Could Tax Reform Be End to EV Incentives

Earlier this week Representative Dave Camp (R-MI), Chairman of the House Committee on Ways and Means, released the Tax Reform Act of 2014. This proposal would make sweeping changes to a very long and complex U.S. tax code. Included in the proposal was a provision to repeal the tax credit for new qualified plug-in electric drive motor vehicles, known as Internal Revenue Code Section 30D or IRC 30D. Or as most of us know it “the $7,500 EV credit.”

Provision:

Sec. 1308. Repeal of credit for new qualified plug-in electric drive motor vehicles.

Current law: Under current law, a taxpayer may claim a credit for each qualified plug-in electric-drive motor vehicle placed in service. A qualified plug-in electric-drive motor vehicle is a motor vehicle that has at least four wheels, is manufactured for use on public roads, meets certain emissions standards (except for certain heavy vehicles), draws propulsion using a traction battery with at least four kilowatt hours of capacity, and is capable of being recharged from an external source of electricity.

For plug-in electric drive vehicles acquired after 2009, the maximum credit is capped at $7,500 regardless of vehicle weight. In addition, after that date, no credit is available for low speed plug-in vehicles or for plug-in vehicles weighing 14,000 pounds or more.

After 2009, the 250,000 total plug-in vehicle limitations are replaced with a 200,000 plug-in vehicles per manufacturer limitation. Under the new limitation, the credit phases out over four calendar quarters beginning in the second calendar quarter following the quarter in which the manufacturer limit is reached.

Provision: Under the provision, the credit for new qualified plug-in drive vehicles would be repealed. The provision would be effective for vehicles acquired after 2014.

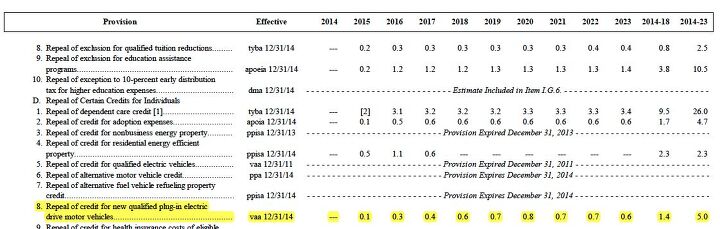

JCT estimate: According to JCT, the provision would increase revenues by $5.0 billion over 2014-2023.

Cost Savings Estimate (in billions):

This isn’t the first time the House attempted to repeal IRC 30D.

Just last January Mike Pompeo, a Kansas Republican, introduced HR 259, a bill that would have also repealed various energy tax incentives to include IRC 30D. But unlike HR 259, which didn’t garner much support, the Tax Reform Act of 2014 is a larger package and one whose passage will likely be celebrated during campaign events later this fall.

While the Camp proposal will change as it works its way through the committees in the House, it’ll be interesting to see if the repeal of 30D sticks. I think it’ll stick, but enactment would take many stars lining up just right.

Camp is from Michigan

First, the Chairman of the Committee, and author of this proposal, is from Michigan. Here members of Congress are expected to fall on their sword for anything that is ‘good’ for automotive. Clearly that message didn’t travel far enough North to reach Representative Camp’s office.

Your tax dollars subsidize rich people’s cars

Should this single provision spiral into its own public debate in the House, I could see members of Congress walking onto the House floor holding poster boards highlighting the cost of EVs like the Tesla Model S, asking ‘the American people’ why government is subsidizing luxury cars for the wealthy.

If the provisions make it through the House, they still face (bipartisan) opposition in the Senate.

Last December Senator Max Baucus, while still Chairman of Senate Finance Committee, released an energy tax reform plan that included a repeal of, you guessed it, IRC 30D. While Senator Baucus is no longer in the Senate (he’s now Ambassador to China), the committee released a cordial statement thanking Representative Camp for his work on the Tax Reform Act and that they looked forward to working with the House on this effort.

That means it’s likely tax reform of some sort could pass both chambers. Even so that doesn’t mean IRC 30D will be repealed.

The Senate is filled with staunch supporters of green energy incentives, namely Senators from California, Oregon and Michigan. But support for IRC 30D could cross party lines too. Take Senator Bob Corker of Tennessee. When he isn’t warring with the UAW, he speaks highly of the Nissan Leaf, a car built in his state and one that benefits from IRC 30D. I imagine any automaker that benefits from these tax incentives will be very vocal on this issue. Then again there are larger long-term corporate tax benefits that could outweigh a fight over a small item like a plug-in incentive. That is something to consider as well.

The wild card for me is the White House. In his first term President Obama set a goal of one million electric cars. That seems to have been set aside as the Administration is including incentives for natural gas vehicles and other forms of vehicle vaporware/technology (coughing – fuel cells). I’m undecided if the White House will take a backseat on fighting any repeal of green energy incentives, assuming there are greater gains to be had in a larger tax reform package.

It’s also important to keep in mind that earlier this week President Obama released a “vision” of a 4-year transportation plan with a price tag of $302B, $150B of which would come from a one-time revenue transfer from ‘pro-growth’ tax reform. The Camp proposal in the House would allocate $120-125B to the Highway Trust Fund. While the President’s vision lacks details, Camp’s proposal makes me believe that the Republican-lead House may not be on the same exact sheet of music, they’re at least playing a similar song.

Many questions remain – particularly as it relates to timing of the highway reauthorization, which expires in September. To have all of this play out in harmony Congress would have to move a tax reform package that is sure to stir every association registered in America, through both chambers while also moving a 4-year highway reauthorization.

Back to my original question – will the plug-in credit be repealed? Yes. No. Maybe. It really depends on the larger package being passed. As you can see there are many moving parts, not to mention a Congress that will likely go into lame duck campaign mode in the fall.

Another option, and one that I didn’t go into here, is rather than to repeal IRC 30D amend it to something a bit less elitists and maybe even a smaller dollar amount (i.e. $2,500 w/ MRSP cap, etc.)

More by John Barnett

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- NotMyCircusNotMyMonkeys so many people here fellating musks fat sack, or hodling the baggies for TSLA. which are you?

- Kwik_Shift_Pro4X Canadians are able to win?

- Doc423 More over-priced, unreliable garbage from Mini Cooper/BMW.

- Tsarcasm Chevron Techron and Lubri-Moly Jectron are the only ones that have a lot of Polyether Amine (PEA) in them.

- Tassos OK Corey. I went and saw the photos again. Besides the fins, one thing I did not like on one of the models (I bet it was the 59) was the windshield, which looked bent (although I would bet its designer thought it was so cool at the time). Besides the too loud fins. The 58 was better.

Comments

Join the conversation

And of course, the picture of a Volt is used in this story. $70K plus Teslas's with $7500 'guberment rebates to the six-digit income buyers good. Leaf - good. Kia Soul electric good. Volt - bad.

While this tax credit was not a particularly good idea (far too large per KWH, capped at 16KWH and too open-ended), various auto manufacturers have made plans based on its availability. Changing the rules with little warning would undermine faith in future tax incentives. Congress could change the rule to "200K units or 2018/19, whichever comes first) and give automakers adequate time to prepare or change course. The GOP often carries on about "uncertain regulatory environment" and this would be a bad example of making tax law uncertain as well.