#WTI

Your Opinion Is Now Worth More Than a Barrel of Oil

While OPEC member states and other oil-producing counties have signed a pact to stem the flow of crude by 10 million barrels a day and hopefully rein in the current price-crashing glut, the situation remains bleak for oil producers around the world. On Monday, May futures for West Texas Intermediate (WTI) dropped to the floor, with prices hitting $5 per barrel.

That number shifted into the negative* as the above paragraph was being written. We’re guessing that’s because the end of the May contract forces physical receipts at a time when storage capacities are basically nonexistent. June WTI prices are still riding just below $23 per barrel.

Meanwhile, Brent Crude is hovering around $26 bbl as the OPEC Basket hangs onto $17.73 bbl on a 4-day delay. The assumption is that both will come down, though perhaps not as dramatically as WTI did.

Global Oil Producers to Hold Emergency Meetings This Week

The world’s largest oil producers are meeting this week for negotiations aimed at saving the energy sector a lot of hardship further down the road. That includes the Organization of the Petroleum Exporting Countries (OPEC), which has been at odds with itself more than usual of late. Hampered by dwindling demand, member countries are suffering and aren’t sure what’s to be done about last month’s price plunge and surplus of crude.

During the cartel’s last meeting, Russia declined to collaborate with OPEC’s planned production cuts. This sent Saudi Arabia into a furious tizzy; it quickly attempted to flood the market with bargain oil in an attempt to drive out lesser players. Like everything else, this was further complicated by the global pandemic. The coronavirus has suppressed oil use to a point where suppliers are growing concerned about storage capacity running out.

Ur-Turn: The Truth About Oil

TTAC reader ( and Pontiac G8/Holden conversion owne r) David Obelcz gives us his thoughts on the current situation in the world of crude oil – and how that will affect car enthusiasts.

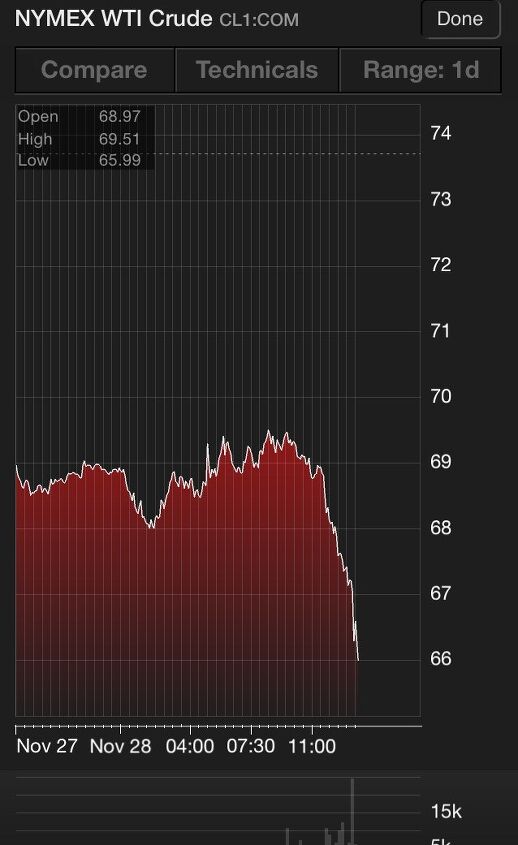

Over the Thanksgiving holiday in the United States, Saudi Arabia blocked a proposed production cut by OPEC, sending oil prices plummeting around the world. As I write this the price of oil and gasoline futures are in collapse. West Texas Intermediate (WTI) futures are down over 10% to $66.15 a barrel on the near-month (January 2015) contract, Brent is at $70.15, and gasoline futures are down to $1.90.

Recent Comments