#CarBuying

Don't Be Fooled by Misleading Ads This President's Day

It’s not fair to say there’s no truth in advertising; commercials often show vehicles driving in a straight line down a dry road, and we all know they can do that. Only the most gullible among us thinks a new muscle car will improve their love life faster than Billy Dee Williams can crack open a can of Colt 45.

All too often, smokin’ deals do not await shoppers who leave the house without reading the fine print. And even that fine print can hide whether you’re actually getting a bargain. With President’s Day coming up on Monday, here’s a few examples of juicy car promotions that are sure to waste someone’s time.

A Landlord's Conundrum: Loaded Lesser Model, or Discounted Premium?

A guest showed up at the apartment yesterday, ready and prepared for when things got hot. No, stop thinking that, you weirdos — it was my landlord. He was replacing my smoke detectors. God.

Nice guy, I should point out, certainly the best landlord I’ve ever had. Anyway, as tends to happen with this fellow, we got to talking about cars. Also per the norm, he found himself on the fence regarding a purchasing dilemma — one that’s no doubt familiar to many readers.

Attention, Cheapskates: Here Are the Most Affordable Cars to Own in Every Segment

There are few things sweeter in life than bragging to your friends and family about the good deal you just negotiated on a new car. They certainly won’t care, but the amount of self-satisfaction received from reminding yourself that you are a force to be reckoned with at the dealership is immeasurable.

Of course, the bargain in the driveway can turn into a money pit once you calculate all the costs associated with vehicle ownership. Fuel costs, financing, insurance, and depreciation can all add up — especially if you purchased the wrong model. So what’s a thrift-obsessed shopper to do, calculate the total cost of ownership on every model in every segment over a five-year period to determine which is the best value overall?

Don’t be ridiculous, someone has already done that.

Bark's Bites: Regulators, Mount Up!

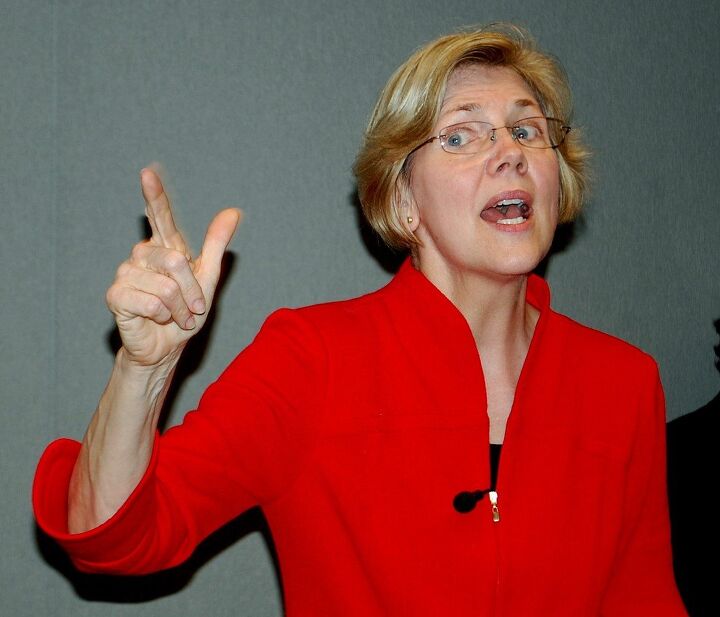

It pains me greatly, dear readers, to say what I’m about to say. Those of you who regularly follow my writing know how I lean when it comes to politics. However, given the current state of the auto dealership world, I have no choice. I gotta admit it — I agree with Elizabeth Warren on something.

Good ol’ P…er, Senator Warren and I both agree that there needs to be more oversight of the automotive lending business. Part of my day job is to educate new automotive advertising sales representatives about the car sales industry, and when I get to the part of the day where I tell them about how the Finance and Insurance office works, I always give them the following warning:

“Guys, if you don’t know about how car loans work, you’re about to get very, very angry.”

So I’ll give you the same warning, friends. I’m going to share about the predatory lending practices that go on behind the scenes, and I’ll tell you what I think should be done to stop it.

