Exotic Cars and Montana Plates

I have a mild obsession with license plates. Which is to say that I often pay extra for those special plates that I think look cool, but no one else ever notices. I also know a lot of weird license plate-related facts. Like, for example: did you know the last number in a Massachusetts plate corresponds to the month it expires? I proudly trot out that one every time I see a Masshole on the road. Surprisingly, my passengers never seem quite as intrigued as I am.

Occasionally, there are benefits to my license plate obsession. For example, I can always spot cars owned by annoying acquaintances in restaurant parking lots, which spares me from actually having to speak to them. And I have the immense honor of being the go-to person whenever my friends have a registration-related query.

One of the questions I get most commonly is: why do so many expensive cars have Montana license plates? And so, I will now answer that, virtually assuring that TTAC will lose the wealthy exotic car owner and Montana attorney readership, but perhaps gain a following among county tax commissioners.

It’s all about taxes

In its simplest form, an exotic car with a Montana plates is an immense tax dodge. Being the Wild West, you see, Montana levies no sales tax. Instead, its government chooses to operate under the unique “we don’t need no stinkin’ money” principle, which possibly explains why they went without speed limits for several years: they couldn’t afford the signs.

Let’s do some quick math before going any further.

Say I purchased a Bugatti Veyron, which is very possible since my own car is similar in a lot of ways. For example, it also has some number of turbochargers that’s less than seven. And four wheels.

In my home state of Georgia, the Veyron’s $1.7 million MSRP would be taxed at seven percent, which comes out to $119,000. For a license plate. I have often said state governments should actually help automakers sell supercars like the Veyron, since the revenue from one Veyron is equal to around 65 Accords.

Now, pretend you don’t live in Georgia. Pretend, instead, you live in Montana. Perhaps you think you’ve made an upgrade, but it’s 63 degrees here in Georgia and I’m writing this on my porch. What say you now, Montanan?

Anyway, if you lived in Montana, the same Veyron would cost virtually nothing to register. Yes, maybe $200 for some fee or other, and of course the requisite $30 for the special plate that no one notices. But aside from that, nothing. You’ve just saved $118,770.

I know what you’re thinking: can’t a guy with a $1.7 million car afford $120k in taxes? Probably. But can’t a guy with a $30,000 Accord afford to spend $20 to board the plane ten minutes before other passengers? It doesn’t matter how rich you are: no one likes to needlessly spend money. Thus, exotic car owners – a bunch that’s probably no stranger to minimizing their tax burden – often turn to Montana for registration.

How does it work?

Surprisingly, minimizing your tax burden by registering a car in Montana is actually pretty easy. Step one is finding an attorney in Montana willing to act as a “registered agent” and set up an LLC (that’s “limited liability company”) on your behalf. Google returns about four million results (literally, four million) so I won’t name any names.

The law firm is important because your registered agent needs an actual Montana address to form your LLC. And the LLC is crucial because it’s going to be the actual owner of the vehicle. That’s right: technically, the vehicle is no longer yours. Instead, it belongs to your newly-formed company – which just happens to be based in tax-free Montana! What good luck you had when choosing a place to incorporate.

In most cases, it costs around $1,000 up front to form the LLC and use the law firm as a registered agent. Each law firm also charges an annual fee of around $100 to continue acting as your registered agent (“hush money” so they don’t rat you out to your DMV). And the state of Montana collects a registration fee every year – but it’s a fraction of what other states usually charge.

Interestingly, you don’t need to buy a Bugatti Veyron for this to make sense. Let’s say you purchase a new Chevy Tahoe Hybrid, which is by far the best Tahoe on the market. (Over/under on how long this article is up before I get attacked for that one in the comments?) With a base MSRP of around $54,000 (what a deal!), the Tahoe Hybrid would mean a $3,800 sales tax bill – at least. In Montana, it’s still just a grand up front and a few fees every year thereafter. A quick $2,800 savings.

So why don’t more people do it?

As far as I can tell, the main reason people – even those in the know – don’t take advantage of Montana tax savings is because doing so is risky (and, frankly, a bit morally questionable). Let’s be honest: unless you live in Wyoming or possibly Idaho, no one is going to believe you’re actually from Montana. Especially if you’re driving a Panamera. When I see a Montana plate in Georgia, I automatically assume “tax dodger” unless it’s a beat-up old Silverado with Bush/Cheney bumper stickers.

While you might not care if your neighbors know you’re not really from Montana, you probably should. That especially applies to California residents, since the Golden State recently launched a “CHEATERS” program that’s designed for people to turn in their tax-evading neighbors. Using a simple online form, the nosy bastard who lives next door can tell the cops exactly what you’re up to.

That’s important because most states have a law against keeping a car for more than a month or two without registering it at your home address. Of course, it’s technically not your car – it belongs to your corporation, which makes the Montana plates “legal.” But it’s thin ice – and some states are already cracking down. In 2010, Massachusetts stated going after RV drivers pulling this scheme. And I imagine “CHEATERS” has caught more than a few exotic-owning Californians, turned in by neighbors angry that the guy next door with the flashy red car wasn’t paying his “fair share.”

