And Yet More Ways To Cash In On The Economic Downturn

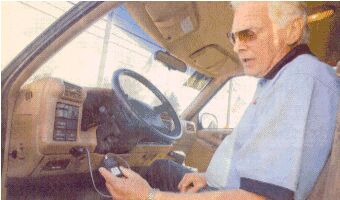

Not everyone can weather an economic downturn with the grace of, say, a Ferrari. Even with Wall Street bonuses under fire from DC, The Scuderia’s North American boss tells Wall Street Journal that “our customer base is not mainly those people. Our people have serious money.” No, really. Giant, heaping piles of it. Which is nice for them, but we’re not all in that boat, ne’est-ce pas? For the “less insulated” portions of the economy struggling to make payments on our less “investment grade” vehicular assets, the new economy is here to make things more efficient. For the people to whom you owe money. The Journal explores the rise of vehicle disablers, small satelite-linked devices with which your loan holder can “turn off” your vehicle when you miss a payment. The logic goes that people miss fewer cell phone bills if they know they will instantly lose service. And if it comes to reposession, satellite tracking makes the job easier and less expensive. Some customers complain that the ever-present reminder of their indebtedness is unwelcome, but lenders and dealers are finding them harder to resist every day.

More by Edward Niedermeyer

Comments

Join the conversation

I've heard of this being used at buy-here-pay-here type places, where the dealer would have to send a regular (weekly, monthly) signal to the car or it would stop operating. Problem is, those places are as shady as their customers, and buyers would be hosed when the dealer went out of business. Regarding the "black box" - that is frustrating. I have a right not to testify against myself. If I pay for a car, it should not be able to circumvent my rights on my behalf.

The first time one of these devices prevents someone from getting medical assistance, well, you can guess the rest.