January 2015 Sales: Buick's Cars Bring The Brand Down

Rough starts do not invariably lend credence to the belief that 2015 will be full of doom and gloom. Although January accounts for 8.5% of a calendar year, the month was responsible for just 6.7% of all new vehicle sales in 2013; only 6.1% of all new vehicle sales in 2014.

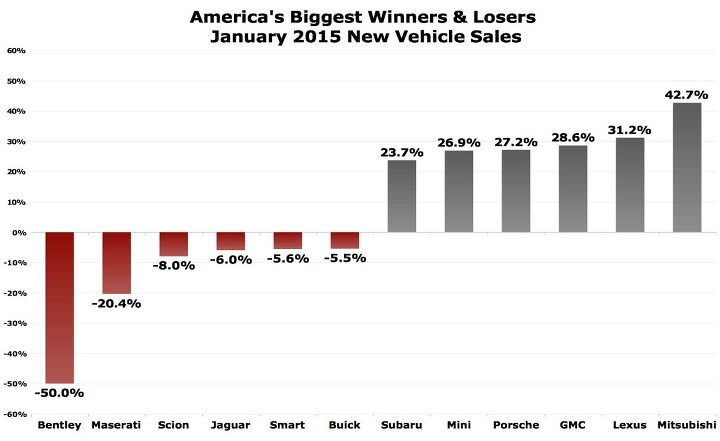

For a number of auto brands, however, 2015 could be difficult. At Scion, for example, sales fell 7% in 2013 and 15% in 2013, decreasing in 19 consecutive months before January 2015’s 8% year-over-year decline.

• Encore sales up 46.5% in January

• Regal falls into three-digit territory

• GM car sales down 7.3%

Jaguar volume slid 6% in January, a poor follow-up to 2014’s 7% drop. Although the XE will help, it’ll be a while before the brand’s new entry-level model actually lands. Smart is entering a transition phase, and the 6% drop in January to just 492 sales translated to the brand’s lowest-volume month since January 2013 and the second-lowest since November 2011.

Meanwhile, the 20% and 50% drops at Maserati and Bentley, respectively, equal slight volume decreases which could easily be made up in a single month at some point down the road.

But after 2014’s 11% increase – the fifth consecutive year in which annual volume has improved – and ten monthly YOY improvements in 2014, Buick sales slid 5.5% in January 2015.

Cause for concern? Likely not: Buick sales decreased slightly in January of last year, as well, and the year turned out to be one of significant growth. However, the specific areas in which the Buick lineup struggled are slightly more worrying.

Although it was made clear yesterday that TTAC is no fan, Encore volume predictably jumped 46.5% to 3465 units in January. It was the brand’s second-best-selling model behind the Enclave, which attracted only 32 more sales than its baby brother. Enclave sales were basically flat, down just 12 units compared with January 2014.

Buick car volume, however, tumbled by more than 1800 units, a 24.5% loss created by declines at all three car nameplates.

LaCrosse sales in America were down 29% to 2023 units in January.

At first glance, one might assume that big LaCrosse months at the end of 2014 (more than 10,000 LaCrosses were sold in November and December) downgraded inventory levels. But Automotive News reported more than 17,000 LaCrosses in stock at the beginning of January. It is entirely possible, however, that deal-making at the end of 2014 brought forward sales that might otherwise have occurred in the first-quarter of 2015.

Regal sales in America were down 45% to 792 units in January.

This was the first time monthly U.S. Regal sales fell below four digits since June 2010, the reborn Regal’s first full month on sale. GM possessed a 96-day stock of Regals at the beginning of January.

Verano sales in America were down 11% to 2776 units in January.

The Verano accounted for half of all Buick car sales in January 2015, down from 42% in January 2014. There was no shortage of available Veranos on dealer lots. Calendar year 2014 Verano volume was down 4%.

America’s car market hardly expanded in 2014, but there were signs of life in January. Eight of America’s ten best-selling cars reported improved sales in January. Chrysler, Dodge, Ford, Mazda, Mitsubishi, Nissan, Subaru, Toyota, and Volkswagen all generated improved January car sales, in addition to gains made by a number of premium brands.

Yet car sales trouble wasn’t a Buick-exclusive issue at General Motors last month. Although Buick was the most sorely impacted overall, Cadillac car sales slid 7%, but the brand was rescued by strong Escalade sales. Chevrolet car sales slid 5%, but light truck Chevys jumped 43%, propelling the brand to a 20% overall improvement. (GMC, remember, doesn’t sell any cars.) As a result, GM car volume was down 7% in January 2015, a month in which U.S. car sales jumped 8%.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 3-On-The-Tree In my life before the military I was a firefighter EMT and for the majority of the car accidents that we responded to ALCOHOL and drugs was the main factor. All the suggested limitations from everyone above don’t matter if there is a drunken/high fool behind the wheel. Again personal responsibility.

- Wjtinfwb NONE. Vehicle tech is not the issue. What is the issue is we give a drivers license to any moron who can fog a mirror. Then don't even enforce that requirement or the requirement to have auto insurance is you have a car. The only tech I could get behind is to override the lighting controls so that headlights and taillights automatically come on at dusk and in sync with wipers. I see way too many cars after dark without headlights, likely due to the automatic control being overridden and turned to "Off". The current trend of digital or electro-luminescent dashboards exacerbates this as the dash is illuminated, fooling a driver into thinking the headlights are on.

- Kjhkjlhkjhkljh kljhjkhjklhkjh given the increasing number of useless human scumbags who use their phones while driving (when it is not LIFE AND DEATH EMERGENCY) there has to be a trade off.It is either this, or make phone use during driving a moving violation that can suspend a license.

- Wjtinfwb Great. Another Solyndra boondoggle wasting the tax dollars we contribute and further digging us into debt. The saying, "don't listen to what they say, watch what they do" has never been more accurate. All this BS talk about "preserving Democracy" and "level playing fields" are just words. The actions say, "we don't give a damn about democracy, we want to pick the winners and use the taxpayer revenue to do it". 100 million is chump change in auto development and manufacturing and doling that out in 300k increments is just a colossal waste. Nothing happens in a large manufacturing enterprise for 300k., it's a rounding error. A symbolic gesture. Ford and GM likely spend 300k designing a new logo for the 12V battery that runs your radio. For EV development it's a fart in a Hurricane.

- Bd2 Let's Go Brandon!

Comments

Join the conversation

Buick's sales slid in January because old people don't like to go out in the cold, and January was really cold.

Scion dropped more than Buick: maybe young people don't like cold weather either? The 20-ish young lady who lives next door just kicked her Altima ('11-'12 model) to the curb for a Verano. I will agree that they seem tight inside, but the high driving position? A bonus in that market. Buick is still thought of as a premium brand in the Black community, IMO. It's not quite on Caddy level, but above Chevy (well, until recently). You could call it starter luxury. I'm torn about seeing more Opel rebadges and seeing actual Opels .. and still mulling over buying a low miles Saturn Astra ...