#fraud

Stellantis Staffers Charged With Conspiracy to Cheat Emissions Tests, Defraud Customers

Federal prosecutors Tuesday unsealed new criminal charges that named several Stellantis (formerly Fiat Chrysler Automobiles) officials accused of conspiring to cheat U.S. emissions tests and defraud customers buying their diesel-powered products. The indictment was opened in the Eastern District of Michigan, identifying FCA diesel senior manager Emanuele Palma (42) and two Italian nationals employed by FCA Italy SpA — Sergio Pasini (43) of Ferrera and Gianluca Sabbioni (55) of Sala Bolognese.

Palma had been charged previously and becomes a co-conspirator in the alleged plot to develop a 3.0-liter diesel engine used in FCA vehicles that could flummox emissions tests allowing the automaker to sell vehicles that did not adhere to government regulations. The motor started appearing inside engine bays in 2014, including popular models like the Ram 1500 and Jeep Grand Cherokee.

Playing With Numbers: Texas Dealer Accused of Major Fraud

The Reagor Dykes Auto Group was formed in 2006 after Bart Reagor, shown above, teamed up with a business partner to create a company that now eclipses half a billion dollars in annual sales. This is accomplished through a myriad of manufacturer franchises ranging from Ford to Chevy to Toyota, not to mention its dozen or so rooftops dealing solely in used cars.

Now, the company is facing allegations of major financial chicanery. In court documents filed last week, Ford Motor Company accuses Reagor Dykes of running one of the “largest floor-plan financing frauds in the history of the United States.”

Dealers Being Targeted by Used-car Fraud Ring

A new type of sales fraud is taking advantage of lenders’ and dealerships’ automated payoff systems. Basically, criminals have begun selling high-end used vehicles that have been obtained illegally and vanish before anyone is the wiser.

Mark Maida, the CEO of AutoBuy, has said his Florida-based company was on the receiving end of the scam in 2016 and wants to warn other prospective buyers before the same thing happens to them. He doesn’t believe it was an isolated incident and claims there have been other dealers and lenders across the state that have been affected by the swindle.

Is Carvana's Ex-Con Co-Founder to Blame for Its Fading IPO?

Carvana, the company we previously razzed for its innocuous multistory automotive contrivances, has suddenly found itself facing some legitimate problems. The car dealer is now famous for two things: vehicular vending machines and a majority shareholder with criminal ties to a major savings and loan scandal — who also happens to be the father of the business’ CEO and co-founder.

The organization is also facing a share price that has dipped 40 percent since its April 27 IPO. However, that can likely be blamed on an over-saturated used car market. Secondhand cars are incredibly affordable at the moment so, if you wanted to support Carvana or any other used vehicle vendor, now would be a good time. You just have to be alright with doing business with Ernie Garcia II, the ex-con investors are likely going to blame if the share price doesn’t bounce back.

Guam Residents Unknowingly 'Owned' Luxury Vehicles in Export Scheme

Guam, besides having the highest per-capita Spam consumption in the world (16 tins per person, on average), is also home to a recently uncovered fraud scheme that placed high-end vehicles in the driveways of island residents.

On paper, anyway. The unsuspecting residents — over 50 of them, authorities say — had no idea their names were placed next to luxury SUV registrations in the Department of Motor Vehicles database.

Pennsylvania GM Dealer Indicted for Phony Loan Scheme

An Erie, Pennsylvania Buick-GMC dealer, its owner and general manager, and another man were indicted this week for wire fraud over a bogus loan application scheme.

A U.S. District Court handed down the indictment on Tuesday, Automotive News reports, with court documents alleging the three men submitted fake car loan applications through “straw individuals.”

Motor Association Allegedly Defrauded of Millions by IT Executive Who Bought Office Building, Porsches

How do you buy an Arizona vacation home, a boat, two Porsches and an office building on a $210,000-a-year salary?

According to the CBC, the vice-president of information technology for the Alberta Motor Association managed to find a way, and it sure wasn’t legal. Jim Gladden is accused of draining $8.2 million from the AMA through fake invoices, then spending the money like a high-flying tycoon.

TTAC News Round-up: New Salvo Hits Volkswagen, Korean Competition Looms, and Benz Big on Batteries

After seemingly using up its legal arsenal against Volkswagen, the U.S. is pulling its backup out of an ankle holster and taking another shot.

That, Kia and Hyundai might get a Korean competitor, Mercedes-Benz is feeling charged up, Audi is still a fuel cell fan, and Volvo wants to standardize EV recharging … after the break!

It's a Day That Ends With "Y", Meaning More Bad News for Volkswagen

There’s never a dull moment at Volkswagen, and today the automaker finds itself fighting battles on so many fronts they’ll soon be wishing for General Eisenhower’s plotting table.

As the company steels itself for further bad terrible financial news, German prosecutors have widened their probe into the diesel emissions scandal and targeted 17 Volkswagen employees.

The new headcount is a big jump from the earlier six suspects, and authorities have said they’re not done looking. So far, none hail from Volkswagen’s management board, but Klaus Ziehe, a spokesman for the state’s attorney’s office, has said that management involvement has not been ruled out.

