November Sales: Incentives up 71%

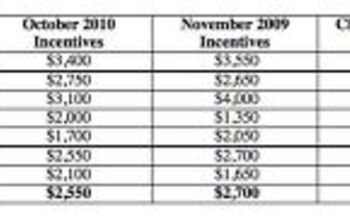

Autoremarketing reports that not only were November’s results the 11th straight monthly drop this year, they were also the steepest thus far. In even better news ( at least for the makers of your favorite brand of anti-depressants), the Seasonally Adjusted Annual Rate (SAAR) of sales shows that things are even worse than they initially appear. “When December’s numbers are extrapolated, fourth-quarter SAAR is expected to be 10.4 million units,” intones Autoremarketing, “which would be 35.8 percent weaker than the fourth quarter of 2007 and the heaviest drop-off in 4Q SAAR since 1967.” And this, despite widespread attempts by OEMs to redline their sales with cash on the hood. Average cash rebates in November were $3,392, up 71 percent from a year ago and at their highest level since 2003. Incidentally (or not) 2003 was also the last time we saw turn rates as slow as this month. Vehicles sat an avaerage of 83 days on the lot in November, up from 73 days in October and 58 days in November of last year. Market stratification continues apace, as “compact basic” and “compact conventional” models sat only 35 and 44 days respectively, while anything with the name “utility” in its category sat for at least 100 days on average. Finally, “negative equity trades (as a percent of all trades) dropped to 25.48 percent in November, the lowest level for this metric since the start of 2003 as owners with upside-down vehicles either could not obtain a loan or stayed out of the market altogether.” Bail that.

More by Edward Niedermeyer

Comments

Join the conversation

In spite of the talk of an enormous surplus of new cars, why are there no astonishing deals on new cars in my newspaper?

I don't think deals are amazing. I think deals are fake, at least on cars. I don't really think they are getting the message. Or maybe only part of the message. They recognize that reducing price should help sales. So they are advertising sales like crazy. With trucks, there are deals. With cars, the incentives don't seem much different from last year and the year before. They need to make the step beyond talking about sales and really hold sales. Then they'll get a response. The short answer is cars still cost too much. Financing, or lack thereof, is another way of saying that people cannot afford cars and are unable to service the debt. Because they cost too much. A huge unit surplus in a real economy would be followed by price reduction. But why bother- they don't have to sell cars. All they need to do is sit still and let taxpayer money flood in.

ronin: "They need to make the step beyond talking about sales and really hold sales. Then they’ll get a response. The short answer is cars still cost too much." Agree. Moreover, I think the incentives and promotions aren't very effective because the car biz has long had so much flim-flam that buyers doubt cars can actually be bought for advertised prices.

I wonder if the deflation spiral may have started, people putting off their possible car purchase on the basis that there may be a better deal next week/month/year.