Bark's Bites: Subprime Lending Is Even More Bizarre Than You Imagined

“We’re dirty, yeah, but so are the dealers. We’re all dirty in this business.”

The petite, honest-faced young lady sitting across from me at my lunch table doesn’t look like a predator. To be fair, she isn’t. She just works for a company that’s one of the biggest subprime lenders in the country, with offices in several states. By the time a dealer calls them for a loan, they’ve already tried every traditional bank and credit union in their Rolodex.

And in exchange for a delicious burrito, she agreed to meet with me and pull back the kimono on the subprime auto lending business in the United States, a business which many in the financial sector believe to be the next big bubble.

I have a lot of questions, and she’s more than willing to answer them. I ask what sorts of credit scores they’ll approve.

“We can pretty much approve any credit score. I just approved a 413 beacon score the other day. Of course, it was a 25 percent loan. Credit is really just one piece of the puzzle,” Elizabeth* (not her real name) explains to me. “Sure, we pull TransUnion and Equifax, but we’re also looking at their obligations versus their verifiable income. Medical bills don’t count. It’s just rent plus whatever else is on their credit report.”

“Sure,” I say. “That makes sense.”

“Of course,” she continues between small bites of burrito, “if they’ve just stopped paying a bill, something other than another car loan, we don’t count that bill as part of their monthly obligations. Nobody pays student loans. They’ll have like five or six loans and won’t have paid a damn dime in months. So we don’t worry about those.”

Hang on. It gets weirder. And better.

No Fixed Abode: Fear of a $160 Planet

It sounds like a sci-fi novel, or maybe even a Fredrick Forsyth knockoff written during the Seventies heyday of Cold War action/adventure books: Six Months of the Equinox. You can imagine the plot, right? Something happens to freeze the planet’s orbit at a certain point. The seasons stop. Mayhem ensues. There’s a machine that might be able to restart the orbit, but a cabal of Russian oligarchs makes a plan to seize it. Only one man — let’s call him Chest Rockwell — can save us.

The reality behind the title is nearly as frightening: It’s the half-year that my current wife, known to all and sundry as Danger Girl even though (SPOILER ALERT) she is actually old enough to vote, traded in one of her Tahoes for a Chevrolet crossover in an attempt to balance her budget. This is the kind of thing that I typically associate with bubbleheads who can’t do math, but Danger Girl is a CPA with extensive financial training. Was she right to do it? It’s a relevant question, because — as you’ll see below — it’s one that we could all be asking ourselves three years from now.

QOTD: When Did You Lay 'em Down and Smack 'em Yack 'em?

Last week I asked the B&B about the worst L they ever took on a car or bike deal. To my surprise, a lot of readers were forthcoming about not always being steely-eyed cash-purchase Vanguard Funds billionaires who always make salespeople cry and who get loans that are so good the bank actually pays them interest. To those of you who responded with a story or a description: THANK YOU for putting just a tiny little pebble in the way of the Internet Tough Guy steamroller.

This week we’re going to let the braggarts and the Dave Ramsey disciples and the Rich-Dad-Poor-Dad types have a word. Of course, it would also be nice to hear real things from real people. The subject is: What’s the best deal you ever made on a car (or motorcycle, or both)? I’ll kick it off.

Breaking: Sleazy Used Car Salesman Heads to the Slammer

It’s among the most prolific stereotypes of the automotive world. The shady used car salesman. Often pictured standing next to an overvalued Kia Sephia (a “smokin’ deal!”) while wearing a loud sport coat and white belt, the specter of these fly-by-night fraudsters have plagued reputable dealers for decades.

In Oshawa, Ontario, a city best known for housing General Motors’ Canadian headquarters and a former TTAC managing editor, one such criminal just met his fate. How sweet it must be for the poor buyer he swindled.

Are Car Subscription Services Going to Become the New Normal?

Automakers are throwing everything they currently have at the wall to see what sticks. The concept of “mobility” is now so broad that it encompasses automation, electrification, vehicle connectivity, alternative modes of transportation, driving aids, ride-sharing, ride-hailing, and even subscription services — and plenty of companies are giving them all a shot.

