential.

So, how about a 2018 Fusion Wagon Ford — perhaps with that slick six-speed manual your European customers enjoy?

Twenty year auto industry professional. Currently CEO at Turbo International, the premier American manufacturer of OEM replacement turbochargers for the global aftermarket.

More by Seth Parks

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Spectator Wild to me the US sent like $100B overseas for other peoples wars while we clammer over .1% of that money being used to promote EVs in our country.

- Spectator got a pic of that 27 inch screen? That sounds massive!

- MaintenanceCosts "And with ANY car, always budget for maintenance."The question is whether you have to budget a thousand bucks (or euro) a year, or a quarter of your income.

- FreedMike The NASCAR race was a dandy. That finish…

- EBFlex It’s ironic that the typical low IQ big government simps are all over this yet we’re completely silent when oil companies took massive losses during Covid. Funny how that’s fine but profits aren’t. These people have no idea how business works.

Comments

Join the conversation

They already sell a Fusion wagon, it's called Edge. There's also a Taurus wagon, known as Explorer, as well as Focus wagon, the Escape.

I'd buy a Fusion Wagon in a heart beat. But I saw one on I-70 coming back from Breckenridge 2 weeks ago. Was it a test car, a mule, or a Europen owner driving in the US?