Ur-Turn: The Truth About Oil

TTAC reader ( and Pontiac G8/Holden conversion owne r) David Obelcz gives us his thoughts on the current situation in the world of crude oil – and how that will affect car enthusiasts.

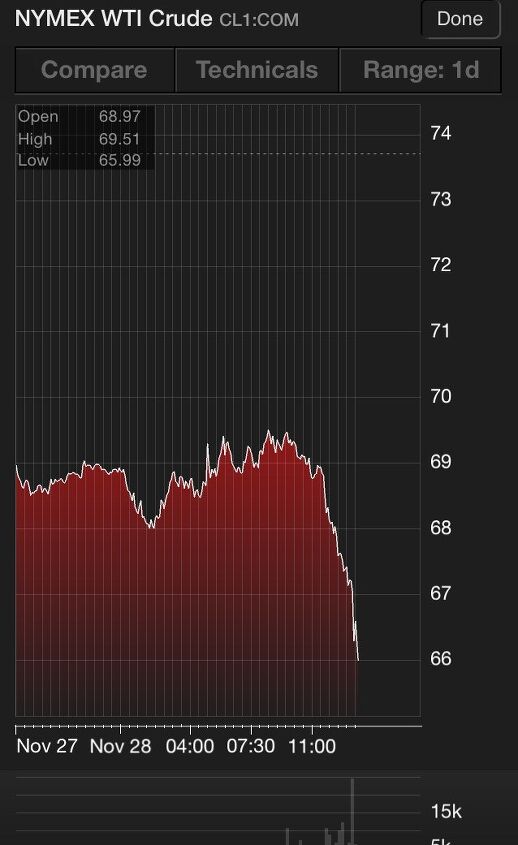

Over the Thanksgiving holiday in the United States, Saudi Arabia blocked a proposed production cut by OPEC, sending oil prices plummeting around the world. As I write this the price of oil and gasoline futures are in collapse. West Texas Intermediate (WTI) futures are down over 10% to $66.15 a barrel on the near-month (January 2015) contract, Brent is at $70.15, and gasoline futures are down to $1.90.

To put this in some perspective, on January 3, 1986 a barrel of WTI was $26.00 – that would be $56.33 a barrel today, adjusting for inflation (remember this number, it will be important later). This was at the start of the 1986 oil crash, where the price for WTI would bottom out at $10.83 on July 23, 1986. Today as the Great Recession fades behind us, you can drive through the fringes of Phoenix, Las Vegas, or along the Treasure Coast of Florida and find grass growing through the cracks of subdivision roads for homes never built. In 1996 you could do the same in Houston, with blighted neighborhoods spotted with abandoned homes falling into ruin. The Gulf Coast economies were devastated, and it took Houston and the surrounding area more than a decade to recover financially. When prices crashed again in 1998, the Gulf Coast had a much more diversified economic base, so the blow wasn’t as hard.

As United States oil production skyrocketed post World War II, along with consumption, the easily tapped reserves coupled with swelling imports from the Middle East fueled the greatest economy in the world. In that era the big threat was all things Communism and nuclear annihilation. If we kept the Middle East countries rolling in cash for their oil, the United States could keep Soviet influence to a minimum. We drove GTOs, General Motors feared being declared a monopoly, men walked on the moon, and we watched the Indy 500 on our color TVs.

United States oil production peaked in 1970. Three years later in response to the Yom Kippur War, OPEC, along with Egypt, Syria, and Tunisia, declared an oil embargo that lasted from October of 1973 to March of 1974. The embargo caused the price of oil to quadruple, collapsed the United States stock market, plunged the country into its third worst recession in history, and planted the seeds that grew into today’s modern post-Soviet oil industry. In addition we got malaise era cars, an under 200 HP Corvette, the rise of the Japanese automakers, the 1979 Chrysler bailout, and Ford almost going bankrupt.