Inside Stories From the War Between Automakers And Dealers Over Exports

There’s not a more uncomfortable phone call for a car dealership’s finance manager to make then asking a customer to come back to have their finance or lease contract rewritten. This is typically caused by sales managers — the people most despised by finance departments — who spot deliver a vehicle based on their wrong guess about the rate or term a lender would approve the deal. Needless to say, the vast majority of these rewrites result in a higher monthly payment for the customer.

A couple of years ago, a finance manager at a Los Angeles Mercedes-Benz dealer told me and a Mercedes-Benz Financial colleague of mine about the day he picked up the phone to fix the opposite situation: the dealership had miscalculated the taxes on a client’s lease on a black ML350 Bluetec SUV and they needed the client to return and sign a new lease agreement reflecting payments of $14 per month lower than the original contract.

He called the customer with the good news only to hear, “No no no! Payment good. Payment good. We OK!”

After he hung up, he thought, “We just got snookered. That ML is probably on a slow boat to China and the factory is going to kill us.”

Volkswagen's Woes Mount, Fraud Office Investigating Misuse of Money

The European Union’s anti-fraud office is investigating Volkswagen for misusing publicly funded loans to develop illegally cheating software in its cars, the New York Times reported Wednesday.

Volkswagen was provided the low-interest loans by the European Investment Bank to develop engines that were more fuel-efficient and produce less carbon dioxide, according to the report. In September, the automaker admitted that 11 million vehicles worldwide polluted more than advertised and used an illegal “defeat device” to fool emissions tests.

The automaker’s woes compounded Wednesday: A European bank — partly funded by the U.S. — announced it would suspend a $327 million loan to Volkswagen that would have been used to build a $1.2 billion factory in Poland. That factory was slated to build commercial vehicles.

The Dealer Who Swindled $6 Billion From General Motors

In the opening moments of the above scene from the flick “Fargo,” Oldsmobile dealership sales manager Jerry Lundegaard is working up some bogus paperwork to cover his tracks with General Motors Acceptance Corporation (GMAC). We can infer that he sold some floor-planned cars and did not pay back GMAC, which was the impetus for the movie’s storyline of his bumbling attempt to extort money from his father-in-law.

Jerry’s store may have been “out of trust” with GMAC on a few dozen 1987 Cutlasses, but that pales in comparison to the scheme concocted by New York car dealer John McNamara.

Between 1980 and 1991, McNamara convinced GMAC to advance him $6.2 billion to pay for 248,000 conversion vans that did not exist. It was one of the largest Ponzi schemes in history and ended up costing GMAC $436 million, equal to $725 million in today’s dollars.

We would like to show you a photo of McNamara but none are to be found. That may be because it is believed he went into the Witness Protection Program a few years after his conviction for fraud in 1992. Just picture Lundegaard with a really big brain.

McNamara’s brilliant swindle was deliciously simple. It was based on one undeniable truth he learned from his years of owning a Buick-Pontiac-GMC dealership on Long Island: General Motors and GMAC were too incompetent and too bureaucratic to figure out that they were being scammed.

US Uber Users Latest Victims In Hacking, Selling Scheme

Uber customers in the United States are the latest victims in a hacking scheme where Uber accounts are sold on the dark web for as little as $1.

Lyft Sued For Breach-Of-Contract, Fraud Linked To $1K Bonus Program

A 22-page complaint filed against Lyft in federal court says the transportation network company reneged on a $1,000 bonus promised to new drivers.

Tales From The Cooler: The Land Of The Crooked Car Buyer – Part Two

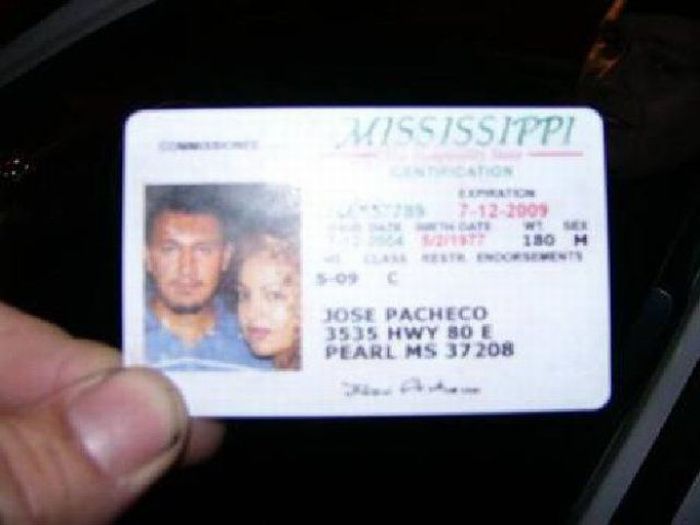

Fraud Rule Number One: no matter how cute your girlfriend may be, do not include her in the picture on your fake ID.

Welcome to Part Two of our exclusive series on the rollicking world of Los Angeles luxury car buyers defrauding automakers, banks and dealers. In Part One we looked at Lemon Law scofflaws and odometer clockers. Today we will examine the crooked schemes that can be used to obtain the vehicle of your dreams. We will begin with the case of robber Baron Haghighi, who last month tried to con a few cars out of several Southern California high-line dealerships.

Recent Comments