#france

Scrapyard Find: 2010 Citroën C4 Picasso VTR+

While SUVs and crossovers have become increasingly popular in Western Europe in recent years, compact MPVs have done very well there during the past quarter-century. One model that proved to be a solid showroom hit was the Citroën C4 Picasso, and I documented one of these machines during my recent trip to the scrapyards of Northern England.

Junkyard Find: 1959 Renault Dauphine

French cars have been junkyard rarities in North America for decades now, which is an ongoing disappointment for those of us who enjoy poring over machinery that ranges from fascinating to baffling in our local Ewe Pullets. I discovered a Mexican-market '06 Peugeot 407 in a Denver boneyard, earlier this year, and thought years would pass before the next time I'd hear the ghosts of André Citroën, Louis Renault, and Armand Peugeot singing La Marseillaise over a car graveyard.

Citroën Introduces Oli Concept: A Miniature EV for Our Dystopian Future

Following Citroën’s preview of its new logo, there was a healthy buzz around the foreshadowed concept model that would first wear the badge. As French automakers are known for going against the grain, occasionally resulting in some brilliant innovation, there was a level of genuine excitement that the brand would deliver something truly novel during a period where the industry seemed to be running out of ideas.

The resulting vehicle turned out to be extremely innovative. However, it wasn’t quite the morale booster some of us had anticipated, because the concept isn’t designed for today’s world. Instead, Citroën delivered a vehicle that’s designed for a future existence where resources are unavailable and people have to make do with less of everything. Though that doesn’t mean some of the concepts included in the design aren’t absolutely brilliant.

Rare Rides: The Wallyscar Brand, From Tunisia With Pride

Today’s topic is an automaker you’ve likely never heard of. It’s a small company that was founded not that long ago, offers vehicles in very limited markets, and produces around 600 vehicles per year. Its product is based upon old ideas from other manufacturers, all done up in fiberglass until very recently. Let’s enter the wonderful world of Wallyscar.

French Government Claims Stellantis CEO's Pay Is Suspect

France has grown suspicious of Stellantis CEO Carlos Tavares’ compensation, which the government has dubbed irregular and indicative of a need for further financial regulations in Europe. The issue doesn’t appear to have much to do with where the money is coming from, but rather the size of his current payment package.

Tavares oversaw the merger between PSA Group and Fiat Chrysler Automobiles in 2021 while he was still CEO of the former company. Having previously climbed the ranks at Renault, the executive has served as chairman of PSA’s management board since 2014. Now heading Stellantis, Tavares is positioned to receive roughly $20.5 million in compensation for 2021. In addition to that, he’s reportedly eligible for a stock package worth an extra $34.7 million and long-term compensation of about $27.2 million — which the French government believes is too much.

Rare Rides Icons: The Abandoned Bugatti EB 112, a Super Sedan

Power, luxury, exclusivity, and grand touring driving enjoyment. The Bugatti EB112 promised all those adjectives in spades were it ever actually produced. But it was born at a very difficult time in the company’s history, and the super sedan never made it beyond the concept stage.

However, due to some interesting timing at the company level, the EB112 was not just a one-off concept. In fact, there are three in existence.

Rare Rides: The 1978 Sbarro Windhound, a Luxury SUV of 6.9 Litres

Today’s Rare Ride is the third car in the series from designer Franco Sbarro. Our premier Sbarro creation was a windsurfing-specific take on the Citroën Berlingo, and the second was a very hot hatchback called the Super Eight – a Ferrari underneath.

While both of those creations were one-off styling exercises, today’s Sbarro actually entered very limited production. Presenting the Windhound of 1978.

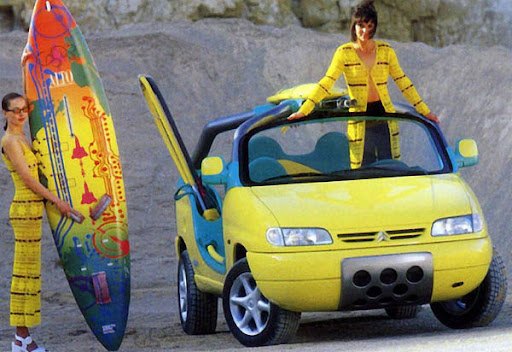

Rare Rides: Rad Van Time With the 1998 Citron Berlingo Calao, by Sbarro

Today’s Rare Ride started off as a standard and rather uninteresting Citroën Berlingo van, and was then thoroughly edited by Sbarro into a windsurfing-oriented beach vehicle.

It’s a lot to process, visually speaking.

