Home Sales Drive Car Sales

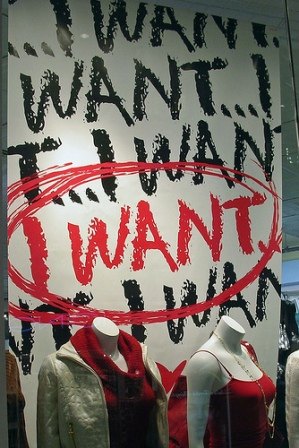

According to the (appropriately-named) SubPrime Auto Finance News, you can blame the cratering housing market for collapsing new-car sales. "Lower equity translates into an inability to borrow against the house to buy a car," opines Art Spinella of CNW Research. This is especially true in California and Florida, where new car buyers lead the league table for tapping into their home equity to finance a new whip. As of six months ago, California's supply of unsold new houses was running in excess of 80 months. Spinella reckons the Golden State's (and thus America's) auto sales recovery depends on reducing the staggering inventory of unsold new homes. So, Art, when? "Probably not until the final quarter of this year or the first quarter of next, but in either case a California turnaround will benefit all auto sales in 2009." Meanwhile, the number of homeowners who are "upside down" on their home loans is adding more fuel to the pyre. In fact, some 68 percent of those who bought homes in 2005 owe more than the house is worth. Ouch.

Glenn is a baby-boomer, born in 1954. Along with his wife, he makes his home in Connecticut. Employed in the public sector as an Information Tedchnology Specialist, Glenn has long been a car fan. Past rides have included heavy iron such as a 1967 GTO, to a V8 T-Bird. In between those high-horsepower cars, he's owned a pair of BMW 320i's. Now, with a daily commute of 40 miles, his concession to MPG dictates the ownership of a 2006 Honda Civic coupe which, while fun to drive, is a modest car for a pistonhead. As an avid reader, Glenn enjoys TTAC, along with many other auto-realated sites, and the occasional good book. As an avid electronic junkie, Glenn holds an Advanced Class amateur ("ham") radio license, and is into many things electronic. From a satellite radio and portable GPS unit in the cars, to a modest home theater system and radio-intercom in his home, if it's run by the movement of electrons, he's interested. :-)

More by Glenn Swanson

Comments

Join the conversation

I personally have no credit card debt after once having a lot of it, and I'm on schedule to pay off my 30-year mortgage 13 years early. I do have several car loans. One is is interest free (thank you Chrysler), and the other is a low-rate through a credit union. As with credit cards, I just got tired of paying interest and now I have that money to put towards my mortgage. :)

I don't mind having a mortagage (we are still young ) b/c if we didn't our income taxes would be horrendous as the standard deduction is way too low (capped at ~$18k). Then there's the local story (waiting in line for the cheap gas in the area) about this local guy with a recently purchased Hummer living in an apartment. He had to take a 2nd job in order to afford the payment for the truck. Now he's SOL b/c he can't afford to fill the tank half the time and drive the 60 mile roundtrip to work. He's so enamored with being noticed while driving than to save money. He notes that he should drive what he wants and needs the Gov't to reduce the gas prices. Guy is single, no family and doesn't off road or tow anything. Just has the Hummer to feel better about himself - then eat ramen or mac & cheese for dinner. I'll let go of this cliche - can't have your cake and eat it too!

When my fiance sold her condo (early '06, right before the market went South), she ended up buying a car with some of the profits. It was a new Mazda3 5-door, nothing expensive, but is the best all-rounder of the compacts, in my opinion. Was it a stupid move? I don't think so. She needed a car, and, due to my MINI woes, we made sure she got a fun, practical car w/ a warranty! The best part was not having a car payment. As well, she paid off 90% of her credit card debt, the rest of my car payment, and we used most of the money to pay off an apartment we bought about 6 months before (yes, we made a killing on the sell). Oh, and we still had a decent amount of money left over as part of a down payment on a 2nd apartment 1 year later!