Detroit News Declares Japanese Price War, Needs New Calculator

Yesterday, the Detroit News warned of a sneak attack by the Japanese on the U.S. auto market:

“Nissan Motor Co.’s take-no-prisoners approach to gaining U.S. market share has the auto industry worried that a price war is brewing that will erode the profit progress made since the recession ravaged auto sales.”

According to the Detroit paper, Nissan’s recent price reductions are

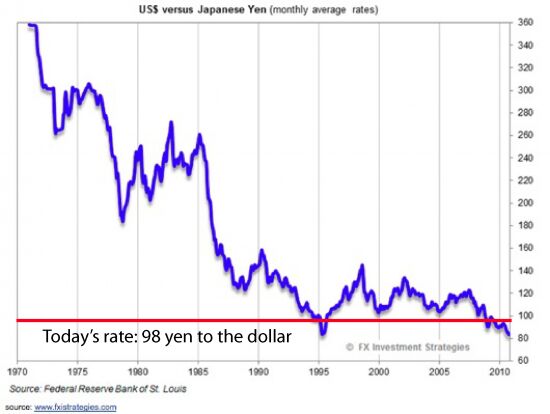

“the first sign of a Japanese automaker taking advantage of the weakening yen that Prime Minister Shinzo Abe has pushed down to improve Japan’s economy. That currency’s 15 percent swoon versus the dollar since Oct. 31 gives Japanese automakers an extra $1,500 per car they can use to cut prices or offer additional features while keeping prices even.”

It’s only a sign if you are both blind and fact-resistant.

Nissan lowered the price of its Altima by $580, and its sales “jumped 41 percent, surpassing Ford Motor Co.’s Fusion and closing in on Honda Motor Co.’s Accord,” reports the DetN from the price war front.

Joining the militaristic metaphors is Michelle Krebs of Edmunds. Nissan’s price reductions “strike me as a scorched earth policy of going for market share and sales volume at seemingly all costs,” Krebs said.

What they all forget or simply don’t mention is the fact that the Altima, along with more than 70 percent of the cars sold by Nissan in the U.S., does not come from Japan. The cars are made in North America. The cars are completely decoupled from the yen. “By 2015, Nissan aims for 85 percent North American production,” says Nissan’s Yokohama spokesman Chris Keeffe. “We build where we sell.”

Last week in Nagoya, Toyota’s America-Chief Jim Lentz said the same, and he flatly denied that the cheaper yen has any influence “either on price or on the equipment level – we price to market, not to a currency rate.”

The fact that a car made in North America can’t get cheaper just because the dollar buys more yen in Tokyo seems to be too complicated for the Detroit paper and its Detroit sources.

Or possibly, both simply trust that they can play the American public for a big fool.

The DetN missed a scoop: The yen actually is nearly 20 percent cheaper than on Oct. 31, not 15 percent, but numbers are not the DetN’s strong suit:

When Nissan shaves $580 off an Altima to get its formerly lackluster U.S. sales going, then that’s a “price war” invl the DetN’s book. When GM takes $5,000 off the price of a Volt, then “Detroit has implemented discounts on some models, such as the Chevrolet Volt plug-in hybrid, and offered promotions such as free oil changes,” writes the Detroit News, reporting live from the alternate reality .

And this is Mulally on drugs: Allegedly manipulated “cheap” yen should be a lot cheaper to trade at “normal” levels

Ford especially has been pushing the tale of “the Japanese manipulate the yen” for years, even when the yen was obscenely high. It always found journalists to go for the story. Just hours ago, Alan Mulally told Bloomberg that “Japan is “absolutely” manipulating its currency,” and while he was at it, “that Japan is a closed market for U.S. automakers.”

While this inanity may play well in Idaho, neither the Detroit carmakers nor the Detroit News scribes are that stupid. Most likely, they set the scene for bigger discounts and smaller profits, while blaming it on the people they usually blame, the Japanese.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- FreedMike Yeah, this trend needs to die a painful death.

- THX1136 This reminds me of a 'fad' back when I was in high school that was equally silly. A few folks would put spacers in the rear springs to lift the back end of the vehicle to ridiculous heights. We would joke that they must think it makes the car go faster since it feels like you're driving downhill all the time. Dangerous for all the reasons Redapple2 mentions.

- Arthur Dailey Just a couple of questions. Are you adding a stabilizer to your gas tank as the gas sits so long? Aren't tires usable for up to 10 years after manufacture, rather than 7? And should you wait so long between oil changes? Even with the low mileage can the oil degrade? Eagerly awaiting responses from one and all.

- Redapple2 I m afraid I d hate the crazy color 2 yrs down the line of a 6 year ownership. So, after dark blues, and dark reds I m back to a wonderful deep, pearly, lustrous white. Looks good at night. In the day. Clean; and when dirty, hides it.

- THX1136 Some folks down the street from me had a beautiful blue/green Jeep. I stay away from grey, brown, silver and black. Ironically I own a white vehicle at the moment due to not being able to afford the blue one I was considering and not wanting the aforementioned colors. A nice emerald green, most shades of blue (Santa Fe Blue is a favorite) and the 'hotter' colors like orange, purple and yellow appeal, but as KOKing mentioned it's got to look 'right' on the car in question.

Comments

Join the conversation

The US is under attack again? It seems to be the mantra for its existence. What about the US with its recent policies managing its ecconomy. Is that currency manipulation? Look at what it has done to our manufacturing sector in Australia. Hey, but when you guys act in a similar it is for the good of the world. Not mentioned the 30% of Japanese vehicles moved across the Pacific, the cost or transportation, which runs into several thousands of dollars. If the Big 3 can't compete then maybe they should sit down with the UAW, management and government to find ways to increase their competitive edge. Maybe a chicken tax on car imports? I do think the US relies on scare tactics to mobilise and modify paradigms. The continual perception that US is under threat so much by foreign companies/countries is wearing thin. There are real threats and not so real threats, this isn't a threat, just a wake up call. Maybe Detroit should just make the hard decisions with the government and UAW. Get on with it and stop whining, have a look at restrictive UAW workplace practices and become competitive. The foreign manufacturers in NAFTA don't seem to have this problem or did they require bailouts during the GFC. And try and call me anti American again, I'm not I'm just a realist.

Then why did they sold stakes in Mazda, if Japan is such a nice base camp to attack other markets. At least, they sold it at the timing of very favorable currency rate in 2010...