#India

Mercedes Falls Behind BMW In India

If you hear a loud screeching noise coming from the Stuttgart area, that’ll probably be Dieter Zetsche berating his Asian management team. The Economic Times of India reported that the Mercedes-Benz marque has lost its leadership of the luxury car segment in India to BMW after nearly ten years on top. Daimler also posted a 10.43% decline in sales in India, as volume fell to 3,247 units (if that doesn’t seem like much, consider that Mercedes also trails BMW in China by about 60k units to about 90k). And just like that, out come the excuses: “We are behind BMW in 2009 because of limited availability of our E-Class car … I don’t want to focus on leadership. We want to have a profitable growth,” Mercedes Benz India Managing Director and CEO Wilfried Aulbur told reporters. “We see a very strong growth in 2009 and it will be a blockbuster year for us. We are very bullish and we expect, it will be a high double-digit growth.”

GM's Sell-Out To China Continues

When news came out that GM would sell a critical 1 percent of their Chinese joint venture to SAIC (now owner of a 51 percent majority,) and that GM would sell half of their Indian operation to SAIC, rumors swirled that GM would sell-out their future in the world’s only remaining growth markets to raise cash for Opel. It doesn’t seem that way. GM is mortgaging their future at the pawn shop for pocket change. A whacko report even claims that GM is already under Chinese control …

Indian Supreme Court: "Chevrolet" SUV Less Capable Than A Mountain Goat

Indian Automakers To Rescue Sicilian Fiat Plant?

Whitacre: GM-SAIC Deal Was Henderson's Idea

Yet Another NanoSwatter. By GM And SAIC

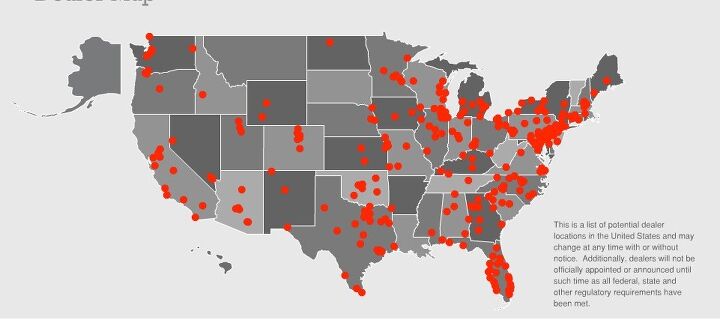

Let’s get small: The new 50:50 joint venture between China’s SAIC and GM may plan to launch an entry-level low-cost car for the Indian market, say’s India’s Wheels Unplugged.

VW And Suzuki Planning The Nano-Swatter?

Das Autohaus [sub] has it from India’s Economic Times that VW and Suzuki are planning a low-priced mini-car which could give Tata’s Nano some problems.

Done Deal: Suzuki And Volkswagen Hitched

Who would have thought that they are moving that fast: VW will buy a 20 percent stake in Japan’s Suzuki for $2.5 billion. It’s announced and it is official, including a photo-op with a beaming Winterkorn next to a grinning Osamu Suzuki. Rumors of that, well, tie-up had been around for a while and had recently intensified, but the speed is nonetheless surprising. Except for those who know Piech. At the September IAA auto show, Piech had said that 12 brands are better than 10. Everybody who knew Piech knew that he was referring to MAN/Scania trucks on one end of the spectrum, and Suzuki small cars and even motor bikes at the other.

Volkswagen Prepares To Take 20 Percent Stake In Suzuki

Rumors of a VW-Suzuki tie-up were first floated on these pages by Bertel Schmitt, who reported that VW might be after a ten percent stake in the Japanese firm last summer. And with news last week that GM was buying out Suzuki’s stake in CAMI, the momentum seemed to be building. Well, Reuters reports that Volkswagen could announce that it’s taking a 20 percent stake in Suzuki, a deal valued at $2.8b, as soon as this week. Another source tells Reuters that the VW stake could become a 33 percent plus controlling interest in the future.

Maruti Suzuki Gears Up For Indian Turf Battle

In my editorial on GM’s plant to take on the Indian market in partnership with SAIC, I wrote that Maruti Suzuki’s monstrous market share indicated the possibilities for GM. Well, the Indian market leader isn’t going to just sit on that lead. In 2007, Osamu Suzuki said that his firm’s Indian passenger car market share would never drop below 50 percent, an assertion that took two years to prove untrue. The WSJ reports that although the overall Indian market will probably grow 16 percent this year, Maruti’s share of that market has fallen over the last year from 45 percent to about 40 percent (with passenger car share down from 55 percent to 48 percent).

GM Zombie Watch 22: International House Of Panic

News that GM is selling a control-shifting single share in GM Shanghai to its Chinese partner SAIC was the toads-from-heaven flourish at the end of an epic week for the RenCen. The day after the last of GM’s lifer CEOs left the building, Opel’s CFO followed suit. One management re-organization and a rough LA Auto Show later, came this symbolic surrender of GM’s largest market for a measly $85m. Accompanied by news that The General would buy out Suzuki’s stake in CAMI for an estimated $46.5m, no less. Oh yeah, and something about India. Freshly-minted CEO and notorious rattlesnake killer Ed Whitacre isn’t about be accused of not trying to shake things up. The only question is where will everything land?

One Percent Of GM China Worth $85m

Fresh details on GM’s Asian wranglings are coming in, and it seems that SAIC paid The General a mere $85m for the one percent needed to control the joint venture. GM’s Nick Reilly tells the New York Times:

the 51 percent stake would give S.A.I.C. the right to approve the venture’s budget, future plans and senior management. But the venture has a cooperative spirit in which S.A.I.C. has already been able to do so… S.A.I.C. wanted to have a majority stake to consolidate the venture in its financial reporting

Which is about as credible as the conclusion that the Shanghai and India deals are going to provide GM International with a meaningful amount of cash with which to rescue its European and Korean divisions. As it turns out, the Indian deal isn’t going to translate into free cash for GM. GM and SAIC will set up a joint Hong Kong-based investment company, which GM will give its Indian operations and SAIC will fund with $300-$530m, bringing its overall value to $650m.

GM Sells Its Future To China

And so it happened. Xinhua (translation via Gasgoo) has put on the wire that General Mayhem will “transfer half of its Indian operations to SAIC Motor by setting up a 50-50 joint venture there with the Chinese partner.” As expected, “GM and SAIC have also reached an agreement to transfer 1 percent of GM’s stake in their 50-50 Shanghai car venture to SAIC.” With that little percent, SAIC has a controlling majority of the Chinese joint venture. What for?

Tata Defends JLR Acquisition

Ford were mighty relieved when it managed to off-load it’s British marques, Jaguar and Land Rover, to Tata. Now after 1 year and 9 months of ownership, causing the normally profitable Tata Motors to fall into a £41 million pound loss and falling sales, how do you think Tata are feeling about the purchase of JLR? Sad? Depressed? Suicidal? According to steelguru.com, Ratan Tata is surprisingly optimistic.

If we assume that the global meltdown is a phenomenon that will be over in the near term, I think we will look back and say that these are very strategic and worthwhile acquisitions. There were many questions raised regarding whether these two large acquisitions Corus and JLR are worthwhile and whether the prices were right in terms of being at the top of the market, virtually. My view on that is that if you want to buy a house and that house is of a particular value, then it may not be there if you wait

Recent Comments