The 1979 energy crisis had an even bigger impact on today’s energy landscape. Although global oil production dropped just four-percent with the collapse of Mohammad Reza Pahlavi’s Iranian government, wide spread panic happened. In addition, President Jimmy Carter started the deregulation of oil prices in April of 1979. A year later the price of oil had almost tripled to $39.50 a barrel – that would be $114 today. History shows that the 1979 energy crisis was more manufactured, than the result of a true crisis in supply. With the damage done, there was another major recession.

The price of oil then started a near 20 year decline with peaks and valleys, including the 1986 oil shock valley, several peaks during the Iran/Iraq war when tankers were treated as military targets, followed by another oil price crash in 1998, then another price spike during the first Gulf War, and the latest price spike that happened before the Great Recession.

But something changed in 2005, United States total energy consumption peaked. A weak US dollar created a new normal in the price of a barrel of oil, and over the next decade Americans got use to the price at the pump.

In the 2007 State of the Union Address, President George W. Bush made what is called the “Twenty in Ten Challenge,” to reduce United States gasoline consumption 20% in 10 years. The same year the Energy Independence and Security Act was passed. Five years later US energy use had plummeted from 25% of global consumption, to 20%.

Just seven years after George W. Bush issued the challenge in his State of the Union address, total US energy consumption has dropped 20%, US oil consumption has dropped 14%. Even with expanding job growth, growing GDP, and growing exports – it wasn’t all about the Great Recession. The gasoline consumption picture isn’t quite as rosy, but it is down 6% from 2007 to 2013.

These improvements in the United States are largely due to dramatically improving fleet fuel economy in light vehicles, heavy trucking, and aircraft. Secondarily, energy consumption is down due to big improvements in appliance efficiency. Air conditioning remains the number one consumption device for electricity in American homes – cable TV set top boxes are now number two.

The point of this long background is that in 2015 the rules of how the price of a barrel of oil impacts the United States economy has changed. In 2014 total OPEC imports are projected to be at 1985 levels, and less than 40% of total US imports. In October of 2013, the United States reached a major tipping point, producing more oil than it imports. Refined petroleum products has been the largest US net export in terms of dollars, since 2011. When I consulted for Conoco in the 90s there was a lot of talk about shale oil reserves, but how it was not cost effective to tap them. Fracking has changed that, and the United States is currently in an unprecedented oil boom. In North Dakota if you have a pulse, you can work 80 to 100 hours a week, make $17 an hour at Walmart, and yet, there still remains a serious labor shortage.

China is now the largest car economy in the world, and we are seeing the impact from this in the United States. From tax friendly (in China) engines under 1.5 liters in American cars and CUVs, to interior and exterior design and features made for Chinese consumers carried over into other markets. Our declining dependency on foreign oil, and our concurrent shrinking consumption is a blessing, and a curse.

At $70 a barrel, fracking operations profitability start to become problematic. We know from over 70 years of history, that if pricing reaches a point where a certain production source becomes too costly, these sources are turned off, supply tightens, price increases, profitable sources are turned back on. We’ve seen this cycle of boom and bust multiple times since 1972. For a lot of complex reasons, the price of oil does not follow a rational price curve during these peaks and valleys, and both are dangerous to the economy. In the Gulf of Mexico, oil producers are already stacking offshore rigs, because the cost of production at some deep water sites is too prohibitive at current market prices.

At $70 a barrel, most OPEC nations can’t fund their governmental operations effectively. When this happens, OPEC has historically dialed production back, raising prices, but that didn’t happen. Only Kuwait and Qatar are in the black. But what is of bigger concern is at $70 a barrel, crude from the Canadian Oil Sands is unprofitable along with United States ethanol, found in 10% quantities at a gas station near you.

There are those who will say that the market is being manipulated to put the squeeze on Russia, Iran and ISIS (or ISIL or IS if you prefer). However Russian oil operations are still profitable at $50 a barrel, and Iran’s oil operations are unprofitable at almost any oil price point that the global economy can sustain, and remain healthy (Iranian crude is very heavy, very sour, hard to refine, and not preferred by buyers).