Of course, many drivers won’t have any issues. Police officers may not inquire about your out-of-town plates when they pull you over for speeding. If they do, a simple explanation of “it’s registered to my business” will probably suffice. It’s not like they’re going to ask for your articles of incorporation when they could be stopping other drivers and earning more revenue.

But if you are caught, it could mean bad news. Most states will probably insist on back taxes, which would wipe out your entire savings and hit you with a massive bill. And it’s not totally inconceivable to prosecute offenders for tax evasion. Imagine going to your garage to start up your Veyron one morning only to be greeted by Chris Hansen. Why don’t you have a seat right over there for me? Do you really live in Montana? What were you thinking, Jim?

Back to license plates

Despite the potential pitfalls, there’s one major benefit to Montana registration – at least for those of us with a mild license plate obsession. Apparently eager to make up for lost sales tax revenue, Montana issues full-color special license plates for every cause imaginable, resulting in some of the most unusual, odd and downright bizarre license plates on the road. Some examples:

Montana Quilters

Yes, there’s a license plate for Montanans who enjoy quilting. And while you don’t have to get a pro-quilting vanity plate like our example, what kind of quilter would you be if you didn’t? Unfortunately, Google Images shows that “LVQLTN” and “QLTLVR” are already taken. Surely, everything else is still available.

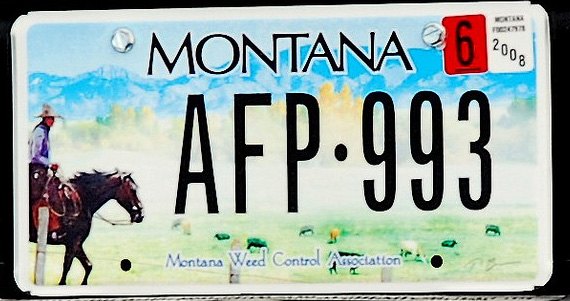

Weed Control

This isn’t what you think. No, it’s not a group of Montanans desperately trying to keep pot out of the hands of youth. That’s the “Pro Choice, Pro Family” tag. Instead, this is a license plate that’s actually dedicated to controlling weeds. For some reason, it depicts a cowboy on a horse. Perhaps he’s spreading herbicide.

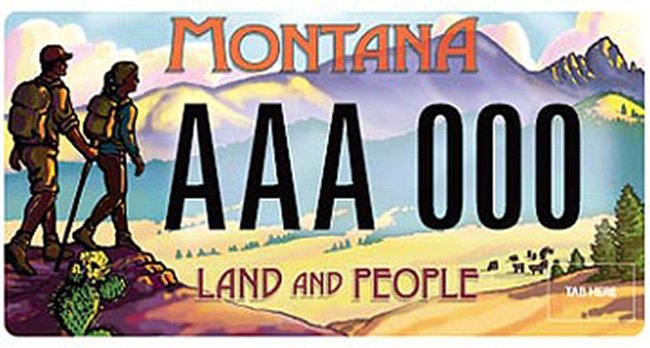

Land and People

The Montana “Land and People” license plate has no apparent purpose, other than to display a multi-colored image showing that Montana does indeed possess both a) land, and b) people. There’s also a small heard of what may be bison on the “Land” portion, though they figure more prominently another Montana plate that says simply “Let Buffalo Roam.” And what better way to facilitate that than to drive your car on paved highways through the state?

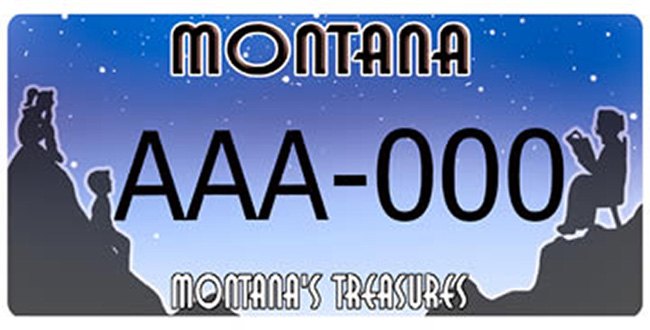

Montana’s Treasures

My personal favorite Montana license plate is the “Montana’s Treasures” tag, which is sponsored by something called the “Montana Area Agencies on Aging Association,” or MAaaaaaaaaa. So what are “Montana’s treasures?” Old people. As depicted by an elderly woman sitting in a rocking chair reading to two children, all of whom appear to be seated rather precariously on a cliff.

