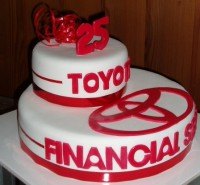

Toyota Tops GM in Lending

As you might expect, with Toyota nipping on GM's heels sales-wise, the two companies' financial arms have also been neck-and-neck. Automotive News [sub] reports for the first half of 2008, though, Toyota Financial Services pulled ahead of GMAC as the biggest U.S. auto lender. Research done by AutoCount estimates TFS had a 6.35 percent share the lending market, while GMAC held 6.2 percent. With GMAC's cuts in leasing, they expect TFS to stay ahead for the rest of the year. In the first six months of this year, 58 percent of Toyota, Lexus and Scion vehicles sold in the U.S. were financed in-house. About 46 percent of GM vehicles in North America were financed by GMAC. Other captive finance companies in the top ten were: American Honda Finance at fourth overall with 4.95 percent of market share; Ford Credit at fifth with 4.77 percent; Chrysler Financial holds seventh place with 3.15 percent and Nissan Infiniti Financial is eighth with 1.87 percent market share. The other four spaces are held by various banks. Perhaps a more interest and relevant stat would be the total lost in over-estimated residuals and bad credit risks. Anyone want to guess who'd be most likely to top that list?

More by Frank Williams

Comments

Join the conversation

He who has the gold, makes the rules...

Toyota is riding for a fall, and a very big one, on its lending practices. The LA Times reported a few months ago that Toyota was pushing 7 year auto loans. Detroit's leasing problems were just the tip of the iceberg, and Toyota won't miss the berg the next time around. The average new car loan now is for more than sixty months, which means that the loan is made in the expectation that it will not actually be paid off, but rather that the balance will be rolled over into a new loan when the buyer trades again. This Ponzi scheme only works, though, as long as the buyer can continue getting loans for amounts that exceed, almost instantly upon signing, the actual value of the collatoral. The more that a carmaker keeps its new car loans in-house, the more it has at risk on both resale value and the ability to generate money to loan to feed new car sales. Toyota has its derriere hanging just about as far out the window on this as the folks at GMAC. They've just avoided making a mess in public, so far, because they stayed out of the mortgage market. But the ripple effect of the credit crunch is still spreading and Toyota just hasn't received the message - yet.