Carpocalypse: The Triage

When I was a young and budding Creative Director on the Volkswagen account (some time in the wild 70s,) I was told that there is only space for 10 automakers on this planet. In 2008, Marchinonne said there is room for 6. Now, the odds are there is Lebensraum for 3 to 5 automakers, depending on who you ask.

The prophets don’t seem to look around when they say that. The annual OICA list of the world’s largest automakers has 50 positions. In China alone are anywhere between 60 and 120 automakers, nobody seems to have a definitive number. Since I was a young and budding Creative Director on Volkswagen 30 years ago, the number of carmarkers worldwide has risen dramatically. It looks like the minute a country turns from a “developing country” into an “emerging country” (whatever that may be,) they want at least one of their own automakers. Even Iran has a couple of sizable automakers, they aren’t on the OICA list, and it’s not for a lack of units made.

If it would be true that one needs annual output in excess of 5m cars to survive, then our choices would be limited to Toyota, GM, and Volkswagen. Reality looks different.

The motorized mass mortality doesn’t seem to happen, and it won’t happen anytime soon.

If there was a global event that could have triggered mass extinction of the dinosaurs, then it was the carmageddon of 2008. Without government intervention, it would have broken the neck of several automakers. Curiously, it wasn’t the necks the prophets had in mind. It was the biggest ones that nearly died, would they not have been rescued by the generous donations of people like you and me.

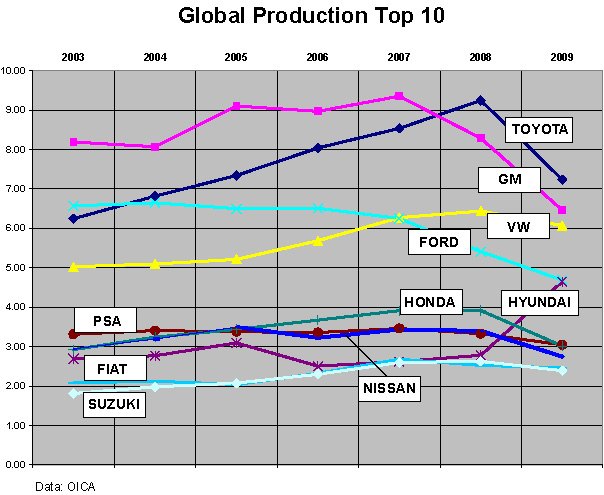

Sometimes, it’s good to take a long-term look. Over the weekend, I lined up the OICA production numbers from 2003 to 2009, and plotted them over time. For the top ten only, all fifty would have been too confusing. I took strictly the official OICA numbers. If you have issues with them (and there is reason in several cases,) the issues must be taken up with OICA. They are production numbers only, the metric the industry goes by. If some want worldwide transaction price rankings: I don’t have them.

What does the big picture tell us?

Toyota and GM, the two giants, suffered similarly, and a lot. GM started hemorrhaging a bit earlier and fell a bit deeper, but overall, GM fared not much differently than Toyota. If GM would have been better managed and would have built reserves instead of living from paycheck to paycheck, they could be in the same situation as Toyota, without any government help.

Ford was mauled badly. It is amazing that they survived without a bankruptcy and a GM-sized bailout.

Volkswagen, through sheer luck, was in the right place (China) at the right time, and was a nobody in the wrong place (U.S.A.) at the wrong time. Hence, Volkswagen survived carmageddon relatively unscathed. If they wouldn’t have been sidetracked by their own in-house version of the carpocalypse, the Porsche-Piech-Wiedeking-coup-and-counter-coup, they probably would look even better today.

The big winner is Hyundai. While nobody was watching and everybody was self-absorbed, dark horse Hyundai came from behind and showed that even if the sky is falling, there is room to rise.

The others are biding their time. No major battle damage (except for Honda.) They are all pretty much treading water.

