Nissan Largest Japanese Carmaker. In Profits

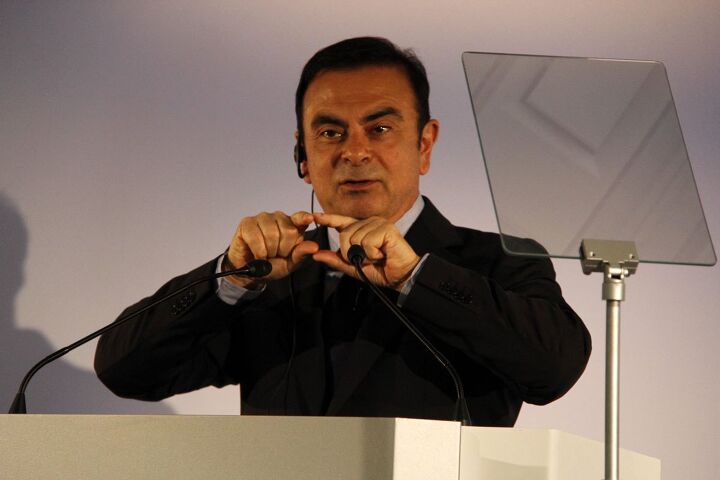

Nissan pulled off an even bigger miracle than Toyota and ended a (this time truly) catastrophic year with a big profit. Today in Yokohama, Nissan CEO Carlos Ghosn announced that Nissan delivered a pre-tax profit of 535.1 billion yen (US $6.76 billion) for the fiscal year that ended on March 31, “despite natural disasters and currency exchange headwinds.”

Japan’s second largest car company produced the largest profit, exceeding that of Toyota, which had announced a 432.9 billion yen ($5.4 billion) profit before taxes on Wednesday. At the end of last year it was already evident that Nissan had survived that truly catastrophic year best. Today, that fact was confirmed by a beauty of a balance sheet.

When asked what risks are in front of Nissan, Ghosn answered: “The biggest risk is the strength of the yen.” Ghosn is the designated hitter of the Japanese auto industry when it comes to the Yen. He can say what Japanese colleagues would love, but don’t dare to say.

At each quarterly results conference, a reporter of the Nikkei needles Toyota with the question when the company would finally produce a profit at its factories in Japan, instead of offsetting homemade losses with foreign gains. Toyota usually gives a polite non-answer.

Ghosn doesn’t even wait for that question. Unasked and blunt, he says:

“We have healthy profits this year, but all the profits come from international operations. When you take a look to the non-consolidated results in Japan, they are negative. The reason they are negative is because of the strength of the yen. We are protecting ourselves by using as much international capacity as possible and by holding the exports from Japan to the minimum level.”

Just about every car that is exported from Japan is exported at a loss. Instead of paying taxes on income at home, Japanese carmakers pay the price for the abnormally strong yen, Nevertheless, Nissan expects for the new fiscal a pre-tax profit for 680 billion yen ($8.5 billion) on sales of 5.5 million units for Nissan only.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Teddyc73 Oh good lord here we go again criticizing Cadillac for alphanumeric names. It's the same old tired ridiculous argument, and it makes absolutely no sense. Explain to me why alphanumeric names are fine for every other luxury brand....except Cadillac. What young well-off buyer is walking around thinking "Wow, Cadillac is a luxury brand but I thought they had interesting names?" No one. Cadillac's designations don't make sense? And other brands do? Come on.

- Flashindapan Emergency mid year refresh of all Cadillac models by graphing on plastic fenders and making them larger than anything from Stellantis or Ford.

- Bd2 Eh, the Dollar has held up well against most other currencies and the IRA is actually investing in critical industries, unlike the $6 Trillion in pandemic relief/stimulus which was just a cash giveaway (also rife with fraud).What Matt doesn't mention is that the price of fuel (particularly diesel) is higher relative to the price of oil due to US oil producers exporting records amount of oil and refiners exporting records amount of fuel. US refiners switched more and more production to diesel fuel, which lowers the supply of gas here (inflating prices). But shouldn't that mean low prices for diesel?Nope, as refiners are just exporting the diesel overseas, including to Mexico.

- Jor65756038 As owner of an Opel Ampera/Chevrolet Volt and a 1979 Chevy Malibu, I will certainly not buy trash like the Bolt or any SUV or crossover. If GM doesn´t offer a sedan, then I will buy german, sweedish, italian, asian, Tesla or whoever offers me a sedan. Not everybody like SUV´s or crossovers or is willing to buy one no matter what.

- Bd2 While Hyundai has enough models that offer a hybrid variant, problem has been inadequate supply, so this should help address that.In particular, US production of PHEVs will make them eligible for the tax credit.

Comments

Join the conversation

it would be interesting to know how much the insurance claims helped.

Bertel is pretty good at capturing Carlos's expression. I bet your arm must be sored from holding telephoto len.