Keystone Vote Looms Amid Iraq Implosion

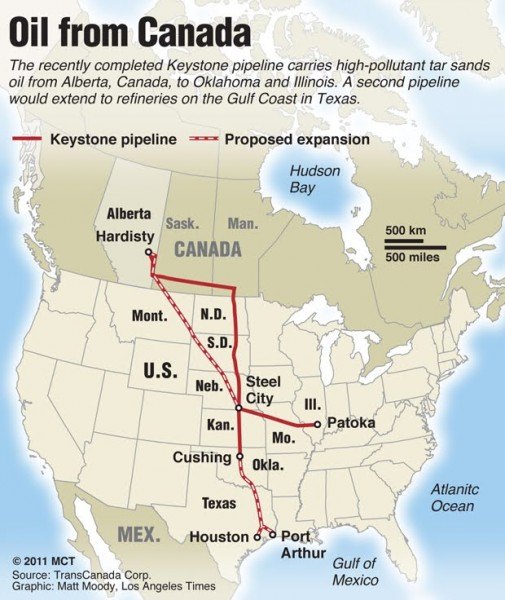

Global oil prices are on the rise as the crisis in Iraq contributes to market instability. Large chunks of Iraq’s oil production infrastructure have fallen under militant control, leading to a sharp drop in output. Meanwhile, Canadian officials are upset with the Obama administration’s handling of the Keystone pipeline. They contend that the inaction on Keystone is keeping millions of barrels of Alberta crude from reaching more profitable markets.

Bloomberg reports that market analysts are divided on how much the Iraq crisis will influence crude prices in the future. This isn’t particularly surprising, given the number of variables in that still-developing situation. However, all observers expect that the price will only go up. The price of Brent crude on the London exchange has already crested $113 a barrel as of June 13; this is the highest level since last September. In the United States, West Texas crude is near $107, also the highest price since the previous September. Most forecasters expect oil to reach around $120 a barrel by the fourth quarter, when rising demand will also drive up prices. Longtime oilman T. Boone Pickens told CNBC that a complete shutdown of Iraqi production could drive oil into the $150-200 range by destabilizing world markets.

Part of the problem is attributable to the OPEC oil cartel’s difficulties in increasing supply. Since the Libyan revolution, oil production in that key OPEC member has declined precipitously to barely 10% of previous output. Meanwhile, fluctuating production in Nigeria and other OPEC members has introduced more volatility into the supply and demand curve. A report issued by the International Energy Agency last week states that Iraq could provide up to 45% of all growth in global oil output through 2020. As militants from the hyper-violent Islamic State in Syria and Iraq (ISIS) group overrun ever-larger swaths of the country and curb down production, that future is looking cloudy.

The latest Iraq crisis comes just as negotiations surrounding the embattled Keystone XL pipeline are finally coming to a head. The U.S. Senate Energy and Natural Resources Committee will likely vote this week to approve the pipeline. The bill under consideration is an attempt to sidestep the regulatory approval process, which critics say the Obama Administration has intentionally drawn out. The bill is unlikely to make it far in the Senate, due to general gridlock as well as the opposition of several key Senators.

The government of Canadian Prime Minister Stephen Harper is displeased with the Obama administration’s perceived stalling on the pipeline. Finance Minister Joe Oliver and Natural Resources Minister Greg Rickford have both criticized Obama, stating that continued delay of the pipeline is hurting the Canadian economy. Currently, crude from the Alberta oil sands is undervalued due to a transportation bottleneck, leading to lower prices. The Canadian Chamber of Congress estimates that this bottleneck is costing the Canadian economy as much as $50 million a day in lost revenue. Therein lies the contradiction at the heart of the dispute.

Environmental concerns and global warming have long been cited as the Obama administration’s reasons for drawing out the Keystone approval process. In reality, the economics of the pipeline are heavily skewed in Canada’s favor, to the possible detriment U.S. consumers. Keystone is the most visible manifestation of the long-term goal of Canadian energy companies to find markets outside the U.S. As the Wall Street Journal explains, and the Canadian Chamber of Commerce and Harper government freely admit, Keystone’s biggest benefit will be to Canadian oil producers, not American consumers. Keystone will enable them to export oil outside of the low-priced American market to higher-priced markets in Asia, Europe, and the developing world. Keeping Canadian crude from hitting world markets is in the best interests of the U.S., but not the Canadians. Of course, it’s not exactly kosher to say that out loud, considering that the United States is still getting about half its oil imports from Canada.

Given that, the “solution” to the Canadian oil price problem is probably going to be built entirely on Canadian soil. Oil companies are already developing a “Plan B” system of trans-Canada pipelines, should Keystone not be approved. Even so, the long-term viability of the Alberta oil sands depends on a relatively high minimum price floor. The highly adulterated quality of that oil, and the resulting expense of processing and refining it, means that Albertan production can only be profitable when the price of oil is relatively high. This reason combined with new technology is the explanation for why Canadian tar sands haven’t been highly productive until recently. A worldwide decline in the price of oil, such as what happened in the 1980s and 1990s, could still be devastating to tar sands production.

More by J.Emerson

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Corey Lewis It's not competitive against others in the class, as my review discussed. https://www.thetruthaboutcars.com/cars/chevrolet/rental-review-the-2023-chevrolet-malibu-last-domestic-midsize-standing-44502760

- Turbo Is Black Magic My wife had one of these back in 06, did a ton of work to it… supercharger, full exhaust, full suspension.. it was a blast to drive even though it was still hilariously slow. Great for drive in nights, open the hatch fold the seats flat and just relax.Also this thing is a great example of how far we have come in crash safety even since just 2005… go look at these old crash tests now and I cringe at what a modern electric tank would do to this thing.

- MaintenanceCosts Whenever the topic of the xB comes up…Me: "The style is fun. The combination of the box shape and the aggressive detailing is very JDM."Wife: "Those are ghetto."Me: "They're smaller than a Corolla outside and have the space of a RAV4 inside."Wife: "Those are ghetto."Me: "They're kind of fun to drive with a stick."Wife: "Those are ghetto."It's one of a few cars (including its fellow box, the Ford Flex) on which we will just never see eye to eye.

- Oberkanone The alternative is a more expensive SUV. Yes, it will be missed.

- Ajla I did like this one.

Comments

Join the conversation

It seems the Alberta oil will move west to Asia. Well, I sort of knew this as I stated the oil is of more value to the Canadian's going to Asia then south to the US. http://www.bbc.com/news/world-us-canada-27896552

@Lou_BC What rumblings have you heard of or read in your neck of the woods? Have there been surveyors out and about looking at viable routes?