Looking ahead, the decisive battle for world domination in terms of sheer production numbers is fought in China. It’s the world’s largest auto market and growing like gangbusters. By the end of the year, the Chinese will most likely have bought more than 16m cars, compared to projected sales “in the low 11m” in the U.S.A. GM is strong in China. Toyota is weak in China. Vokswagen is strong in China. Ford is weak in China.

Assuming continuous moral and political support at the home front, provided by GM’s main shareholders, GM will most likely re-take the #1 position in global output this year. The mid-term trend points strongly in that direction. However, this will be a hollow victory. Most of the volume in China comes from cheap little delivery vans built by a company called Wuling, a joint venture in which GM has only a 38 percent share. GM gave up the majority of their joint venture with SAIC for the express purpose that SAIC can reflect the whole profit on their books. How this will play out financially remains to be seen.

The big winners in China and elsewhere will be Volkswagen and Hyundai. Re-check the mid-term trend for details. Both Volkswagen and Hyundai are well positioned in China. Volkswagen much more so than Hyundai. Volkswagen profits immensely from a low Euro, and from increased exports. Ford is not a serious player in China. Therefore, I see Hyundai overtake Ford worldwide by year-end. The appreciating value of the Japanese Yen will cause Toyota additional pain when the books are closed. The low Euro and the teetering European market will hurt Ford. Ford has big exposure in Europe.

By the end of the year, the production ranking will most likely be #1 GM, #2 Toyota, #3 Volkswagen, #4 Hyundai, #5 Ford. In terms of profits, it most likely will be a tight race between Toyota and Volkswagen.

PS: Speaking of China, I will be touring the most scenic sites of China (factories in godforsaken places) all of this week with some hardy European customers. You will see very little of yours truly. Don’t worry (or don’t get your hopes up), BS shall return.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Shipwright As my Avatar shows I had an '08 GT 500, Grabber Orange convertible. I now own a '12 GT 500 Kona Blue coupe.

- ArialATOMV8 I tend to prefer more amusing colors when picking out a car (if possible). My 2017 Lexus RX is painted in a Nightfall Mica (Dark Blue) and I really dig the look. In the dealership it stands out compared to the regular tame blacks, silvers and whites. Soon I may be at the point to afford a new car and when I do, I'll do my part and spec/hunt for an allocation of a vibrant color.

- Tassos Tim is not that good with colors.The bright "pink" is not pink, but FUCHSIA. Both colors may look good on a woman's sweater, but not on steel panels.

- Tassos While I was a very satisfied owner of a much earlier Accord COupe 5 speed (a 1990 I owned from 1994 to 2016), I don't like the exterior styling of this one so much, in fact the 2017 sedan looks better. Or maybe it sucks in white. The interior of my 1990 was very high quality, this one looks so-so. The 157 k miles were probably easy highway miles. Still, Hondas are not Toyotas, and I remember the same service (like timing belt replacement) back then cost TWICE for an Accord than for a Camry. Add to this that it has the accursed CVT, and it's a no. Not that I am in the market for a cheap econobox anyway.

- 3-On-The-Tree My 2009 C6 corvette in black looks great when it’s all washed and waxed but after driving down my 1.3 mile long dirt road it’s a dust magnet. I like white because dust doesn’t how up easily. Both my current 2021 Tundra and previous 2014 Ford F-150 3.5L Ecobomb are white

Comments

Join the conversation

NulloModo JLR is going great guns in Europe and China. In fact sales in China are stunning especially when you consider they don't produce locally. I think in the UK JLR are now consistently showing growth of circa 50%! The USA is struggling economically more than most so perhaps that accounts for the difference. Sadly for Ford they only have minnow premium car maker Lincoln and that's a US only brand.... So all that growth JLR is now enjoying is in markets where Lincoln doen not compete. Personally I think Ford should have sent Lincoln to the rest home in the Sky and just gone with JLR.

Despite the little blip, in 2010, not shown on the chart, all the automakers are in for some more tough times as the year, and recession/depression, continues. Ford WILL be in for some very rough times and have to do some more cost cutting to survive. I wonder if the American people will have the stomach for another automotive bailout?