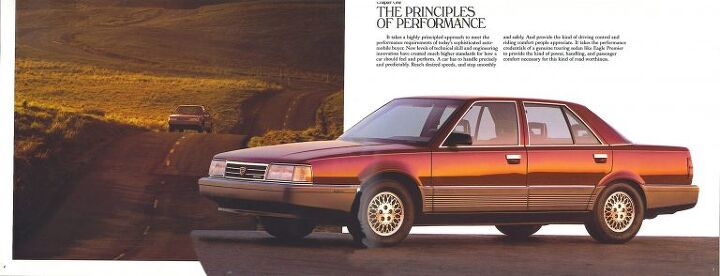

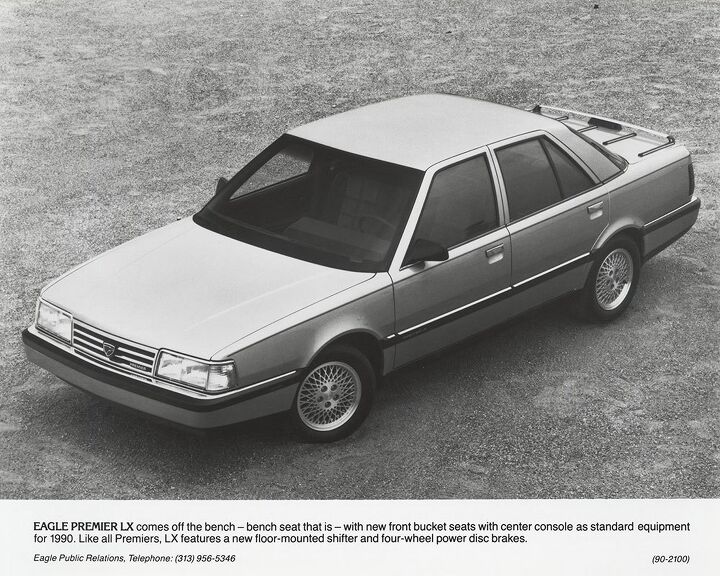

Rare Rides: The Eagle Premier Story, Part VI (The End)

Today we wrap up our Rare Rides series on the orphan Eagle Premier (other five parts here), and discuss the boxy sedan’s important legacy at Chrysler.

Rare Rides: The Eagle Premier Story, Part V

The fifth entry in our Rare Rides series on the Eagle Premier brings us to 1988. The Premier was newly on sale after a delayed introduction, and the company building it was not the same company that spent years designing it.

Chrysler was in charge of the Premier’s fate.

Rare Rides: The Eagle Premier Story, Part IV

Today is the fourth installment in our Eagle Premier series. Parts I, II, and III brought us through late 1987 when the Premier finally entered production, albeit well behind schedule.

The Renault group’s high profile chairman had been assassinated in fall 1986 by French extremists, and the company’s new chair, Raymond Lévy, was experiencing pressure from all sides.

Rare Rides: The Eagle Premier Story, Part III

We continue our coverage today of the Eagle Premier from over 30 years ago. Parts I and II detailed the inception of the AMC-Renault joint project, and the technical aspects of what was a pretty advanced (or quirky) family sedan.

The time had come to put this all-new AMC offering on sale, but Premier arrived alongside some very unfortunate historical circumstances.

Rare Rides: The Eagle Premier Story, Part II

Part I of The Eagle Premier Story covered the inception of the collaborative AMC-Renault X-58 project in 1982, and its front-drive full-size flagship goal. It was to be an all-new car to lead AMC’s North American offerings. In today’s installment, we’ll take a look at the stylish sedan’s technical details more closely.

Rare Rides: The Eagle Premier Story, Part I

Today’s Rare Ride combined Italian design and French running gear in a full-size sedan marketed under an all-new brand: Eagle.

It’s time for the Eagle Premier story.

Europe Proposes Banning Internal Combustion Cars By 2035

Last week, the European Union proposed banning the sale of all new internal combustion vehicles starting in 2035. With several member nations proposing restrictions in the coming years, EU leadership feels it can accelerate the timeline to force electric vehicles as the de facto mode of transportation. The European Commission has suggested making it illegal to sell gas or diesel-powered vehicles in 14 years, with aims to reduce CO2 emissions produced by automobiles by 55 percent (vs 2021 levels) by 2030.

But countries that still produce vehicles have expressed reservations about the scheduling. France absolutely agrees with mandating restrictions that would reduce greenhouse emissions. Though President Emmanuel Macron’s office has been pressing that hybrid vehicles would be able to do much of the heavy lifting and fears that an outright ban of internal combustion could hamstring the industry if conducted too early. Germany, which manufacturers more vehicles than other EU member nations, is of a similar mind.

Recent Comments