Last week, we talked about Volvo’s new car subscription service. Most of us had difficulties rationalizing the price based on how the product is being offered. A lot of companies are testing those waters right now, especially luxury brands. Lincoln recently launched a subscription initiative that is extremely similar to Cadillac’s, and Porsche has been buzzing about its own “Passport” service. However, mainstream brands like Ford and Hyundai are also trying their hand — albeit very differently.

Forget Standing Outside the Apple Store, There's Deals to Be Had at the Dealership

Black Friday, the strange and alluring date that compels companies to push certain deals in a bid to firm up the bottom line, doesn’t end when the clock strikes twelve. Nor do the savings only apply to bizarrely non-car-related items that can leave readers of certain websites scratching their heads. Automakers, for example, regularly push Black Friday savings through to the end of the month.

With a handful of days remaining, there’s no shortage of car companies ready and willing to dent your new vehicle’s hood with a bag of cash. So, if you’re in the market, put down that bamboo oil diffuser and let your mind (and wallet) roam. Here’s what might be on offer at your local dealer.

Auto Loan Delinquencies Continued to Climb in the Last Quarter

The 60-day auto delinquency rate continued to climb through the third quarter of 2017. Driven primarily by “relaxed” underwriting standards from years past and increasing subprime originations, TransUnion’s senior vice president and automotive business head, Brian Landau, said two-month payment lapses rose 7 basis points to 1.4 percent.

At the same time, the average balance of outstanding auto loans increased by around 5.9 percent, resulting in the lowest year-over-year growth rate since the third quarter of 2012. The group’s Industry Insights Report cited this quarter’s serious auto loan delinquency rate as the highest observed since Q3 2009 — you know, when nobody had any money to pay their bills.

QOTD: If You Could Turn Back Time…?

Every last one of us remembers sitting in a restaurant, wondering if we’d made a horrible mistake by choosing salad over the potentially superior soup of the day. Soup is unpredictable; salad is a safe choice. But what if the soup, as it sometimes is, was actually the more satisfying choice?

You missed out, and time only makes the doubts and regrets grow stronger.

Out in your driveway, or perhaps stashed in a nearby parking garage, is a car you bought or leased based on the assumption it was the best choice of all available options in your price range. Has the passage of months or years revealed your present vehicle as a safe salad to someone else’s weak-at-the-knees, far more satisfying soup? Did you make a mistake this time around?

It's End-of-year Incentive Time, but One Deal Stands Out

Snow has already touched Minneapolis pavement, meaning it’s time for automakers to hurry up and clear out 2017 models. Special offers, like the coming winter, are rolling in fast.

Not surprisingly, many of the end-of-year incentives target the increasingly unloved passenger car segment. If two or four doors and a trunk is your bag, you’re in luck, though crossover shoppers aren’t being ignored in the rush to unload old inventory. However, if you’re a fan of the Big H, and especially its sportier offerings, Christmas might have just arrived early.

Bumper Crop of Flood-damaged Vehicles Has NICB Worried About Your Next Car

From the Texas coast to Georgia, the southern U.S. took a long-delayed pounding this summer after years of hurricane “drought.” Hurricane Harvey struck, then lingered for days, over the Corpus Christi-Houston area in late August, sending hundreds of thousands of vehicles to the salvage yard. Hurricane Irma followed shortly thereafter, striking Florida before moving up into the southeastern states.

Perhaps aware of Texas’ reputation, Harvey cut the largest swath through the country’s rolling stock, with roughly 422,000 insured vehicles now awaiting salvage auctions. Irma’s wrath adds a further 215,000 to the flood-damaged mix. For the National Insurance Crime Bureau, it’s not necessarily those vehicles that are leading to restless nights — it’s ones with owners unable to make an insurance claim.

Ask Jack: Ten Grand to Go Fast?

Speed costs money; how fast do you want to go? It’s the kind of thing you see on the back of T-shirts worn by grey-haired men at “Cars and Coffee,” but that don’t make it not true.

With that said, there are a million different ways to spend your speed-seeking dollar, some of them better than others. Which brings us to this week’s $10,000 question…

Recent Comments