The Russian economy is definitely being squeezed by the plunging global oil prices, with the Russian economy generating 60% of its revenue from energy sales, 50% of that from oil exports, there is little motivation for Russian leadership to cause too many problems in Ukraine, or declare a Western Europe embargo. For now, the fear of the full Stalin treatment has kept the Russian elite quiet in their public criticism of Putin’s actions, but sanctions are taking their toll.

Saudi Arabia tipped their economic hand yesterday. They’ve declared a war on the price of oil and are willing to put their $576 billion in cash reserves on the table to slow down North American oil production. Economists predict that Saudi Arabia can fight a two year financial war of attrition in an attempt to slow down advancing United States, Canadian, and Mexican production.

You must always remember, oil is a global commodity. American buyers (meaning you and me) are cheap and we actually enjoy lower prices than most of the globe (if you eliminate third world Hell holes and banana republics). But oil and gas companies are not charities, they answer to shareholders. Fracking operations can be profitable down to as low as $45 a barrel, for existing wells. There is the technicality – existing wells. At $70 a barrel it is questionable that new wells will be profitable, and fracking wells have a short production life. If the producers become convinced that this isn’t a seasonable valley, decisions will be made based upon the quarterly balance sheet, and new wells won’t be created. With Saudi Arabia declaring financial war, don’t be surprised if you see new fracking operations slow down.

Supply will tighten, jobs growth in North Dakota, which is unsustainable, will level off, and eventually the price will start to climb back. Employment in the Oil and Gas Sector has grown 40% nationally since 2007, representing the lion share of all private sector job growth in the United States economy since the Great Recession.

There is the double edged sword. If the price of oil drops to under $60 a barrel, and US production is curtailed, the typical improvement in the US economy from each American getting a boost in disposable income, could be blunted with the loss of jobs in our booming energy sector. Think 1986.

For now, China is quite content growling at its neighbors over oil rights in the South China Sea, and letting western interests secure their oil contracts in the Middle East. They will also happily slurp up every drop the United States chooses not to use either through fuel economy improvements, or economic decline.

A serious oil bump is coming (I won’t say crash – yet , but bump) – and that’s problematic for the United States in particular. The economies of North Dakota and Wyoming have “bubble economy,” written all over them, and the benefits of the booming US oil industry have rippled through all sectors of the US economy.

Keystone XL has taken on an additional sense of urgency for Canada, because Keystone XL is not about reducing American oil imports from the Middle East and Venezuela by 40% (Middle East imports are already in freefall and Chavez is dead) or creating American jobs. It’s about Canada getting its relatively expensive tar sand oil to markets willing to pay the price in Asia and South America. If American purchases of their more expensive oil declines in favor of cheap OPEC crude, the Canadian economy and the companies surrounding the industry will get hurt. That is what Saudi Arabia is banking on. If Saudi Arabia can hurt the economy of Iran in the process, and slow down the growth of religious extremism outside their borders, even better.

The real reality is this. The price of gasoline at American pumps will never return to late 1990s levels. It is an economic impossibility because the overall cost structure for production won’t support those price points anymore. In inflation adjusted dollars, another 18% drop in WTI futures prices will put us square into 1986 oil crash price points. Economics 101 and the laws of supply and demand always take control.

Enjoy the cheap gas for now, eventually it will go back up and when it does, it will go up fast and hard under the wails of peak oil, drill baby drill, and those pesky Chinese are using up the supply. Oh, it will likely put the globe back into another recession.

More by Ur-Turn

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Justin You guys still looking for that sportbak? I just saw one on the Facebook marketplace in Arizona

- 28-Cars-Later I cannot remember what happens now, but there are whiteblocks in this period which develop a "tick" like sound which indicates they are toast (maybe head gasket?). Ten or so years ago I looked at an '03 or '04 S60 (I forget why) and I brought my Volvo indy along to tell me if it was worth my time - it ticked and that's when I learned this. This XC90 is probably worth about $300 as it sits, not kidding, and it will cost you conservatively $2500 for an engine swap (all the ones I see on car-part.com have north of 130K miles starting at $1,100 and that's not including freight to a shop, shop labor, other internals to do such as timing belt while engine out etc).

