Killer Yen And Thai Floods Cost Toyota $4 Billion

Toyota presented today its revised outlook for the fiscal year 2012 (ending March 31, 2012). Only people who inhabitate spaces under rocks gasped when Toyota’s Executive Vice President Satoshi Ozawa announced that Toyota is looking at making only half the money it projected back in August. After a gloomy forecast in June, recovery from the tsunami had progressed faster than thought. Then, the waters in Thailand and the killer yen kept rising.

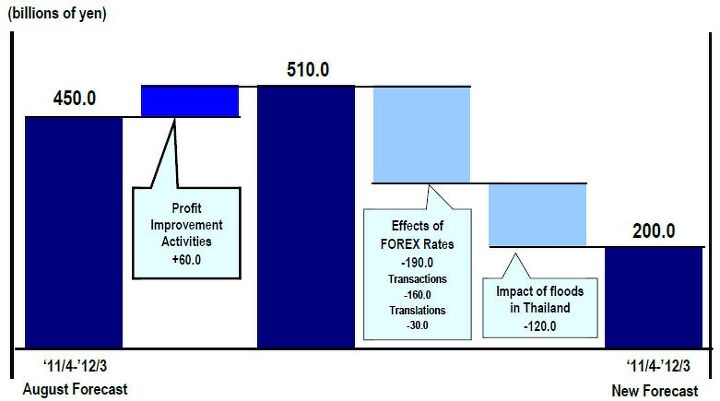

The floods in Thailand will cost Toyota 120 billion yen ($1.54 billion). The killer yen will destroy 190 billion of its own currency in the books of Toyota , or a whopping $2.33 billion. All in terms of operating income. Toyota expects a net profit of 180 billion yen ($2.3 billion), down 54 percent from the 390 billion yen forecasted in August.

Osawa said that the Thai floods resulted in 230,000 cars not made. Targets for fiscal 2012 were downrevised to 7.38 million units for 7.6 million units estimated in August.

Careful: Don’t believe it when wire services write “Toyota expects to sell 7.38 million vehicles worldwide this year instead of 7.6 million it predicted four months ago.” Toyota expects the 7.38 million this FISCAL year, not this CALENDAR year. A projection for the calendar year was not immediately available (we’ll try to get one,) but the back of my envelope says between 7.6 and 7.7 million across all TMC companies (Toyota, Daihatsu, Hino.)

Even the last inhabitant of spaces beneath rocks finally realizes what we had cautiously intimated a year ago, and what we had said loud for more than half a year: By the end of the year, that’s in three weeks, the ranking will go GM Volkswagen Toyota #3.

Ironically, Thailand was the place where Japanese carmakers fled to escape the rising yen.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kjhkjlhkjhkljh kljhjkhjklhkjh A prelude is a bad idea. There is already Acura with all the weird sport trims. This will not make back it's R&D money.

- Analoggrotto I don't see a red car here, how blazing stupid are you people?

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

Comments

Join the conversation

Profits made by lying to the Public/Govt about stuck accelerators - $1.2B Money saved by lobbying against safety improvements - $0.4B Money saved by hiding safety defects in the US - $1B Losses due to Japan Quake/Tsunami - $1.3 B Losses due to Thai flooding - $1.3B Net - $0.00 I think we are even now.

I would speculate there are two major impacts with an annualized profit project dropping to $2.6 Billion US (at today's exchange rate, give or take a Yen, assuming my math was right) 1) Huge pressure on the Japanese government to weaken the Yen - however there are macro economic factors that make that difficult 2) If one can't happen, as we're already seeing, Japan will see it's own manufacturing arms leave the country. Auto will be first, but others may follow. DEY TERK ERRRR JOBS!!! This raises further questions on long term quality and reliability. The perception in America post Toyota recall debacle is not Japanese = good, it is made in Japan = good. This was because for almost all vehicles recalled, the versions impacted where the made in US ones. That had nothing to do with Bubba and Floyd, it had more to do with supply chain and suppliers - but try explaining that to someone. 3) Longer term impact on R&D and contenting. The Koreans and US companies are putting huge pressure on Japan to raise the content bar, right at the time they were dropping it. A lack of free capital and tightening CAFE standards makes it hard to tweak engines and transmissions while coming up with the next interior ooooo ahhhhh that customers appear to want in the North American B, C, and D segments. I see this as the biggest issue.