59 Views

Chart Of The Day: Porsche Sales By Model 1995-2010 (YTD)

by

Edward Niedermeyer

(IC: employee)

Published: November 30th, 2010

Share

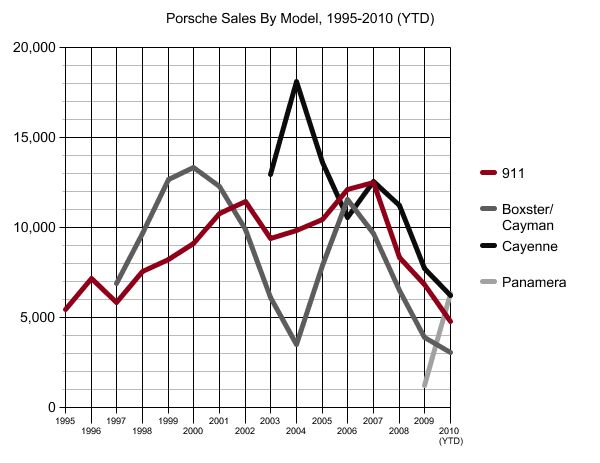

Yesterday’s discussion of Porsche’s identity as a pure sports car company (compared to an SUV-peddling luxury brand) was predictably emotional, so here’s the cold, hard truth. The Cayenne has been Porsche’s best seller in the US since its introduction, excepting a 911-happy 2006. Oh, and this year it’s on track to come in second… to the Panamera. Meanwhile, Porsche’s Boxster/Cayman duo has been dropping off since before the most recent recession even began, and 911 sales are approaching a 15-year low. Now that we know the facts, is there any debate about what would happen to Porsche if it stuck to its sports car knitting?

Edward Niedermeyer

More by Edward Niedermeyer

Published November 30th, 2010 4:30 PM

Comments

Join the conversation

It is true that the demographics are slowly changing and that there are going to be fewer and fewer people in the younger age group (and correspondingly more in the older ones). The short term effect is certainly that that means more people being able to afford a Porsche, in the longer term the future is less clear. There is no definite evidence pointing towards brands underlying an ageing or a cohort effect when it comes to cars. Were it an ageing effect, people would simply change the cars and preferences as they transitioned between life stages, which will happen with vehicle types to some extent (differing needs) but not necessarily brands. The cohort effect would be people forming an opinion / association with the brand at a certain stage in their life and changing it but little going forward (it tends to be much more stable if they have no actual first hand experience). If this is the way car brands operate then the Cayenne might actually be positive in a way - while we like to pretend otherwise, the car enthusiast market is fairly small and not that consequential, whereas the market the Cayenne appeals to is certainly more mainstream. It could very well be that the customers for traditional Porsches are simply slowly dying out or that their number is diminishing to regions, where it will be more and more difficult to serve them effectively. In any case, both Porsche and BMW seem to be making a bet away from a pure driving pleasure / performance focus, which is not saying that the bet is correct but it seems to be the current direction.

I bought a new 911 when I turned 40 (which I still own) and a new Panamera 4S now that I am about to turn 50. I also own a new Audi S4, a Supercharged Range Rover, and two other cars. I just sold a V10 M-5 and owned a 540 and a 745 for many years. I love cars. Several points: car companies are not immune from changing markets and need to constantly update and refine their wares. All of this BS I read above whining about the Cayenne and the Panamera reminds me of when the 911 went water-cooled. If it had not, today the same people who whined about the 996's radiators would be whining about the underpowered 997. Now, onto the Panamera: it is fabulous. It outhandles, outshifts, and is only a hair slower than the M5. It also gets about 65% better gas mileage. People's need change and it is great that Porsche is smart enough and dynamic enough to expand their lineup accordingly. PS I am an investment banker and always chuckle at the jealousy and naivetee people exhibit about my industry, including many of the posts above.

Imag, Excellent point re "naivete". Apologies. The rest of your response is so filled with anger and half-truths that I fear any attempt I make to educate you will waste my time. To be clear, my industry has made some terrible mistakes and is deserving of some scorn, but labeling everything and everyone in it with a broad brush is simply incorrect. Next time you drive on a road, use an iPhone, take a airplane ride, or pop some Lipitor thank an investment banker for raising the capital necessary for those products and services to exist. If you would like to have a civil discussion please indicate so and I will respond. My bet is you won't. I dare you to prove me wrong. Sincerely, JLOSF

C, Thanks for your note. I agree with many things you wrote, and disagree with some as well. I will respond back in greater detail in the next day or three. Sincerely, JLOSF