India's Nano Wars

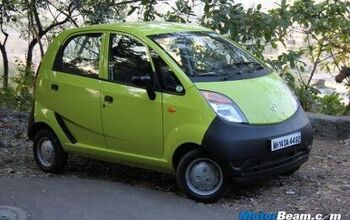

With Tata unable to produce enough Nanos to keep up with demand, more automakers are gunning for its entry-level segment. Renault-Nissan is teaming up with its Indian-market partner Bajaj to produce a car that’s even cheaper to produce than the Nano. “I can tell you the cost of this car would be lower than any car today made in India,” Renault-Nissan CEO Carlos Ghosn tells Gasgoo, adding that a lower production cost wouldn’t guarantee that the new car would be priced lower than Nano. The Renault ULC, as the low-cost car is being called during development, will be available in India in 2012, by which time GM and Toyota could have competing models on the market. Ford’s recently-announced Indian market low-cost car, based on the discontinued previous-generation European Fiesta, will be positioned above the Nano. And that strategy also appeals to Honda. The Motor Company tells the WSJ that rather than competing directly with the lowest-cost segment, a sub-Fit (Jazz, as it’s known globally) hatchback will be introduced around 2012 to compete with Ford’s model. The Jazz/Fit currently sells for about $15,000 in India, leaving a huge window between there and the Nano’s approximately $3,000 price price tag.

For automakers scrambling to break into India’s auto market there seems to be two separate strategies: the major global players are gunning for the lowest-cost segment, while the second-tier players are shooting just above it. The exception to this rule is Volkswagen, which was the first to the Chinese market and has become the number one player there. And unless a rumored tie-up between VW and Suzuki takes place (Maruti Suzuki is by far the biggest automaker in India), it will have almost no presence in India. Meanwhile, GM’s presence seems set to be eclipsed by its Chinese partner, SAIC. Hindu Businessline reports that SAIC will likely pick up 50 percent of GM’s India operations in hopes of developing a greater export market for Chinese-produced vehicles, and lowering the cost of GM’s Indian-market offerings. The light truck and low-cost car segments are seen as Chinese firms’ greatest strengths vis-a-vis its Indian competitors, but with the globals flooding in to India in hopes of gaining a foothold in one of the last huge growth-potential markets, India’s car wars won’t be a gimme for anyone.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Hari Your route home sounds like the perfect stretch for a car like the Alfa Romeo Giulia. Its renowned handling and dynamic performance make it an ideal match for those curves. For enthusiasts or potential owners interested in understanding all the capabilities of the Giulia 2017, the owner’s manual is an invaluable resource. Check it out here: https://chatwithmanuals.com/automobiles/2017-alfa-romeo-giulia-owners-manual/. Our AI-powered chat makes navigating the manual simple, helping you quickly find specific details about the car's features and specs. Perfect for making the most out of those driving moments and truly understanding your vehicle!

- Dale I'd consider the RAV4 if the Prime were on the table as paying for gas is for suckers. Otherwise, we have a couple of Mazdas and they are swell. I've driven older versions of both and the CX-5 is a nicer place to live.

- Haran Spot-on review of the Mercedes-AMG GT’s price adjustments and new features! For those intrigued by the all-wheel drive and enhanced features of the latest model, you can delve deeper with the complete operator's manual available here: https://chatwithmanuals.com/automobiles/mercedes-amg-gt-operators-manual-edition-c2020/. It’s a fantastic resource for understanding all the specs and new additions without getting bogged down by the complexity typically associated with car manuals. Chat with the manual using AI to quickly find exactly what you need to know about this sporty beast. Perfect for those who appreciate detailed insights on their luxury investments!

- Flashindapan Beautiful color combinations. I assumed they stop selling the TT here at least five or six years ago.

- Carson D Just don't be the whistleblower who reports on the falsification of safety data. That's a deadly profession.

Comments

Join the conversation

Well, I'm confused about your confusion. The Nano plant has not yet reached its 350k unit annual production capacity because Tata had to move production to a different plant than they had originally planned (due to the riots pictured above). Demand is strong for the Nano, and Tata isn't able to fill it right now. This explains why A) Tata is considering franchising Nano production from knock-downs and B) competitors are going after its market segment.

Where's the confusion?

With Tata willing to sell knocked down kits of the Nano to other companies, and with Gordan Murray planning on licensing production of the T-25/T-27 city car, it might be possible for a company to carve out a niche assembling small cars designed by other companies. As Ed pointed out, the delay in ramping up production on the Nano is because Tata had just about completed construction and setup of the plant they had dedicated to building the Nano, when political pressure forced them to abandon the plant and move production somewhere else. Most of the opposition to the plant was ginned up by politicians. Ironically, whatever farmers were displaced by the plant were forced to move by the state government, in the hands of the communist party.