Surprise! August Sales Sucked!

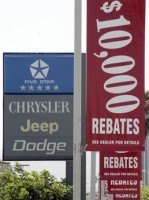

The Detroit Free Press reports that early August sales estimates show a 14.4 percent drop in new metal moved. But don't turn off your pacemaker yet; the biggest shocker is that Detroit is bearing the overwhelming brunt of the downturn. Estimates from Edmunds show that Chrysler sales dropped 34 percent, GM slid by 27.5 percent and Ford endured a 16.3 percent drop compared to August a year ago. Toyota continues to shed sales but grow market share, slipping by half the industry average at 7.2 percent. The winners in August were Honda, which posted a 0.9 percent increase, and Nissan which defied the market to bump sales by 2.3 percent. On the whole, the market appears to be picking up slightly, with a 13.1m seasonally adjusted annual sales rate (SAAR) up from 12.6m in July. With consumer confidence rising in August, the overall economy appears to be taking its Prozac, but don't expect an auto sales turnaround this year. GM's sharp losses show that even with once-popular "employee pricing" incentives, consumer demand for cars isn't what it once was.

More by Edward Niedermeyer

Comments

Join the conversation

I'm not sure GM sales tanked in August. I've been shopping for an HHR. Most dealers only have a few on the lot. And no dealer I spoke to would budge one dollar from the Employee Price. Same for Cobalt and Malibu. They come in, they get sold. The salesman told me GM trucks are starting to move again. But what happens when Employee Pricing ends?

Limmin, the GM employee price takes the dealer markup to "0". They are left only with the 3% hold back. If you are buying say a $15,000 econobox, the dealer gets $450.00 for the salesman, operations, floor plan interest and you name it. No, I guess that will be the bottom number. The real benefit to the dealer is it unloads his bloated lot until the 2009's come and fill it up again.

@ Jerry - There are still factory to dealer or customer cash incentives that are additive to further reduce the transaction price below the "Employee Program." For example - a few months ago before this program was in place, you could have received massive incentives on a Tahoe. These incentives effectively put the transaction amount of the Tahoe many thousands below dealer invoice. So The dealer could sell the car way below invoice, but still pocket some $$$ if they did not pass the full amount of the incentive to the customer. And, they still keep the 3% holdback at the original invoice amount. I would imagine incentives are different today, but they did not go to zero. Messing around with interest rates and lease rates (well, only with certain automakers) is another way to further juice the transaction, and the gravy-interest-rates often change quite substantially when these nationwide gimmick events get launched. Anyway - anyone who straight up pays the dealer invoice in the new campaign gets hosed. @ MattVA - I'm not completely sure how Edmunds does their estimates... but I think one key component of their forecast error was an inability to estimate fleet sales. No automaker has to report a split out of their fleet registrations separate from retail sales. And systems that guesstimate sales as the month is still in progress do not have the ability to accurate include fleet. So no one can prognosticate industry-wide numbers if automakers change fleet mix (that is, reduces the fleet percentage as a part of their total sales). Many Domestics are taking this number down while companies like Nissan are taking theirs up.

"GM's sharp losses show that even with once-popular 'employee pricing' incentives, consumer demand for cars isn't what it once was." Maybe that's because "employee pricing" isn't all that great. GM's own price quotations show the $21,399 "employee price" on a base LaCrosse is 14% under sticker. A base Lucerne goes for 14.6% off MSRP. Those are slow-selling models that really needed help, but they're still too costly to pull in more buyers. Sadly for Buick, which likes to says it's a "premium American motorcar," few people will pay more for a LaCrosse than the cost of an Accord or Camry. In hindsight, it seems the LaCrosse should have been the new Century--and priced a couple grand less. You say it wouldn't have made a profit at that price? Well, is it now?