Editorial: Does Detroit Have The Will To Succeed?

Detroit’s financial predicament today rests squarely on the shoulders of its executive leadership going back nearly four decades. The American auto industry failed mostly in its will to succeed in a changing business environment marked by the entrance of new competition, adoption of new technologies, and demands for greater fuel efficiency. Had Detroit taken those actions necessary to be leaders, rather than laggards, its overall situation of falling market share, reputation for poor quality (in comparison to certain foreign competitors like Toyota and Honda mostly), and weakening financials might have been avoided.

The automotive industry undergoes significant changes as measured over any ten year period. Each decade since the beginning of the automotive era starting in 1900 has witnessed rapid and unpredictable volatility due to market forces, economics, new technology, and more recently, vehicle production economics and global competition. This has tested the ability of each auto company to adapt to these elements of change. The equity markets place a premium on those auto companies that have organizational, product and production flexibility to best respond. No forecaster can accurately predict the most basic aspects of the industry from the actual sales volume of the next decade to the model mix and market share distribution or profitability from any individual automobile manufacturer. Over the last 100 years, auto companies succeeded or failed on the appeal of their vehicles, their corporate resources and the talent of their managements, which reduced the field of U.S. assemblers to only four (GM, Ford, Chrysler, and AMC) some forty years ago from a much larger field of competitors.

But in the forty years since then, profound and rapid changes in the US domestic auto market have occurred unlike in the past. Two factors stand out: oscillation in energy prices and the growth of foreign brands. And in response to both, Detroit failed. It could not repel the Japanese invasion as a result of the first and second oil crisis in the 1970s with its lack of will to build competitive small, fuel efficient vehicles. Then, as imports grew in scale and scope of product offerings, Detroit looked elsewhere for profit opportunities without fixing its core North American auto business.

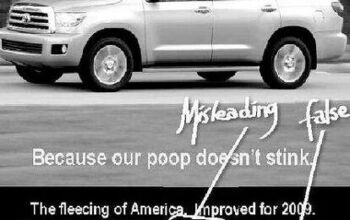

At the same time, Detroit often blamed a host of factors beyond its control for its shortfalls. To wit, currency manipulation, rising health care costs, unfair trade, and labor intransigency would be cited. But the sad fact remains that Detroit is still losing market share as consumers gravitate to the import brands. Strangely, it is not a matter of pricing – Detroit vehicles, especially in passenger cars and CUVs, are less expensive to acquire than those from mainstream competitors. The Wall Street Journal recently ran a story documenting the price differential between the Honda Civic and comparable offerings from Detroit.

Now with GM’s and Chrysler’s admissions of impending failure, a firestorm of debate has erupted as to whether Detroit is deserving of government assistance. That is not the question. In fact, there should be no debate as to whether the United States, as a modern economy, should have its own domestic automotive industry. Without it, we sacrifice our ability to determine our own solutions to future transportation needs. In fact, the current crisis offers a historic opportunity to complete recast the direction of this industry to prepare it for the future. It now remains a question of how many US automakers will make it to the next decade and who should lead them.

I submit that the US should have two remaining auto companies: General Motors and Ford. Chrysler is not viable as an auto company as it lacks future product development capabilities having its engineering capabilities mostly gutted by Daimler and Cerberus.

General Motors does have prodigious engineering talents worldwide which it can leverage. What’s been missing has been executive will to apply this talent to its North American business in recent decades. Only recently have we seen a slow rejuvenation of some products, but the overall portfolio of vehicles remains too broad and non-descript. “Too little, too late” might be the most apt description. In addition, the company has never addressed its multiplicity of overlapping brands, vehicles, and dealers. All of its efforts so far have mostly been to reduce installed production capacity.

With any government assistance to GM, one key requirement should be for wholesale reform of its Board of Directors and top executive management team. They should all be jettisoned for their failure to address known and obvious problems. This is not an ad hominem attack; rather the results of the business in North America over the last forty years mostly prove the point. What’s needed are new executives willing and enabled to make those hard decisions, not beholden to the past practices and culture within this giant corporation. Giving money to executives schooled in the past is no recipe for future success.

Ford Motor Company was, until 2006 and the arrival of Alan Mulally as CEO, in exactly the same situation as GM today. But as an outsider, Mr. Mulally took a fresh look at the company and its operations. By the time of his arrival, Ford had implemented the first of its “Way Forward” plan – which was to reduce installed capacity. But this would prove to be ineffective. Instead, Mr. Mulally outlined his “One Ford” plan – which jettisoned extraneous brands (Jaguar/Land Rover already and Volvo soon) while integrating vehicle platforms between Europe and America. Moreover, with new executive talent recruited from other auto companies/distributors, Mr. Mulally has reoriented his management team with fresh thinking.