- 28-Cars-Later Ford reported it lost $132,000 for each of its 10,000 electric vehicles sold in the first quarter of 2024, according to CNN. The sales were down 20 percent from the first quarter of 2023 and would “drag down earnings for the company overall.”The losses include “hundreds of millions being spent on research and development of the next generation of EVs for Ford. Those investments are years away from paying off.” [if they ever are recouped] Ford is the only major carmaker breaking out EV numbers by themselves. But other marques likely suffer similar losses. https://www.zerohedge.com/political/fords-120000-loss-vehicle-shows-california-ev-goals-are-impossible Given these facts, how did Tesla ever produce anything in volume let alone profit?

- AZFelix Let's forego all of this dilly-dallying with autonomous cars and cut right to the chase and the only real solution.

- Zelgadis Elantra NLine in Lava Orange. I will never buy a dirty dishwater car again. I need color in my life.

Comments

Join the conversation

I don't see anything about a significant component in the pricing of oil. Speculation. Since we don't buy oil directly from the producer or have it custom refined for us ( although I would like some 100 octane gasoline ), someone else has to own it from the well to the refinery. In that stage it's a commodity, so when it looks like the price will rise, people make a speculative investment and buy oil. That demand is what drives up the price so quickly. I'm not knocking that because this gives us an uninterrupted supply. When the price starts to fall fast enough to scare investors, it plummets as the speculators try to cut their losses. The added incentive is with excess oil not being refined, the owner/speculator has to pay to store it until a refiner needs it. It's much more complicated then even this verbose article describes. Iraq supplies are in danger of ISIS control. Political events like these usually have the speculators buying. In this case nothing seems to be able to stop the plunge to the bottom. Though the Russians aren't losing money selling oil, they no longer have the Oil income to cover all the other bills. Delivery fleets are converting to natural gas, which we are up to our eyeballs in. Also people are converting to gas heat which frees up more oil to be refined into transportation fuel as opposed to heating oil. If the Saudis are gambling their cash reserves to put US drillers out of business, they may have sealed their own fate. Their infrastructure is in bad shape and they need to invest their reserves in that to keep production up in future years. People still haven't adjusted their budgets for long term cheap gas. If it goes back to $4 it won't be such a shock. The real problem is the reduction in coal production, which is powering the AC and set top boxes. Drastic changes in regulations will skyrocket the cost of electricity, until we start using our transportation fuel to make electricity, at whatever that equilibrium is. Fracking technology is new and the cost to frack new deposits will be driven down, just like the price of PC's or their replacement by tablets. Of course a big component to the price of gas is demand, and many people are still unemployed, so haven't been commuting for a couple of years now. It takes a long time to replace old vehicles. While manufacturer's fleet mileage has gone up ( at great economic cost) I haven't seen a number for average fuel economy of vehicles on the road. I can't buy a new one. Not that many new more efficient cars have replaced less efficient cars. I would wager total miles driven is still down. Of cour4se as supply goes down, prices will rise and production will go up. That again is where the speculator comes in, distorting the real economic price of a barrel of oil. Also consider the oil bubbles created the local real estate bubbles, as when 10 more house are needed, 50 get built. The bust is inevitable, just hastened by the oil bust.

This is an excellent article, I think there are several factors at play; oil prices have fallen because there's currently a glut on the market caused in part by fracking in the U.S and Canadian production from the tar sands. By keeping production at the current level the Saudis are hoping to drive down the price to the point where fracking becomes unprofitable..I think the Saudis are also worried about the religious extremists-ISIS-in their backyard who are largely financing their operations by selling oil on the black market. Gasoline prices where I live have now fallen to about $1.87 a gallon which is great, but don't expect it to last. Correct me if I'm wrong, but I've read that the Saudis can sell oil profitably at prices as low as $20 a barrel which is well below what fracking operations need-about $70 a barrel to remain profitable.