#SmallTrucks

U.S. Midsize Truck Sales Jumped 48% In April 2015 – Colorado/Canyon At 30% Market Share

Midsize pickup truck sales jumped 48% to just under 31,000 units in April 2015, a gain of 10,000 units.

In April, the overall U.S. auto industry grew by approximately 64,000 sales. Overall pickup truck sales increased by 15,000 units. In other words, much of the growth in the pickup truck market last month was generated by the smaller quintet.

Year-to-date, the Toyota Tacoma-led small/midsize category has grown by more than 38,000 sales, slightly more than the 36,000 sales added by full-size pickup trucks.

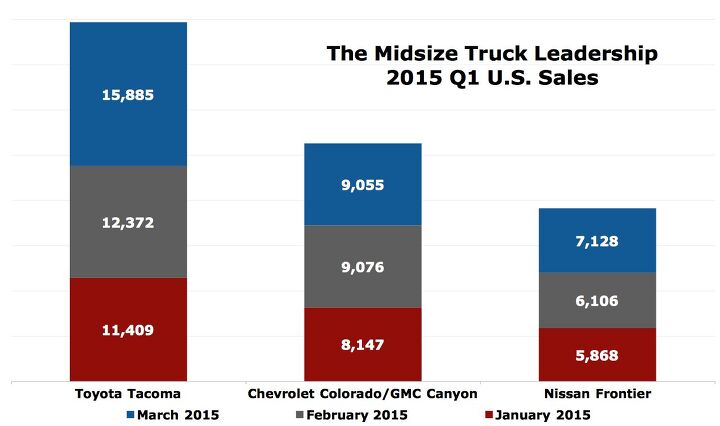

U.S. Small/Midsize Truck Sales In March 2015 YTD: Cain's Segments

The rapid ascent of the new Chevrolet Colorado finally slowed in March 2015 with month-to-month growth amounting to only 58 extra sales. Colorado volume has increased every month since the new truck arrived last fall, from 1491 units in its first full month of October to 6621 units in March.

But even with an overall pickup truck market that was 17% larger in March than in February, Colorado sales grew by just 0.9% during the same period.

Its twin, meanwhile, didn’t sell as often in March as it did in February, sliding from 2513 sales two months ago to 2434 last month.

Cain's Segments: Midsize Truck Sales In America In February 2015

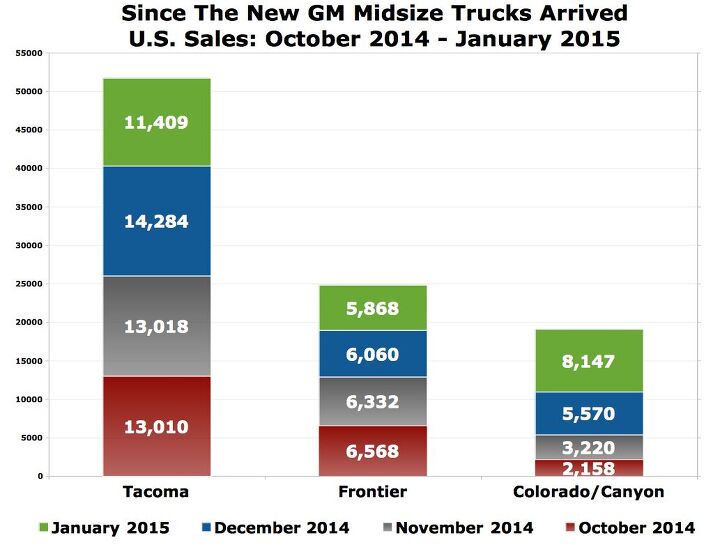

General Motors has reported 28,218 sales of their new midsize trucks since the Chevrolet Colorado and GMC Canyon arrived late in September 2014. Sales of both trucks have increased every month since arriving at dealers. Colorado volume in February was 177% stronger than it was in November; Canyon sales shot up 194% during the same period.

Neither GM pickup is the top-selling non-full-size truck in America, however, nor can GM yet claim the title when their sales are combined. Since October, sales of the top-selling Toyota Tacoma have increased 10% to 64,093 units.

New Colorado And Canyon Are Now Worthwhile Parts Of GM's U.S. Lineup

Although General Motors’ full-size truck twins failed to outsell the Ford F-Serie s in January 2015, GM still came out on top as the best-selling truck manufacturer in America last month.

In the previous five months, the Chevrolet Silverado and GMC Sierra had accomplished this feat on their own, outselling the F-Series by 939 units in August 2014, 7076 in September, 2120 in October, 6294 in November, and 6918 units in December 2014. (The F-Series outsold the Silverado/Sierra by 12,263 units in calendar year 2014 and the total GM pickup truck family by 1045 units.)

• Colorado/Canyon sales steadily rising

• 14 of GM pickup sales generated by midsize trucks

• Still not approaching historic levels

Fast forward to January, when pickup truck volume jumped 22% year-over-year and the F-Series’ core F-150 line became more available in new aluminum-intensive form, and GM’s bigger set of twins fell 5643 sales short of overtaking the F-Series for a sixth consecutive month. But viewed as a full-line pickup truck manufacturer, GM’s 42% YOY improvement to nearly 57,000 sales was more than enough to fend off Ranger-less Ford.

Cain's Segments: Small/Midsize Truck Sales In December And 2014

General Motors’ U.S. market share in the small/midsize truck category grew in December 2014 to 21.1% from 13.9% in November. According to inventory statistics from Automotive News, GM dealers had approximately 9400 Chevrolet Colorados and GMC Canyons in stock at the beginning of December.

• Tacoma and Frontier rising

• GM earning market share

• Small/midsize trucks account for 1/10 pickup sales

Yet a booming auto industry and a surging pickup market meant that even with this new level of competition from the GM midsize pickups, widely regarded as the modern members of the class, the Toyota Tacoma and Nissan Frontier each posted 12% year-over-year improvements in December.

Detroit 2015: Toyota Debuting Next-Gen Tacoma In January

The next-generation Toyota Tacoma will roll down the ramp this January at the 2015 Detroit Auto Show.

Recent Comments