Ford, unlike GM, does not face immediate prospects of demise (barring a bankruptcy of General Motors). It has outlined for the industry a view of its future, its new products, and the expectation that by 2013, there will be 100% commonality of its European and American platforms. I credit Bill Ford Jr. with understanding his company’s need to place a skilled executive at the helm, with the full backing of the Board to make the painful but requisite actions. So in Ford, we have seen an example of how a change in top leadership can make a difference – though profitable results may be years off and interim government financing may be necessary.

So for the American auto industry to survive and prosper, we need Congress to understand that importance of a domestic auto industry. Second, Congress should recognize that it too must make some hard decisions with taxpayer money. This would be to allow Chrysler to fail and be sold in pieces to others. It must also recognize that labor cannot be protected to any more degree than other creditors. Jobs will still be lost; VEBA’s underfunded for the time being. Third, Congress needs to craft a funding program tailored to the needs of the remaining two automakers. In the case of GM, even without a bankruptcy, a complete recapitalization and restructuring of the company must occur. This will require new leadership at the Board and executive management levels with the will to succeed. And Ford just needs time and a little bit of money.

More by Ken Elias

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Zipper69 "At least Lincoln finally learned to do a better job of not appearing to have raided the Ford parts bin"But they differentiate by being bland and unadventurous and lacking a clear brand image.

- Zipper69 "The worry is that vehicles could collect and share Americans' data with the Chinese government"Presumably, via your cellphone connection? Does the average Joe in the gig economy really have "data" that will change the balance of power?

- Zipper69 Honda seem to have a comprehensive range of sedans that sell well.

- Oberkanone How long do I have to stay in this job before I get a golden parachute?I'd lower the price of the V-Series models. Improve the quality of interiors across the entire line. I'd add a sedan larger then CT5. I'd require a financial review of Celestiq. If it's not a profit center it's gone. Styling updates in the vision of the XLR to existing models. 2+2 sports coupe woutd be added. Performance in the class of AMG GT and Porsche 911 at a price just under $100k. EV models would NOT be subsidized by ICE revenue.

- NJRide Let Cadillac be Cadillac, but in the context of 2024. As a new XT5 owner (the Emerald Green got me to buy an old design) I would have happy preferred a Lyriq hybrid. Some who really like the Lyriq's package but don't want an EV will buy another model. Most will go elsewhere. I love the V6 and good but easy to use infotainment. But I know my next car will probably be more electrified w more tech.I don't think anyone is confusing my car for a Blazer but i agree the XT6 is too derivative. Frankly the Enclave looks more prestigious. The Escalade still has got it, though I would love to see the ESV make a comeback. I still think GM missed the boat by not making a Colorado based mini-Blazer and Escalade. I don't get the 2 sedans. I feel a slightly larger and more distinctly Cadillac sedan would sell better. They also need to advertise beyond the Lyriq. I don't feel other luxury players are exactly hitting it out of the park right now so a strengthened Cadillac could regain share.

Comments

Join the conversation

Ronnie Schreiber- Very few ordinary people buy new, full priced, Detroit-branded cars in the United States, especially in big cities outside the rust belt. Now, Detroit sells a fair number of cars, and plenty of ordinary people buy Detroit-branded vehicles (that is, including pickups and SUVs). But a very large amount of Detroit's car sales are to one of the following groups: 1. Government entities. 2. Rental car agencies. 3. People with employee discounts (because they work for, or used to work for and are now retired, or are related to somebody who works for, or used to work for, a Detroit manufacturer or parts supplier). 4. People who get discounts similar to #3 in one of Detroit's periodic nobody-buys-our-cars sales. Keep in mind that the number one company in car sales in the United States is not GM or Ford; it's Toyota. Toyota sells more cars in the US than GM does. Now, GM does sell more light vehicles than Toyota does, because they sell so many pickups and SUVs. But they sell very few cars, comparatively, especially if you consider that a large amount of their sales go to people or groups in the four categories above, and very few of Toyota's sales go to those groups (for example, I believe that the current promotion Toyota has is the first time they ever offered 0% finacing, while Detroit has done so countless times).

@John Horner: "The total cost of ownership for a new Detroit branded car is well in excess of that for a Toyota or Honda." I can accept that this may be your personal experience, but what is the evidence that this is true across the board? I had a '75 Dodge pickup that was poorly put together, but it went 100k and 15 years before I let it die. Then a '90 Dodge pickup that went 190k and 13 years, and was still in great running order when I sold it. Then an '07 GM van that went 90k and 5 years before a deer killed it. I put VERY little money in these in total. OK, this is one person's experience and proves nothing, but I remember checking at some point in the past on the Edmunds site about cost of ownership of domestic vs. Japanese products and finding to my surprise that the Japanese stuff cost more to run. I know that locally, the per hour rate at the local GM shops is $44 vs. I think about $80 at the Toyota shop. In my experience, a domestic just needs an oil change at specified intervals, now 7k+ for GM, and you're good to keep going, whereas the transplant service people seem to want owners to often do this and do that which adds a lot to the cost to operate their stuff. Aside from CR's suspect and very imprecise output, do you know of any data that support your point?