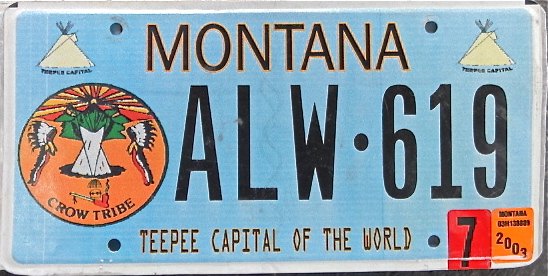

Teepee Capital of the World

Apparently, Montana bills itself as the “Teepee Capital of the World” – a point they drive home with a license plate commemorating the achievement. While you might think this is a bit racist, especially if you’re the kind of person who turns in his neighbors for having Montana plates, you should know an Indian tribe actually created it. Nonetheless, don’t expect to see “Peace Pipe Capital of the World” anytime soon.

Call Before You Dig

This one urges people to call before the dig on their property, which apparently has similar importance to other Montana causes like breast cancer and quilting. Since there is no easy way to display an image of “call before you dig” on a license plate, Montana decided to just give up entirely and depict a chipmunk wearing a hardhat and carrying a shovel. In addition to his devious smile, the chipmunk is holding a piece of paper which, upon closer inspection, says “PLANS.” I think Chris Hansen needs to pay this guy a visit when he’s done with the Veyron owner.

Doug DeMuro operates PlaysWithCars.com. He’s owned an E63 AMG wagon, roadtripped across the US in a Lotus without air conditioning, and posted a six-minute laptime on the Circuit de Monaco in a rented Ford Fiesta. One year after becoming Porsche Cars North America’s youngest manager, he quit to become a writer. His parents are very disappointed.

More by Doug DeMuro

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Redapple2 I gave up on Honda. My 09 Accord Vs my 03. The 09s- V 6 had a slight shudder when deactivating cylinders. And the 09 did not have the 03 's electro luminescent gages. And the 09 had the most uncomfortable seats. My brother bought his 3rd and last Honda CRV. Brutal seats after 25 minutes. NOW, We are forever Toyota, Lexus, Subaru people now despite HAVING ACCESS TO gm EMPLOYEE DISCOUNT. Despite having access to the gm employee discount. Man, that is a massive statement. Wow that s bad - Under no circumstances will I have that govna crap.

- Redapple2 Front tag obscured. Rear tag - clear and sharp. Huh?

- Redapple2 I can state what NOT to buy. HK. High theft. Insurance. Unrefined NVH. Rapidly degrading interiors. HK? No way !

- Luke42 Serious answer:Now that I DD an EV, buying an EV to replace my wife’s Honda Civic is in the queue. My wife likes her Honda, she likes Apple CarPlay, and she can’t stand Elon Musk - so Tesla starts the competition with two demerit-points and Honda starts the competition with one merit-point.The Honda Prologue looked like a great candidate until Honda announced that the partnership with GM was a one-off thing and that their future EVs would be designed in-house.Now I’m more inclined toward the Blazer EV, the vehicle on which the Prologue is based. The Blazer EV and the Ultium platform won’t be orphaned by GM any time soon. But then I have to convince my wife she would like it better than her Honda Civic, and that’s a heavy lift because she doesn’t have any reason to be dissatisfied with her current car (I take care of all of the ICE-hassles for her).Since my wife’s Honda Civic is holding up well, since she likes the car, and since I take care of most of the drawbacks of drawbacks of ICE ownership for her, there’s no urgency to replace this vehicle.Honestly, if a paid-off Honda Civic is my wife’s automotive hill to die on, that’s a pretty good place to be - even though I personally have to continue dealing the hassles and expenses of ICE ownership on her behalf.My plan is simply to wait-and-see what Honda does next. Maybe they’ll introduce the perfect EV for her one day, and I’ll just go buy it.

- 2ACL I have a soft spot for high-performance, shark-nosed Lancers (I considered the less-potent Ralliart during the period in which I eventually selected my first TL SH-AWD), but it's can be challenging to find a specimen that doesn't exhibit signs of abuse, and while most of the components are sufficiently universal in their function to service without manufacturer support, the SST isn't one of them. The shops that specialize in it are familiar with the failure as described by the seller and thus might be able to fix this one at a substantial savings to replacement. There's only a handful of them in the nation, however. A salvaged unit is another option, but the usual risks are magnified by similar logistical challenges to trying to save the original.I hope this is a case of the seller overvaluing the Evo market rather than still owing or having put the mods on credit. Because the best offer won't be anywhere near the current listing.

Comments

Join the conversation

I'm a couple of years late to this party. However, I would like to point out a couple of facts: This isn't a matter of people arbitrarily just registering their cars out of state. These people OWN a corporation in one these states. The corporation owns the vehicle. Therefore, the individual does NOT own the car. And there's not a dam& thing that California or any other state can do about it. If the driver gets pulled over, all he has to say is, "this is a company car." He does NOT have to reveal that he is the CEO or whatever of the corporation. As a matter of fact, in Delaware, your corporation doesn't list the name of the owner of the entity. Only the registered agent. So this is much ado about nothing.

Taxes just kills you. Custom plates are just worthy to put on these exotic cars. But for now I would have to stick my ever loving porche carrera. It has been my project car for a while turning it to a little exotic look, changing hubcaps ( originalwheel.com ) color paint as well.