#ProductionShortfalls

How Shanghai Lockdowns Are Changing the Auto Industry

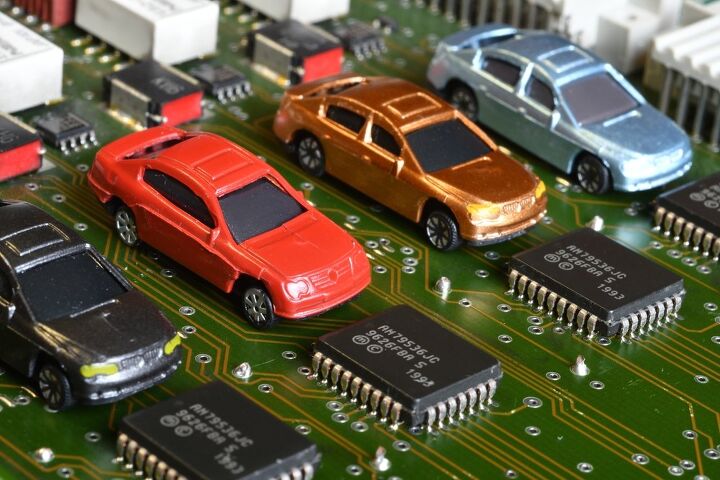

While the semiconductor shortage was long considered the excuse par excellence for why the automotive sector couldn’t produce enough vehicles during the pandemic, some manufacturers have begun pivoting to blaming supply chains that have been stymied by Chinese lockdowns. Toyota is probably the best-known example. But the matter is hardly limited to a singular automaker and market analysts have already been sounding the alarm bell that strict COVID-19 restrictions in Asia will effectively guarantee prolonged industrial hardship around the globe.

Back in April, Shenzhen was emerging from a month-long lockdown. However, the resulting downtime severely diminished the tech hub’s output which exacerbated global component shortages. While Chinese state-run media claimed regional factories maintained full-scale production during the period, the reality was quite a bit different. Meanwhile, Shanghai has remained under harsh restrictions since March and more look to be on the horizon. As an important industrial center and the world’s busiest port by far, the situation has created an intense backlog of container ships that are presumed to create some of the sustained problems that we’re about to explore.

Chip Shortage Lambasts Europe, Supply Chains Confront New Problems

Even though the global semiconductor shortage has been going strong for about two years now, the world has failed to successfully manage the situation. Production stoppages remain relatively common within the automotive sector, with manufacturers continuing to attribute factory stalls to an inability to procure a sufficient number of chips. But the excuse seems to have evolved into a catch-all explanation for supply chain issues that continue that go beyond a single missing component.

That makes it a little hard to determine precisely how much of the ongoing production shortfalls can be pinned on semiconductors. But AutoForecast Solutions (AFS) was keen to take a whack at it and determined roughly 1.4 million vehicles have been removed from the automotive industry’s targeted output for 2022 — that’s on top of the 10.5 million units we lost in 2021. While the issue is indeed global, AFS stated that the last batch of vehicles to get the ax was predominantly from Europe.

Industry Begins Blaming the Bridge, Truckers in Ottawa

With the Ambassador Bridge having been cleared by police over the weekend, those protesting government mandates have literally been relegated to the sidelines. Canadian officers from a variety of departments, including Ontario Provincial Police, are now situated at relevant intersections and Windsor, Ontario, has declared a state of emergency in case demonstrators return.

But don’t think the story is over. The trucker blockade certainly caused trouble for the automotive sector and it suddenly seems interested in rolling the event into the industry’s ever-expanding list of excuses. Now that the rigs have all been removed, spokespeople have been chiming in and they’re being presented as rather single-minded on the matter. They want more assistance from the government to quash any protests that might impact their bottom line and are happy to have something else to blame for why the broader industry remains in such a pitiful state.

Where Are People Waiting the Longest to Buy a New Car?

Nobody should envy car shoppers right now. With production shortages ongoing, there’s never anything you want on the lot, and what is there is likely to be grotesquely overpriced.

This has encouraged consumers to wait longer before replacing their current ride, which is statistically likely to be far older than years past. But not everyone has the same level of patience or financial wellbeing, meaning certain parts of the country are seeing longer intervals between cars than others. There are also regional inventory disparities to account for, encouraging analytics firm Growth from Knowledge (GfK) to conduct an investigation into which parts of the United States are waiting for the longest to procure a new automobile.

Recent Comments