Car Buying Tips: Feeling Used

Every year over ten million vehicles pass through U.S. auto dealer auctions. This decades old free market has always been dependent on you, the consumer. Dealers will bid up those models that are popular with buyers, while those with a limited audience are stuck in what’s commonly called ‘wholesale heaven’. This is a place where thousands of unappreciated and unloved models go until the market dictates otherwise. Over the course of time, consumers dictates the winners… and the losers.

Over the last few years, The Big 2.5 have been downsizing their domestic production capacity to match falling demand, and compensate for their decision to wean themselves from low-profit fleet sales. Enormous assembly plants that once produced hundreds of thousands of new vehicles are now shuttered. The theory: as production sinks, new car prices will eventually hold firm and profits will follow. Unfortunately, the latest patchwork of new product has already come apart, and the domestics' market share continues its seemingly inexorable slide.

There are three main causes for today's used car glut. First, the manufacturers shut off the supply spigot late in the game. Thanks to restrictive union contracts and timid management, carmakers failed to ‘chase down’ falling demand early or aggressively enough. The failure created an ongoing surplus of used cars.

Second, again, The Big 2.5’s market share for new cars is still falling and they’re still failing to match supply to new car demand. Banking unsold inventory and embracing badge engineering has lead to hundreds of thousands of vehicles that consumers do not know or care about.

Finally, Toyota, Honda, and Hyundai have remained fiercely loyal to the idea of building brand identity and limiting supply when the market dictates. This devastates the profitability of the domestics, who are stuck with an over-sized dealer network and a “stack ‘em high and sell ‘em cheap” sales strategy.

This endless stream of unpopular and largely unknown new cars– and the sales incentives that inevitably follow– has created a significant benefit for the U.S. consumer: a depreciation curve that makes lightly used cars a fantastic deal.

In the early days of zero percent financing (late 2001), experts estimated that every $1k in new car sales incentives resulted in a $400 decline in the price of a two-year-old version of the same vehicle. By the time employee pricing came to the forefront (the following summer), the hit to used car prices was closer $600.

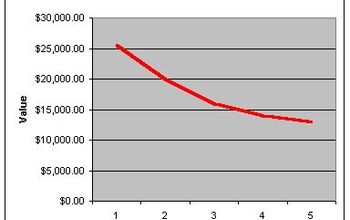

Many dealers peg the current depreciation rate at around $750 per $1000 in new car incentives. For your neighborhood used car dealer, their late model inventory now has a depreciation curve that’s nearly as steep as a new car vehicle’s. As a result, there are literally tens of thousands of unsold low mileage cars churning from dealership to dealership.

The bottom line: a brand new Mazda Miata with all the options sells for around $27.5K. As of April the eleventh, the Average Auction Wholesale (AAW) on a 2006 Chrysler Crossfire with 3,945 miles was also $25k. Not that many consumers would cross-shop the two roadsters, but a Crossfire that stickered for over $45k a year ago now costs the same as a new Miata.

In the last 60 days, a savvy buyer could also pick up a low mileage 2005 Mercury Milan, Pontiac G6, Mercury Grand Marquis, Cadillac Catera, Buick LaCrosse, Ford Freestar or Volvo V50 for around the same money as a brand new, 2007 Kia Rio. That’s cheap.

You may notice these models are the unloved off-spring of over-stretched or neglected brands. The selection and price reflects a new reality: manufacturers have created a perfect storm of overproduction, fleet sales, model inflation (dozens of new nameplates debuting every year), limited marketing resources and bad branding. Though they’ve been available for years, models like the LaCrosse, Montego and Outlander are falling through the cracks, and into used car depreciation Hell.

Plenty of consumers “get it.” As vehicle reliability has increased, more people are buying used– but still not enough to outstrip supply. And yet still, the new cars keep coming.

Smaller new car dealers in larger metropolitan areas are getting whacked by these economics. For every Carmax, Team (formerly AutoNation) and Sonic Automotive Group that expands its operations, a dozen independent dealerships fall by the wayside. Never mind the mainstream manufacturers’ decisions to “rationalize” (i.e. cut) their dealer networks. The growing used car market is forcing hundreds of family-owned new car dealers to either accept competitor buyouts or simply close shop.

For TTAC readers who understand that depreciation is the single largest cost of automobile ownership, or who simply want as much car for the money as they can afford, used cars rule.

As for what you should pay, go to the “completed items” section on Ebay and look for a car that’s roughly equivalent to the apple of your eye. You’ll find a price that’s usually a bit higher than wholesale, but lower than the inflated retail values you’ll find at Edmunds and Kelly’s Blue Book. There’s your starting point.

Call or email a few dealerships and bargain hard. You’ll soon see that the old 80/60 principle for a two-year-old model (80% of the life for 60% of the original selling price) is now closer to an 80/40 split.

It’s proof positive that the free market has spoken. Until and unless mainstream manufacturers can better match supply to demand and learn to produce fewer, more distinctive models, their new cars will continue to make one to two-year-old models cheaper and better values. It’s a virtuous circle– for you.

More by Steven Lang

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts Depends on the record of the company developing them. If it’s got a record of prioritizing safety over years of development, I’ll be fine with it, and I’ll expect it to be less risky than typical idiot human drivers. If it’s a “move fast and break sh!t” outfit like Tesla or Uber, no way.

- Kwik_Shift_Pro4X No thanks. You'll never convince me that anybody needs this.

- Kwik_Shift_Pro4X I'd rather do the driving.

- SCE to AUX EVs are a financial gamble for any mfr, but half-hearted commitment will guarantee losses.BTW, if there were actual, imminent government EV mandates, no mfr could make a statement about "listening to their customers".

- Zachary How much is the 1984 oldmobile (281)8613817

Comments

Join the conversation

I'll add my .02 on the Panther platform. It's been around forever and goes for long periods without update. This makes getting ahold of parts easy and most shops have no trouble what so ever reparing them. I recently bought a used police interceptor with a almost new rebuilt engine for $2600. Even with significant repairs I'll still be ahead financially of where i would be with a new (or slightly used) car payment. Plus it is large, comfortable, safe, and fun to drive.

I think a few here are missing some points. While the depreciation on a BMW or Mercedes is great, the cost to fix one doesn't change. A used M3 with 35,000 might sound like a good deal at $32,000, if there is something even slightly wrong with it, you could be out several thousand dollars. You also need to take into account finance charges and if there is a subsidised lease on the car. Many Cadillac leases are susidised by GMAC that turns $40,000 car into a no money down, $300 a month deal. Math will tell you that you paid $10,800 over 3 years for the use of a new $40,000 car. That's cheaper than what its depreciation would be. If you run it through a business, you may be able to write off the payment as well. There is more to car buying than just stating absolutes that used cars are always the better deal. A friend who recently purchased a 3 year old BMW 525 for $30,000, is finding out the hard way that the new Camry he was considering may have been the better deal